May 30, 2024

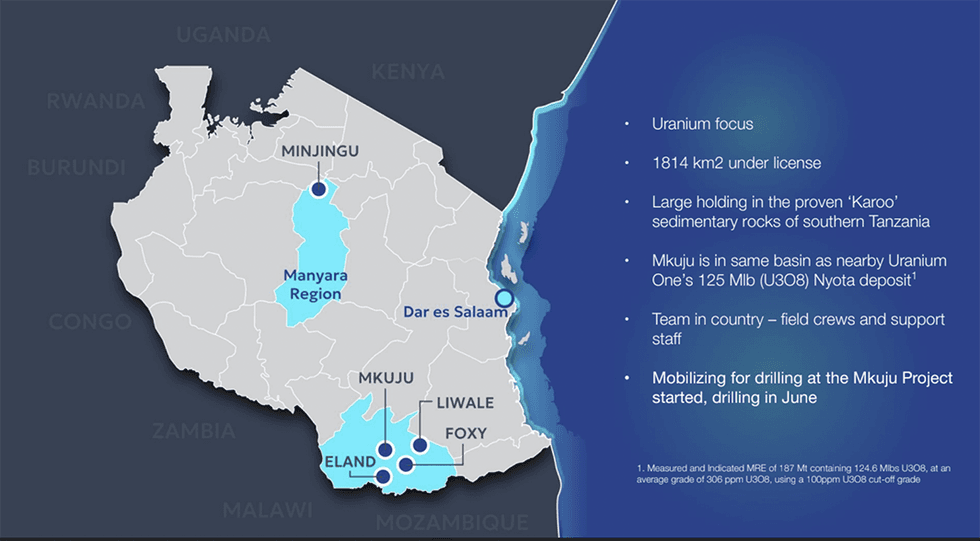

Gladiator Resources (ASX:GLA) focuses on uranium assets covering 1,811 square kilometres located in Tanzania. The company’s key projects include – Mkuju, Minjingu, Liwale, Foxy and Eland. The flagship Mkuju has the potential to host world-class uranium deposits given its proximity to the Nyota deposit, which contains 124.6 million pounds (Mlbs) U3O8. Nyota is regarded as one of the largest uranium deposits in the world.

The company is planning a 2024 drill program at Mkuju focusing on the South West Corner (SWC), Mtonya and Likuyu North targets. The 2024 drilling program will commence with initial core drilling at the SWC target, where 2023 trenching revealed up to 7,139 parts per million (ppm) U3O8. Drilling at Mtonya and Likuyu North aims to explore potential extensions and new zones of the existing uranium deposits.

The Mkuju project spans over 725 sq kms and is located 20 kms south of Uranium One’s Nyota deposit, regarded as one of the largest uranium deposits in the world. Nyota hosts a measured and indicated mineral resource estimate of 187 metric tons (MT) at 306 ppm U3O8, containing 124.6 Mlbs U3O8. The deposit is being developed by global uranium company Uranium One. The Nyota deposit and the Mkuju project are underlain by sediments of the lower Karoo, which are considered highly prospective for uranium.

Company Highlights

- Gladiator Resources is an ASX-listed exploration and mining company focused on uranium. The company operates eight exploration projects, mainly in Tanzania, covering a total area of 1,811 sq kms.

- The company’s key projects include – Mkuju, Minjingu, Liwale, Foxy and Eland.

- Gladiator’s primary short term focus is on advancing the Mkuju project, located only 20 kms south of Uranium One’s Nyota deposit, regarded as one of the largest uranium deposits in the world.

- The 2024 drill program at Mkuju will focus on the South West Corner (SWC) initially, where trench assay results received Dec/Jan 2023/24 confirmed high-grade uranium in sandstone, 1000’s ppm U3O8 in places.

- Further work is also planned at Mtonya and Likuyu North – also located within the promising Mkuju area.

- Tanzania is endowed with many uranium-bearing deposits and is known for its mining-friendly policies. The government offers attractive tax policies and quick permitting processes to encourage investment in the sector.

- The presence in relatively attractive uranium mining jurisdictions such as Tanzania positions the company to capitalize on opportunities in the uranium sector and deliver superior returns to its shareholders.

This Gladiator Resources profile is part of a paid investor education campaign.*

Click here to connect with Gladiator Resources (ASX:GLA) to receive an Investor Presentation

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman John Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

23 January

Investment establishes valuation of C$50M for the polymetallic Häggån project

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce that MMCAP International Inc. SPC (‘MMCAP’) and certain other strategic investors (together the ‘Strategic Investors’) will provide funding of C$10 million for a 19.7% interest in the Company’s... Keep Reading...

21 January

Laramide Exits Kazakhstan Uranium Project After Government Policy Shifts

Laramide Resources (TSX:LAM,OTCQX:LMRXF) has pulled out of a greenfield uranium exploration venture in Kazakhstan, citing policy changes that it says have effectively shut the door on economically viable foreign investment in the country’s uranium sector.The Toronto-based company announced on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00