February 03, 2025

Interpretation of prospective rock types confirmed ahead of Exploration Target

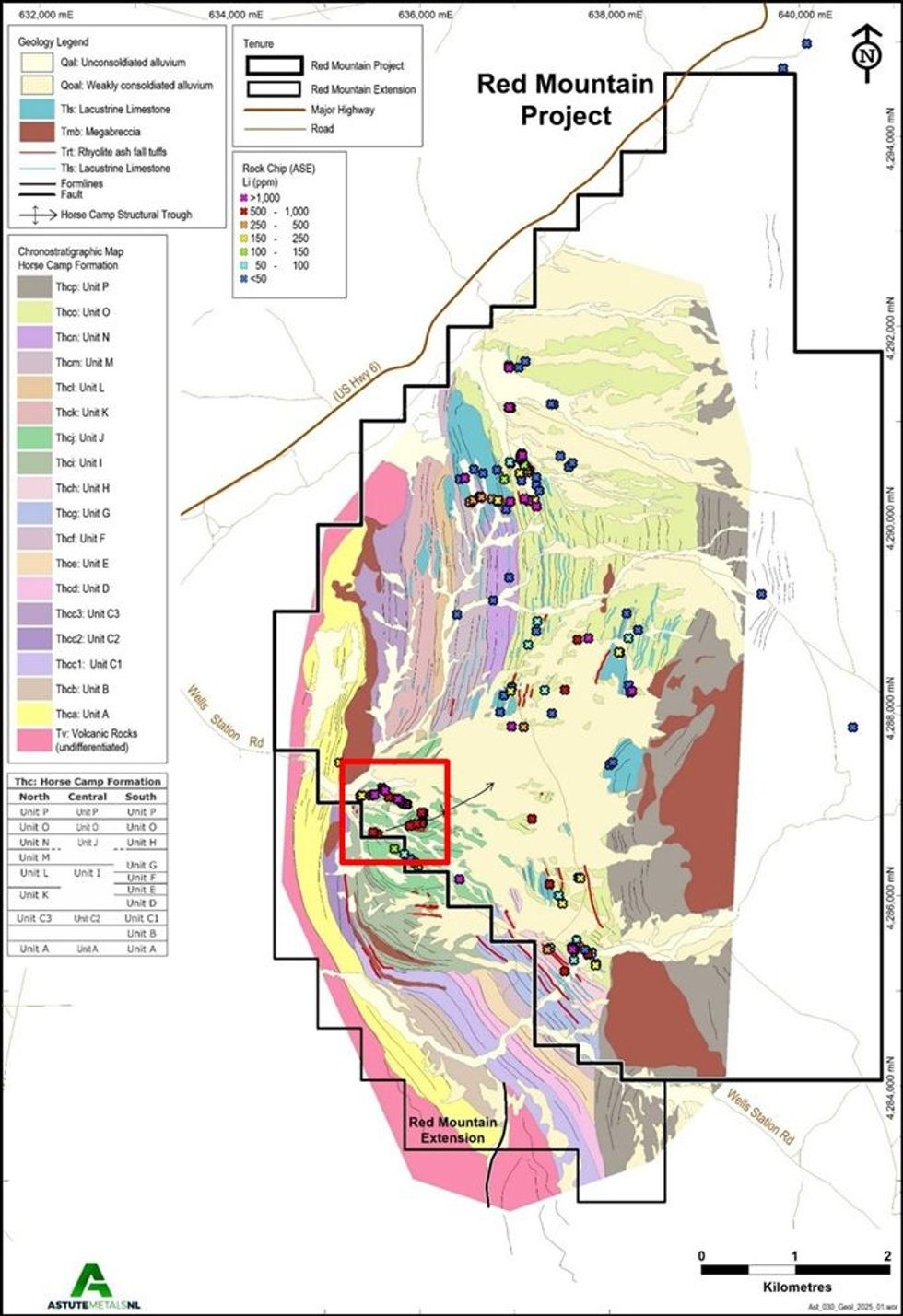

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to advise that recently completed geological mapping and rock chip sampling at the 100%-owned Red Mountain Lithium Project in Nevada, USA has identified a new zone of lithium bearing clay-rich rocks (shown as the Dark green ‘Unit J’ in Figures 1-3) with lithium grades of up to 2,100ppm lithium.

Key Highlights

- Detailed geological mapping completed by consulting expert Professor Phillip Gans of the University of California Santa Barbara.

- Mapping identifies two priority clay-rich and lithium- hosting rock units at Red Mountain.

- Additional rock-chip sampling within ‘Unit J’ identifies a broad zone of mineralisation grading up to 2,100ppm Li.

- Mapped as the most clay-rich rock type. ‘Unit J’ has only been tested by one drill hole, indicating excellent upside.

- Continuous ‘Unit O’ trending approximately north-south through project will underpin the upcoming Exploration Target.

Unit J is a claystone and siltstone dominated rock type located in the west of the Red Mountain Project area which was identified as part of detailed geological mapping undertaken by consultant geologist Professor Phillip Gans of the University of California Santa Barbara. Professor Gans identified Unit J as the most clay-rich rock unit at the Project and recommended a targeted sampling campaign to establish the presence of lithium mineralisation. Subsequently a total of 38 sub-crop and outcrop samples were taken over an area of 800 x 500m of Unit J (Figure 1), with excellent assay results returned from 13 samples grading 1,000ppm lithium or greater. The sampling revealed outstanding exploration potential in this previously unsampled part of the project.

The mapping also identified two priority rock units for future drill targeting – Unit O and the previously mentioned Unit J. Unit O (shown in pale green in Figures 1-3) is dominated by silt and sandstone with clay-rich horizons, is interpreted to be continuous over a 7.8km extent across the Project, and has been tested by 12 of the 13 holes drilled to date, each of which has intersected strong lithium mineralisation7.

The continuous nature of Unit O will underpin a maiden Exploration Target for the Project and inform the drill targeting strategy for the first half of 2025, as the Company advances toward a Maiden Mineral Resource Estimate in the second half.

Astute Chairman, Tony Leibowitz, said:

“With the advice of expert independent consultants, we are continuing to systematically progress the Red Mountain Project. The identification of a new high-grade lithium-bearing unit increases the project’s potential, while the enhanced geological understanding allows the calculation of an Exploration Target, as well as contributes to de-risking of the upcoming drilling campaign, paving the way for a maiden Mineral Resource Estimate in the second half of 2025”

Background

Located in central-eastern Nevada (Figure 4), adjacent to the Grand Army of the Republic Highway (Route 6), which links the regional mining towns of Ely and Tonopah. the Red Mountain Project was staked by Astute in August 2023.

The Project area has broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation2. Elsewhere in the state of Nevada, equivalent rocks host large lithium deposits (see Figure 4) such as Lithium Americas’ (NYSE: LAC) 62.1Mt LCE Thacker Pass Project2 and American Lithium (TSX.V: LI) 9.79Mt LCE TLC Lithium Project3.

Astute has completed substantial surface sampling campaigns at Red Mountain, which indicate widespread lithium anomalism in soils and confirmed lithium mineralisation in bedrock with some exceptional grades of up to 4,150ppm Li1,6 (Figures 1 and 3).

A total of 13 RC and diamond drill holes have been drilled at the project for a combined 1,944.72m. Both campaigns were highly successful with strong lithium mineralisation intersected in every hole drilled7.

Scoping leachability testwork on mineralised material from Red Mountain indicates high leachability of lithium of up to 98%, varying with temperature, acid strength and leaching duration8.

Click here for the full ASX Release

This article includes content from Astute Metals NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00