- WORLD EDITIONAustraliaNorth AmericaWorld

September 20, 2022

GoldHaven Resources (CSE:GOH, OTCQB:GHVNF, FRA:4QS) advances a premium metals portfolio of assets in Canada and Chile. The company has prospective land packages in British Columbia and Newfoundland (Canada) and also holds assets in Chile’s prolific Maricunga Gold Belt. GoldHaven has an experienced management team to efficiently create significant value for investors.

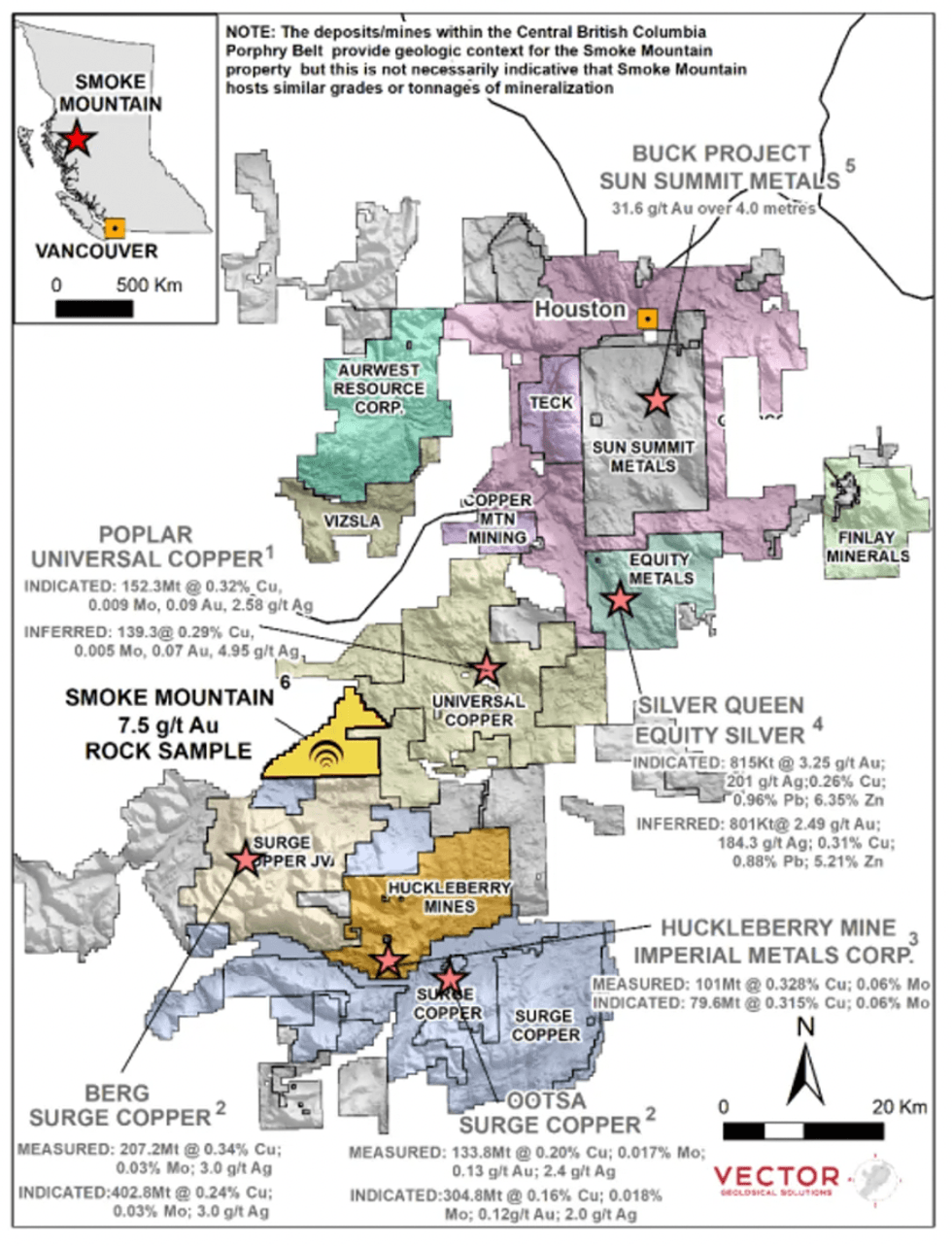

Smoke Mountain is the company’s current flagship project in British Columbia. Smoke Mountain includes a 2.5-kilometre long copper-gold-zinc mineralization trend that has assays of 7.5 g/t gold in initial rock sampling. GoldHaven's claims are contingent on other projects that have already yielded high grades of gold and copper, prompting some to say that this could very well be the next big copper district in North America.

Company Highlights

- GoldHaven Resources is a junior exploration company focusing on gold and copper assets in both Canada and Chile.

- The company’s highly prospective claims neighbour projects with high-grade gold and copper deposits.

- GoldHaven’s projects in British Columbia, Newfoundland and Chile have produced promising, early exploration results, and have the potential to yield significant ore deposits.

- The company’s Smoke Mountain project in BC contains a 2.5-kilometer long copper-gold-zinc mineralization with high-grade assays up to 7.5 g/t gold.

- Pat’s Pond in Newfoundland, located within the province’s prolific Central Gold Belt, had show promising technical indicators and is located in proximity to what will be Atlantic Canada’s largest producing gold mine.

- The company holds claim to some of the most promising ground in the Maricunga Gold Belt in proximity to a number of major discoveries.

- GoldHaven is led by an experienced management team and is supported by a strong technical team of geologists with extensive experience in both Canada and Chile.

This GoldHaven Resources profile is part of a paid investor education campaign.*

GOH:CC

The Conversation (0)

19 September 2022

GoldHaven Resources

Premium Metals Portfolio in Canada & Chile

Premium Metals Portfolio in Canada & Chile Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00