April 16, 2024

Frontier Energy Limited (ASX: FHE; OTCQB: FRHYF) (Frontier or the Company) is pleased to provide an update on the Company’s funding strategy for the Stage One development of its Waroona Renewable Energy Project (Waroona Project).

HIGHLIGHTS

- Frontier has commenced Phase Two of the debt financing process, shortlisting preferred banks ahead of additional due diligence to enable submission of binding, credit approved terms

- The Company anticipates credit approved terms to be provided during the next 8 to 12 weeks, assuming successful completion of due diligence

- Phase One of the Debt Financing Process generated strong interest from Australian and international banks, confirming:

- Interest in providing senior debt financing which aligns with the Definitive Feasibility Study (DFS) assumptions1

- Acceptance of the selected original equipment manufacturers

- Key due diligence requirements and the proposed third-party service providers to undertake the work to meet those requirements

- Ability of potential financiers to meet the proposed timetable

- The DFS set out the maximum debt carrying capacity and included assumptions regarding amortisation periods and interest rates

- Targeted maximum debt carrying capacity in the DFS was between 65% to 70%, which equates to a debt facility of $200 million to $225 million

- The strategic equity investor process is ongoing, with NDAs in place with a number of Australian and international groups

CEO Adam Kiley commented: “Key to the initial phase of the debt financing process was confirmation of our major funding assumptions, which assumed gearing levels of between 65% to 70%, equating to between $200 million and $225 million, equipment selection, due diligence requirements and the funding timetable.

Confirmation of these key assumptions in such a short time frame is testament to the key attributes of the Waroona Project being well understood by financiers, predominately due to its simplicity and its executability as well the strong returns it delivers.

We have now moved into the second phase of the debt financing process and will be working closely with shortlisted banks towards credit approved terms and complete due diligence requirements in a timely manner.”

Shortlisting banks for debt financing

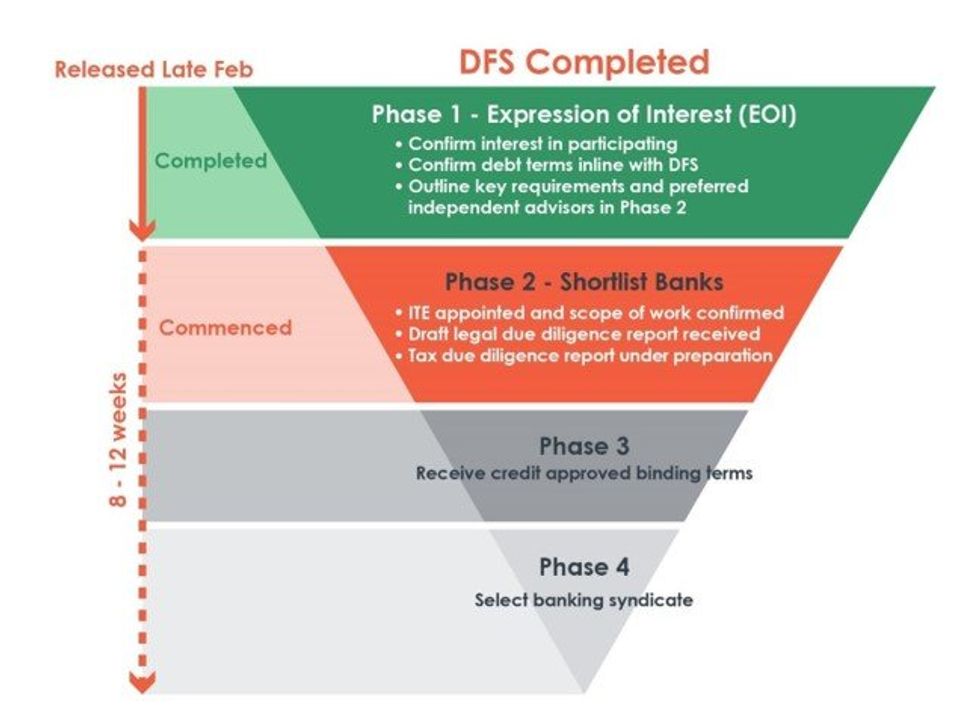

Following the release of the DFS for Stage One of the Waroona Project in late February, the Company commenced the Debt Financing Process to assist in meeting the funding required for development at the Waroona Project. Image 1 below provides an outline of the key outcomes and indicative timing for each phase of the process.

As highlighted above, Phase One of the Debt Financing Process involved the Company’s debt advisor, Leeuwin Capital Partners, seeking expressions of interest from financial institutions to participate in the Debt Process.

Click here for the full ASX Release

This article includes content from Frontier Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FHE:AU

The Conversation (0)

06 February 2024

Frontier Energy

Clean energy to help fill WA’s growing power supply gap

Clean energy to help fill WA’s growing power supply gap Keep Reading...

17 February

RZOLV Technologies Announces OTCQB Listing, DTC Eligibility and Leadership Transition

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711) (OTCQB: RZOLF) ("RZOLV" or the "Company") is pleased to announce that its common shares have been approved for trading on the OTCQB Venture Market ("OTCQB"), operated by OTC Markets Group Inc., under the trading symbol "RZOLF." The... Keep Reading...

17 February

RZOLV Technologies Announces OTCQB Listing, DTC Eligibility and Leadership Transition

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711) (OTCQB: RZOLF) ("RZOLV" or the "Company") is pleased to announce that its common shares have been approved for trading on the OTCQB Venture Market ("OTCQB"), operated by OTC Markets Group Inc., under the trading symbol "RZOLF." The... Keep Reading...

17 February

RZOLV Technologies Announces OTCQB Listing, DTC Eligibility and Leadership Transition

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711) (OTCQB: RZOLF) ("RZOLV" or the "Company") is pleased to announce that its common shares have been approved for trading on the OTCQB Venture Market ("OTCQB"), operated by OTC Markets Group Inc., under the trading symbol "RZOLF." The... Keep Reading...

04 February

Charbone Announces its First Hydrogen Supply Hub in the Ontario Market

(TheNewswire) Brossard, Quebec, February 4, 2026 TheNewswire Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

04 February

Charbone annonce l'etablissement de son premier pole d'approvisionnement en hydrogene sur le marche Ontarien

(TheNewswire) Brossard, Quebec, le 4 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

02 February

10 Biggest EV Stocks to Watch in 2026

The energy revolution is here to stay, and electric vehicles (EVs) have become part of the mainstream narrative. The shift toward green energy is gathering momentum, with governments adding more incentives to accelerate this transition. Increasing EV sales are good news for battery metals... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00