July 08, 2022

Gran Tierra Energy (TSX:GTE,NYSE:GTE,LSE:GTE) produces assets and exploration prospects in Colombia and Ecuador. The company operates the production from the vast majority of its assets, which gives it control over where and when to drill. Gran Tierra is focusing on enhancing recovery by utilizing the waterflooding process that results in higher oil recovery rates and modest future development costs. The company has plans to conduct additional exploration and development operations throughout 2022 and 2023.

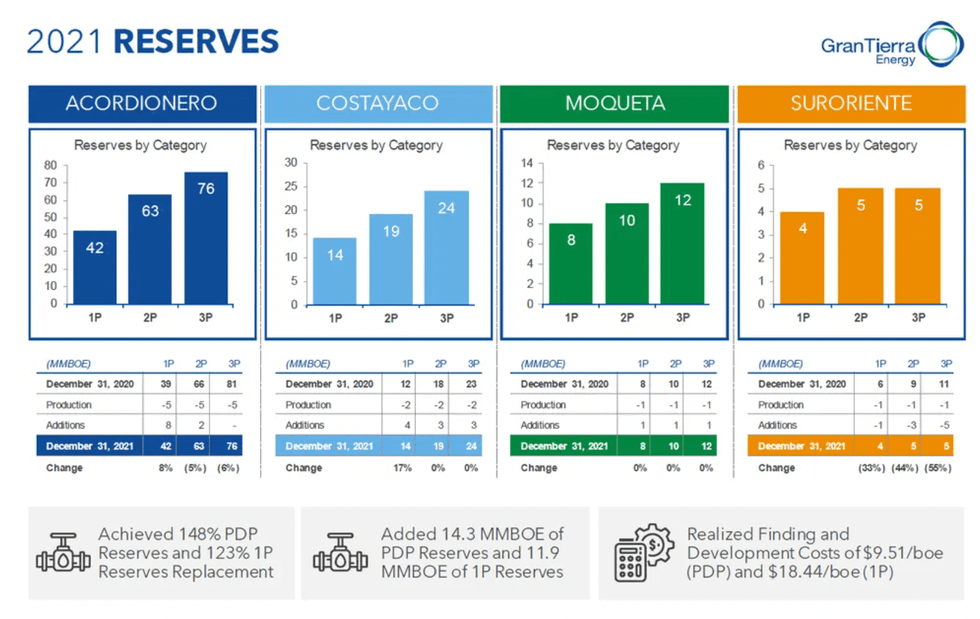

The company is currently increasing its production at its flagship project, Acordionero, by drilling 14-16 new development wells throughout 2022. Since the project’s acquisition in 2016, it has produced roughly 28 million barrels of oil (MMbbl) and generated approximately US$1.3 billion in oil and gas sales. In addition, drilling and completion costs have steadily decreased by over 50 percent during the past four years. The drilling of new developemtn wells is also slated for this year at two of Gran Tierra’s other major fields, Costayaco and Moqueta. All the company’s oil fields have access to robust transportation infrastructure and benefit from a stable economic environment.

Company Highlights

- Gran Tierra is an international oil and gas company focused on exploration and production in Colombia and Ecuador.

- The company leverages waterflooding to improve oil recovery at each of its assets, which are world-class candidates for this enhanced recovery technique.

- Gran Tierra plans to drill several new wells throughout 2022 in addition to conducting exploration programs at its other assets.

- Acordionero, the company’s flagship project, has already produced over US$1.3 billion in oil and gas sales since 2016. Additionally, 14-16 new wells are scheduled to be drilled in this oil field this year.

- The company focuses on enhancing oil recovery at each producing asset to maximize the value of all its reservoirs.

- ESG ratings are essential for Gran Tierra, and the company has already planted 1.2 million trees in Colombia, alongside other environmental initiatives.

- A strong management team with directly relevant experience leads the company towards its goals.

This Gran Tierra Energy company profile is part of a paid investor education campaign.*

GTE:CA

The Conversation (0)

07 July 2022

Gran Tierra Energy

Top Tier Conventional Oil Assets Under Waterflood

Top Tier Conventional Oil Assets Under Waterflood Keep Reading...

17h

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00