- WORLD EDITIONAustraliaNorth AmericaWorld

July 13, 2023

Multiple wide mineralised zones in latest diamond holes at Hotinvaara Prospect confirm extensive nickel system with significant growth potential

Nickel sulphide explorer Nordic Nickel Limited (ASX: NNL; Nordic, or the Company) is pleased to report further assay results from drilling completed at its flagship Pulju Nickel Project (the Project) in the Central Lapland Greenstone Belt (CLGB) of northern Finland.

HIGHLIGHTS

- Assays received for a further three diamond drillholes following the initial wide intersections reported from HOT001 on 26 May 2023.

- Latest assay highlights include1:

- 199.1m @ 0.22% Ni from 20.9m in HOT006

- 25.3m @ 0.29% Ni from 340m in HOT006

- incl 0.6m @ 4.66% Ni, 0.1% Co from 359.6m

- 63.8m @ 0.22% Ni, 0.01% Co from 140.2m in HOT003

- 63.0m @ 0.22% Ni from 211.0m in HOT003

- 20.0m @ 0.26% Ni, 0.01% Co from 284.0m in HOT003

- incl 2.4m @ 0.73% Ni, 0.03% Co from 288.0m

- which included 0.4m @ 1.68% Ni, 0.06% Co from 288.0m

- Pervasive disseminated nickel sulphide mineralisation with discrete high-grade semi-massive and net textured sulphide zones.

- Partial leach assay results confirm nickel is predominantly sourced from nickel sulphides in the main mineralised zones.

- Peak assayed nickel grade from drilling to date of 4.66% Ni obtained in HOT006.

- Shallow, anomalous copper intersected for the first time in HOT003.

- Results support the potential to significantly expand the current Hotinvaara MRE, with an updated MRE scheduled for completion later this year.

- Twenty (20) diamond drillholes now completed for a total of 12,385.2m.

