August 22, 2024

Golden Mile Resources (ASX:G88) is a project development and mineral exploration company focusing on multi asset and multi commodity strategy by advancing core projects, acquiring high-quality assets, and forging tactical alliances with joint venture partners. Golden Mile’s value proposition is driven by a highly experienced leadership team with proven expertise across the resources sector from exploration to development and production.

The company is advancing its newly acquired Pearl copper project in Arizona, and the Quicksilver nickel-cobalt project, located in Western Australia, which has an indicated and inferred resource of 26.3 Mt @ 0.64 percent nickel and 0.04 percent cobalt.

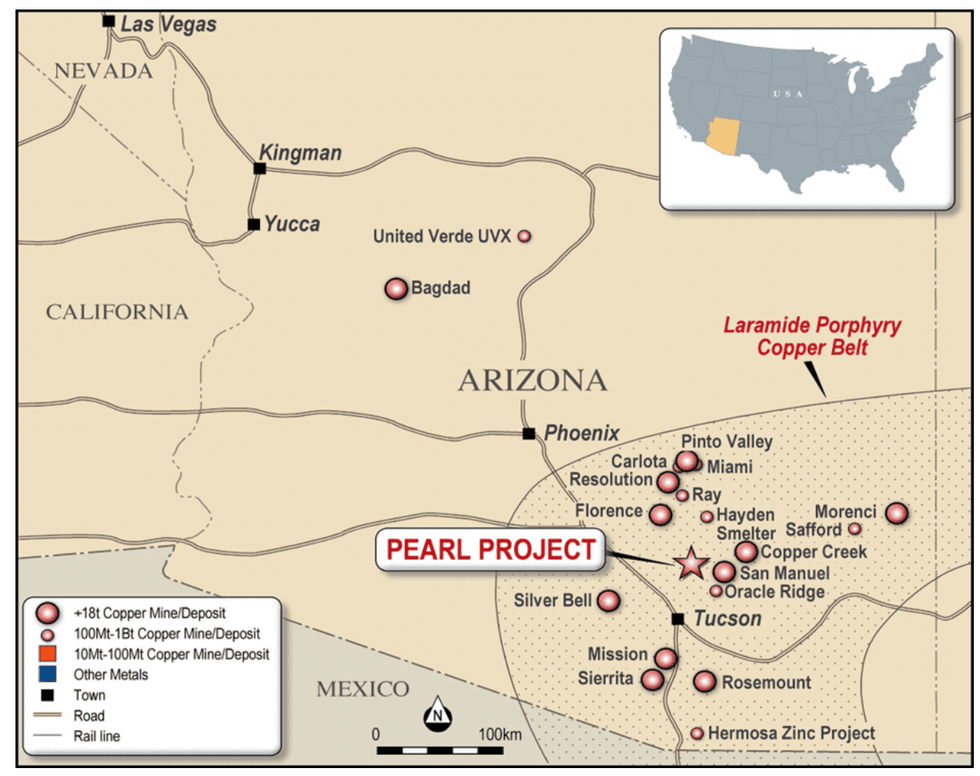

Golden Mile secured the Pearl copper project in August 2024. Located in Arizona, the asset hosts more than 50 artisanal copper workings and shares similar geological characteristics to the San Manuel-Kalamazoo and Pinto Valley porphyry copper mines. The project exhibits widespread surface alteration highlighted by rock chip samples of 7.3 percent copper, 0.43 percent molybdenum, 19.9 percent lead, 4.9 percent zinc and 360 g/t silver.

Company Highlights

- Golden Mile Resources has a diversified portfolio of both advanced projects and exploration assets in tier 1 jurisdictions of Australia and the US.

- The recently acquired Pearl copper project in Arizona is located in the renowned Laramide Porphyry Belt.

- The Quicksilver nickel-cobalt project near Perth has an indicated and inferred mineral resource of 26.3 Mt @ 0.64 percent nickel and 0.04 percent cobalt.

- Golden Mile is backed by a highly experienced management team with proven success in project engineering and development from exploration to production across multiple continents.

This Golden Mile Resources profile is part of a paid investor education campaign.*

Click here to connect with Golden Mile Resources (ASX:G88) to receive an Investor Presentation

G88:AU

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

22 August 2025

Private Placement to Raise $510.8K

Golden Mile Resources (G88:AU) has announced Private Placement to Raise $510.8KDownload the PDF here. Keep Reading...

20 August 2025

Trading Halt

Golden Mile Resources (G88:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 July 2025

June 2025 Quarterly Activities and Cashflow Reports

Golden Mile Resources (G88:AU) has announced June 2025 Quarterly Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

07 July 2025

Aurora Prospect Delivers High-Grade Gold Assays

Golden Mile Resources (G88:AU) has announced Aurora Prospect Delivers High-Grade Gold AssaysDownload the PDF here. Keep Reading...

02 July 2025

Maiden Drilling Campaign Intersects Copper and Lead

Golden Mile Resources (G88:AU) has announced Maiden Drilling Campaign Intersects Copper and LeadDownload the PDF here. Keep Reading...

19h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00