March 17, 2024

Global Oil & Gas Ltd (ASX:GLV) (Global or the Company) has identified the Piedra Redonda gas field located, in its entirety, within Global’s (80% holder) 4,858km2 oil and gas Tumbes Technical Evaluation Agreement (TEA or block) offshore Peru, where work carried out by the previous operator, BPZ Energy, and the internationally recognised oil and gas auditing firm Netherland, Sewell & Associates, Inc (NSAI) defined Contingent and Prospective resources for the Piedra Redonda gas field.

Highlights

- Piedra Redonda gas field contains ‘Best Estimate’ Contingent Resources of 404 billion cubic feet (Bcf) plus ‘Best Estimate’ Prospective Resources of 2.2 trillion cubic feet (Tcf) of gas audited by Netherland, Sewell & Associates, Inc.

- Piedra Redonda gas field is located within Global’s TEA offshore Peru and is a significant asset in its own right, requiring further evaluation in parallel with other significant oil prospects identified within the TEA

- Piedra Redonda will be the focus of the third and final area for reprocessing of existing 3D seismic to further refine and enhance this exciting gas field to understand the potential for future commercialisation

NSAI defined, with an estimate date of the 1 January 2010, a Best Estimate (2C) gross Contingent Resource of 404 billion cubic feet of gas (Bcf) (323 Bcf net to Global) from the existing discovery well C-18X and C-13X appraisal well, and in addition, a Best Estimate (2U) Prospective Resource# of 2.2 trillion cubic feet of undiscovered gas (Tcf) (1.8 Tcf net to Global) in the Piedra Redonda gas field. Please see the Notes in the Appendix relating to the estimates for further information.

#Cautionary Statement: The estimated quantities of gas that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both a risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially recoverable hydrocarbons.

Director Scott Macmillan commented:

“We are excited with the results of our initial review of the Piedra Redonda gas field which contains a best estimate of 404 billion cubic feet (2C gross) and further exploration upside of 2,200 billion cubic feet of gas (2U gross) in the Mancora Formation.

Piedra Redonda is located in shallow water within our Tumbes TEA area and will be further evaluated as part of the historical 3D seismic reprocessing exercise being undertaken by Global to mature our understanding of the play diversity and portfolio of prospects in the TEA.

Whilst we will continue to focus on the evaluation of the oil targets identified in the initial two seismic reprocessing areas selected, the Piedra Redonda gas field offers the Company a low risk discovered gas field with significant resources and further upside within the field which will be evaluated for potential commercialisation.”

Piedra Redonda Gas Field

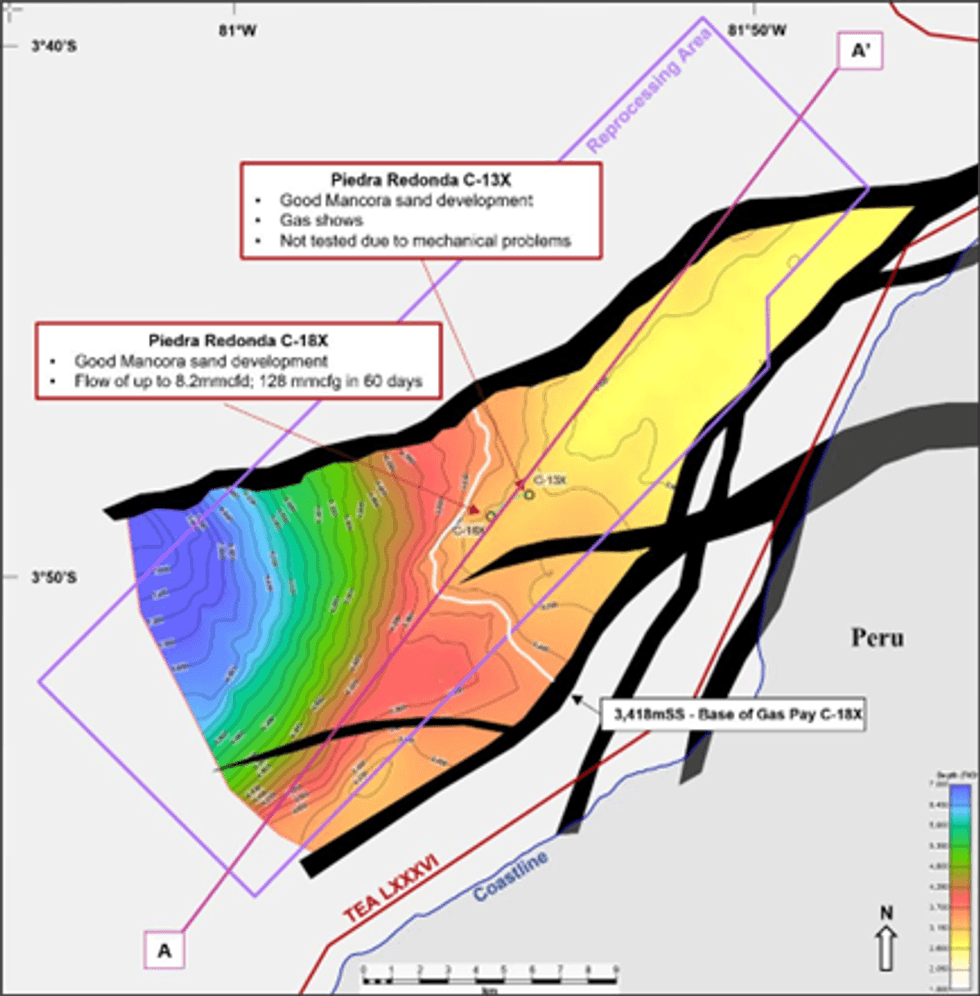

The Piedra Redonda gas field is hosted in the Lower Oligocene Mancora Formation and is defined by a wedge-shape structural trap between two faults (Figure 1).

The Mancora Formation is composed of a series of lowstand and highstand stratigraphic sequences and is bounded by the younger Heath Formation of Late Oligocene age and Eocene age sediments (Figure 3).

The presence of gas was proven in 1978 by the C-18X well which was drilled in 55m of water and flowed at a maximum rate of 8.2 million standard cubic feet per day of gas (mmscfd), recovering a total of 128 million cubic feet of gas (mmcfg) during an extended test over 60 days.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00