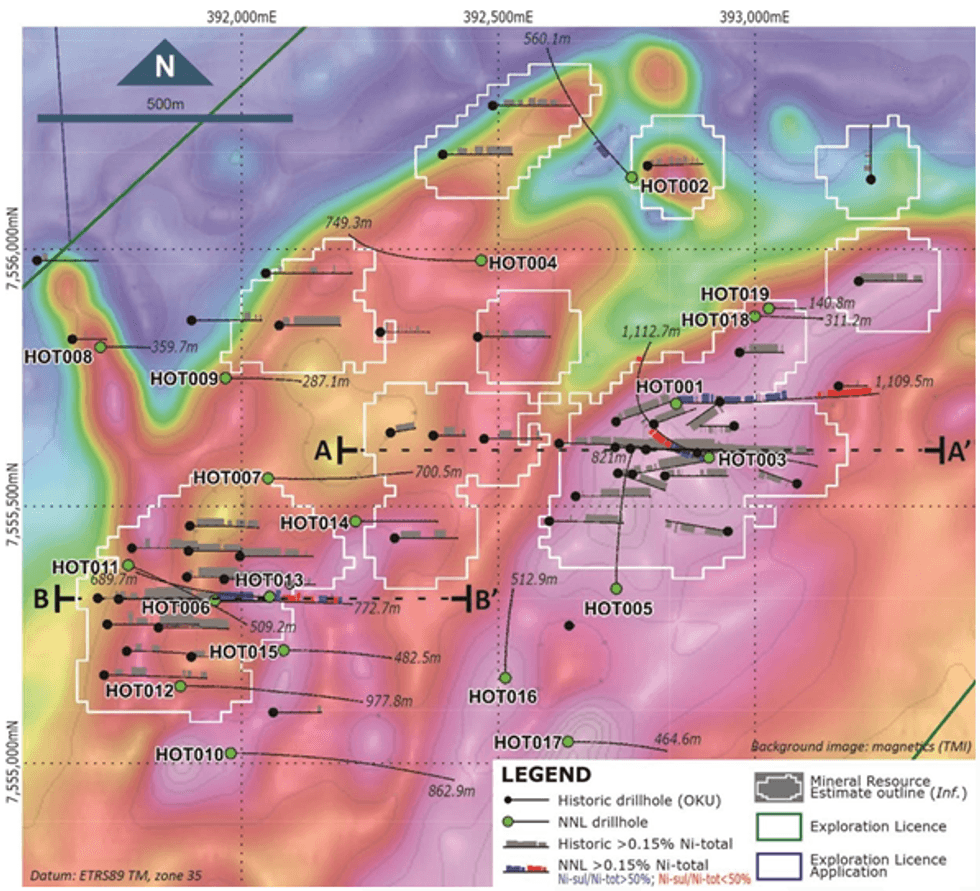

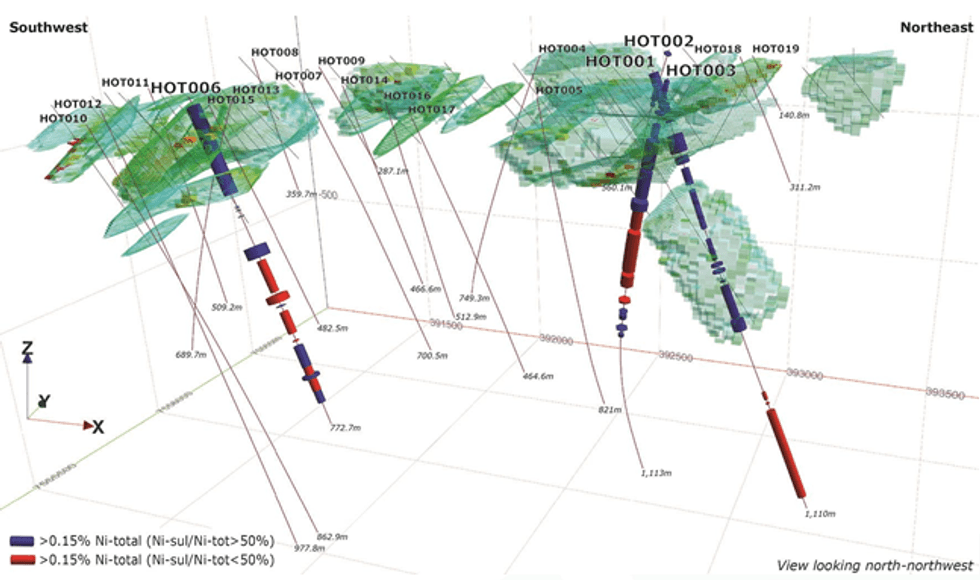

Assays from diamond drillholes HOT002, HOT003 and HOT006, part of the Company’s maiden diamond drilling program at the Hotinvaara Prospect (Hotinvaara), have confirmed and extended the footprint of nickel mineralisation intersected by historical drilling (Figure 1 & Appendix 1).

HOT003 and HOT006 encountered multiple near-surface disseminated sulphide zones as well as discrete zones of semi-massive and net-textured massive sulphides2. The grade of the mineralisation intersected is consistent with the current Mineral Resource Estimate (MRE) for Hotinvaara of 133.8Mt @ 0.21% Ni and 0.01% Co3.

The Phase 1, 22,000m drilling program at Hotinvaara is focused on a dual exploration strategy of targeting high-grade massive nickel-copper sulphides of a similar style to the nearby world-class Sakatti Deposit and bulk tonnage-style disseminated nickel sulphide mineralisation with the potential to host long-life Mineral Resources.

Management Comment

Nordic Nickel Managing Director, Todd Ross, said: “Nordic’s maiden drill campaign continues to confirm historical drilling and, importantly, expand the mineralisation footprint at Hotinvaara. The wide intersections of shallow disseminated nickel sulphides we are seeing in the assays bodes well for when we re-evaluate the Mineral Resource at the end of the Phase 1 drilling program.

“The high-grade nickel sulphide intersections are highly encouraging, confirming that the mechanisms for the massive sulphide formations were operating at Hotinvaara.

“When drilling re-commences after the northern summer break, our activities will continue to focus on zones of both known and potential massive sulphides and systematically step-out from historically drilled areas with the aim of expanding the Mineral Resource. Based on what we are seeing at Hotinvaara, the Company believes that the Pulju project has the potential to host multiple world-class nickel deposits and thereby produce for many generations the critical minerals desperately needed for the energy transition.”

Drillhole summaries

Nordic’s diamond drilling and assay results confirm those from the historical drilling as well as increasing the mineralisation footprint and confidence level of the MRE (Figure 2). Significantly, near-surface disseminated nickel mineralisation has been intersected consistently by drilling. Following is a brief description of the three new drillholes for which assay results have recently been received. Full details of the assay results are provided in Appendix 1.

Drillhole HOT002

Drillhole HOT002 was positioned near the northernmost extent of the known mineralised zone and designed to test multiple geological and geophysical targets, including the basal ultramafic sequences where magma interacted with a regionally extensive evaporite (including anhydrite) sequence.

HOT002 intersected an interlayered sequence of ultramafics, ultramafic skarn and schists down to 165m and appears to lie near the edge of, rather than within, the main mineralised channel. It did not intersect the basal sequences as planned, however, a zone of disseminated nickel mineralisation grading 49.85m @ 0.18% Ni from 119.5m was intersected in an area not currently in the MRE4.

Drillhole HOT003

Drillhole HOT003 was also positioned to test multiple geological and geophysical targets, including the basal ultramafic sequences, and the eastern part of the MRE. Electromagnetic features being targeted included FLEM, MLEM and borehole EM (BHEM) conductor plates.

Click here for the full ASX Release

This article includes content from Nordic Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NNL:AU

The Conversation (0)

03 July 2024

Nordic Resources

Exploring district-scale nickel asset in Finland to support growing demand

Exploring district-scale nickel asset in Finland to support growing demand Keep Reading...

28 May 2025

Total Finland Gold Resources Increase to 961,800oz AuEq

Nordic Resources (NNL:AU) has announced Total Finland Gold Resources Increase to 961,800oz AuEqDownload the PDF here. Keep Reading...

25 May 2025

A$3.5M Institutional Placement and New Chairman Appointed

Nordic Resources (NNL:AU) has announced A$3.5M Institutional Placement and New Chairman AppointedDownload the PDF here. Keep Reading...

21 May 2025

Trading Halt

Nordic Resources (NNL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

11 May 2025

Excellent Gold Intersections Verified at Kiimala Project

Nordic Resources (NNL:AU) has announced Excellent Gold Intersections Verified at Kiimala ProjectDownload the PDF here. Keep Reading...

23 April 2025

Quarterly Activities Report & Appendix 5B

Nordic Resources (NNL:AU) has announced Quarterly Activities Report & Appendix 5BDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00