July 08, 2022

Gran Tierra Energy (TSX:GTE,NYSE:GTE,LSE:GTE) produces assets and exploration prospects in Colombia and Ecuador. The company operates the production from the vast majority of its assets, which gives it control over where and when to drill. Gran Tierra is focusing on enhancing recovery by utilizing the waterflooding process that results in higher oil recovery rates and modest future development costs. The company has plans to conduct additional exploration and development operations throughout 2022 and 2023.

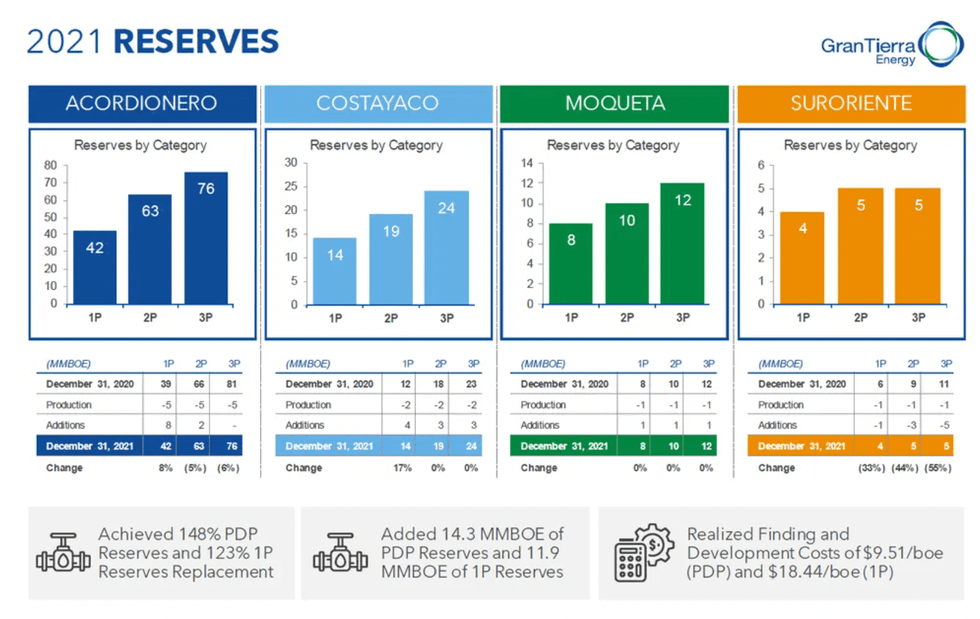

The company is currently increasing its production at its flagship project, Acordionero, by drilling 14-16 new development wells throughout 2022. Since the project’s acquisition in 2016, it has produced roughly 28 million barrels of oil (MMbbl) and generated approximately US$1.3 billion in oil and gas sales. In addition, drilling and completion costs have steadily decreased by over 50 percent during the past four years. The drilling of new developemtn wells is also slated for this year at two of Gran Tierra’s other major fields, Costayaco and Moqueta. All the company’s oil fields have access to robust transportation infrastructure and benefit from a stable economic environment.

Company Highlights

- Gran Tierra is an international oil and gas company focused on exploration and production in Colombia and Ecuador.

- The company leverages waterflooding to improve oil recovery at each of its assets, which are world-class candidates for this enhanced recovery technique.

- Gran Tierra plans to drill several new wells throughout 2022 in addition to conducting exploration programs at its other assets.

- Acordionero, the company’s flagship project, has already produced over US$1.3 billion in oil and gas sales since 2016. Additionally, 14-16 new wells are scheduled to be drilled in this oil field this year.

- The company focuses on enhancing oil recovery at each producing asset to maximize the value of all its reservoirs.

- ESG ratings are essential for Gran Tierra, and the company has already planted 1.2 million trees in Colombia, alongside other environmental initiatives.

- A strong management team with directly relevant experience leads the company towards its goals.

This Gran Tierra Energy company profile is part of a paid investor education campaign.*

GTE:CA

The Conversation (0)

07 July 2022

Gran Tierra Energy

Top Tier Conventional Oil Assets Under Waterflood

Top Tier Conventional Oil Assets Under Waterflood Keep Reading...

22h

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00