July 11, 2022

American West Metals Limited (American West or the Company) (ASX: AW1), a low-footprint, North American- focused base metals explorer, is pleased to announce further strong assay results from the diamond drill program at the West Desert Project in Utah (West Desert or the Project).

Highlights:

- High-grade zinc and copper mineralisation intersected in WD22-05 across multiple intervals, including:

- 17.22m @ 1.04% Cu, 0.58g/t Au, 12.46g/t In from 325.21m

- 3.05m @ 2.58% Cu, 0.91g/t Au, 10.7g/t Ag, 36.31g/t In from 362.39m, including;

- 1.83m @ 4.12% Cu, 1.47g/t Au, 16.58g/t Ag, 56.49g/t In from 363.61m

- 10.67m @ 1.04% Cu, 0.27g/t Au, 4.68g/t Ag, 15.61g/t In from 384.03m

- 6.34m @ 10.71% Zn, 4.3g/t Ag, 53.94/t In from 561.87m, including:

- 3.44m @ 14.06% Zn, 0.14% Cu, 6.2g/t Ag, 59.13g/t In from 564.77m

- 16.76m @ 3.58% Zn, 0.1% Cu, 94.85g/t In from 665.04m, including;

- 3.05m @ 6.19% Zn, 0.13% Cu, 0.11g/t Au, 208.18g/t In from 668.09m, and

- 3.04m @ 5.98% Zn, 81.23g/t In from 678.76m

- Broad zones of copper-gold mineralisation intersected outside of the current resource envelope supporting the potential to increase the historical resource estimate of the West Desert Deposit

- Outstanding zinc-indium grades confirmed within the Deep Zone, increasing confidence for the resource modelling

- Resource modelling and update incorporating these new drill results has commenced

Dave O’Neill, Managing Director of American West Metals commented:

“We are very excited to announce more strong assay results that continue to demonstrate the quality of the West Desert Deposit.

“The results from WD22-05 are important for the resource upgrade currently underway as they have identified significant volumes of copper and gold mineralisation outside of the current resource model as well as confirming strong grades within the Deep Zone of the deposit.

“The drill program is continuing to exceed our expectations and our assumptions about the outstanding growth and higher-grade development potential of West Desert.

“We look forward to reporting on the results for the remaining drill holes in the coming weeks.”

WD22-05 – DRILL HOLE DETAILS

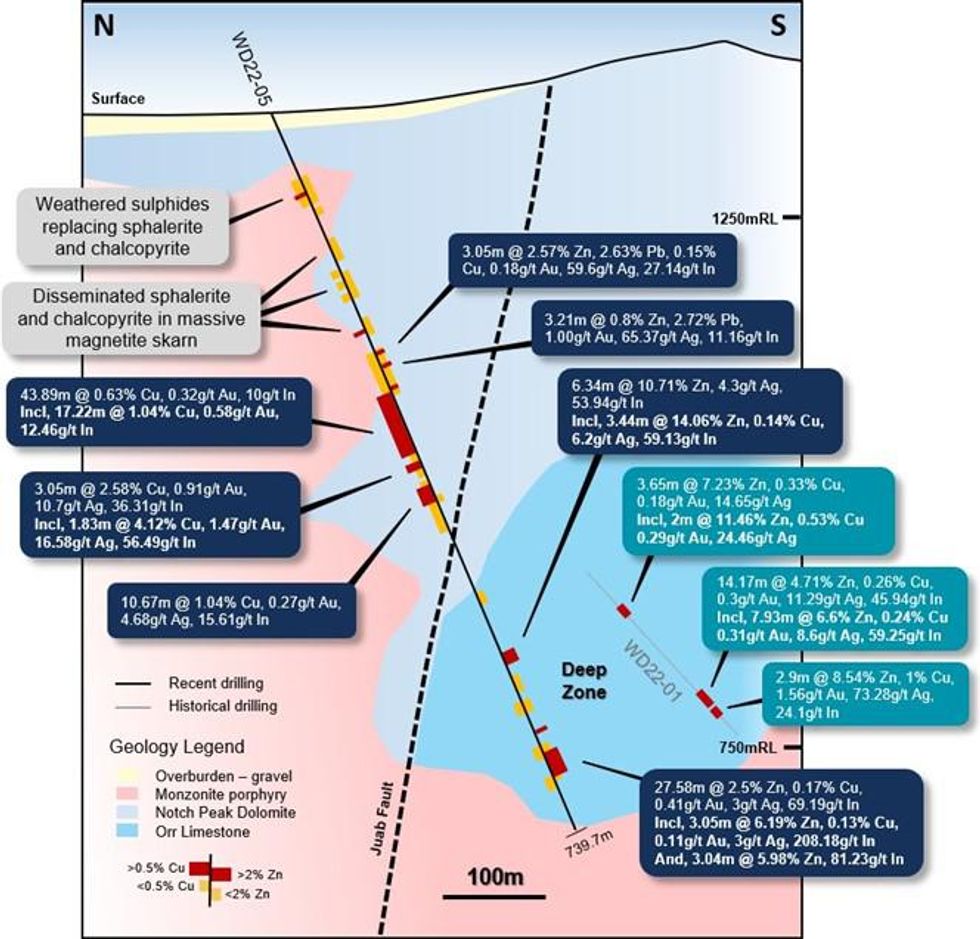

Drill hole WD22-05 was designed to test the continuity of mineralisation on the western edge of the Main Zone, and within the Deep Zone of the West Desert Deposit. WD22-05 is the first drill hole by American West that has intersected the central portion of the Deep Zone.

WD22-05 was drilled to a depth of 739.7m and has successfully intersected a number of thick, massive and semi- massive zinc and copper sulphide dominant zones contained within broad lower-grade intervals (Figure 2). The intersections herein are expressed as downhole widths and are interpreted to be close to true widths within the porphyry and skarn, and approximately 80-90% within the CRD mineralisation.

WD22-05 was selected as the fourth drill hole for assaying to prioritise information on the Deep Zone mineralisation for the ongoing geological and resource modelling.

Figure 1: Photo of chalcopyrite and bornite (copper sulphide) within magnetite skarn In from approximately 363.91m (1194ft) downhole in drill hole WD22-05.

Growth potential in copper

The upper mineralised intervals within WD22-05 are interpreted to form the western edge of the Main Zone of the West Desert Deposit, and are comprised of magnetite rich skarns hosted within dolomite and limestone.

The first major zone contains magnetite skarn/hornfels and the bulk of the mineralisation in this area of the deposit is disseminated, and generally lower grade than the core of the Main Zone. However, strong intervals with abundant sphalerite and galena were encountered between 249 and 269m downhole. Lead and silver are present in higher volumes (i.e., 4.69% Pb, 3.97% Zn, 69.87g/t Ag from 259.37 – 259.68m) than what is typically seen elsewhere within the West Desert Deposit.

The second major skarn (between approximately 294 and 350m downhole) contains variable amounts of chalcopyrite within the entire interval. A narrow, strongly silica altered porphyry with high-grade molybdenum intrudes the skarn between approximately 298 and 302m. Further copper-rich magnetite skarns with bornite (Figure 1) are located directly below the above interval between 350 and 365m, and 382 and 396m downhole.

The strong copper sulphide dominant mineralisation was encountered where the skarn is in contact with the quartz monzonite porphyry. This geological association is common within other large porphyry related mineral systems in the district (i.e., Bingham Canyon). Most of this mineralisation lies outside of the current copper resource shell and is further evidence of the resource growth potential at West Desert.

Figure 2: Schematic geological section at 288810E showing the zinc and copper dominant mineralisation intersected in WD22-05 and WD22-01 (approx. 40m east of WD22-05).

Deep Zone continuity confirmed

Four thick intervals were encountered within the lower portion of WD22-05 and show similarities to typical mineralisation in the Deep Zone, where stratiform magnetite rich skarn and CRD is hosted within steeply dipping carbonate sediments of variable thickness. There is very limited drilling of this part of the West Desert Deposit and WD22-05 provides important information on continuity of the ore within this zone.

Click here for the full ASX Release

This article includes content from American West Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AW1:AU

The Conversation (0)

31 January 2022

American West Metals

Supplying Critical Minerals to Support the Global Energy Transition

Supplying Critical Minerals to Support the Global Energy Transition Keep Reading...

13 December 2023

23.8Moz of Indium and 119koz of Gold in Updated JORC Mineral Resource for West Desert, USA

American West Metals Ltd (American West or the Company) (ASX: AW1 | OTCQB: AWMLF) ) is pleased to provide a significant update to the JORC 2012 compliant Mineral Resource Estimate (MRE) for it’s 100% owned West Desert Project in Utah (West Desert or the Project) with the release of our maiden... Keep Reading...

27 November 2023

Aston Bay and American West Metals Confirm High Grade Copper and Zinc Mineralization at the Tempest Prospect, Storm Copper Project, Canada

Up to 38.2% Cu and 30.8% Zn in assays for select grab sampling of surface gossan rocks at the underexplored Tempest Prospect Prospective gossans have been mapped for more than 4km at Tempest, which is located 40km south of the Storm Copper targets drilled in 2023 A ground electromagnetic (EM)... Keep Reading...

01 November 2022

Quarterly Activities Report for the Period Ended September 2022

American West Metals Limited (American West Metals or the Company) (ASX: AW1) is pleased to report on its Quarterly activities for the period ending 30 September 2022. During the September 2022 quarter, the Company’s focus was on the maiden diamond drilling program at the Storm Copper Project,... Keep Reading...

19 September 2022

Assay Results Confirm Outstanding Growth Potential Of West Desert

American West Metals Limited (American West Metals or the Company) (ASX: AW1) is pleased to announce significant assay results from exploration drilling at the West Desert Project in Utah (West Desert or the Project). WD22-19 has intersected high-grade mineralisation 250m south-west of the West... Keep Reading...

3h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00