Ausenco-led study delivers after-tax NPV of C$1.25 billion at spot gold price; Permitting underway

Fortune Bay Corp. (TSXV: FOR,OTC:FTBYF) (FWB: 5QN) (OTCQB: FTBYF) ("Fortune Bay" or the "Company") is pleased to announce results from an independent Updated Preliminary Economic Assessment ("Updated PEA") for its 100% owned Goldfields Gold Project ("Goldfields" or the "Project") located in northern Saskatchewan .

Updated PEA Highlights:

- Expedited Path to Production: Sub-5,000 tpd open-pit scenario designed to remain within provincial permitting, leveraging a valid EIS (2008), existing infrastructure, and past-producing status.

- Strong Economics; High-Sensitivity to Gold Price:

| Gold Price/oz | USD 2,600 (Base Case) | USD 3,650 (Spot Price 1 ) |

| After-Tax NPV 5% | C$610M | C$1,253M |

| After-Tax IRR | 44 % | 74 % |

| After-tax NPV 5% /CAPEX | 2.0 | 4.2 |

- Gold spot price as of September 19, 2025

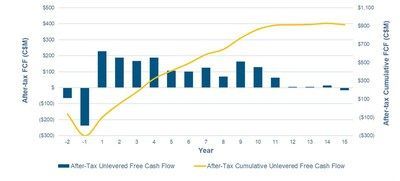

- Robust Financing Fundamentals: 14-year mine life with 896,000 oz payable production; favorable NPV/Capex ratio; and strong Free Cash Flow (after-tax cumulative C$914M FCF base case; C$1,817M FCF at US$3,650 /oz).

- Low-Cost, Capital Efficient: Attractive operating costs ( US$1,207 /oz cash cost; US$1,330 /oz AISC), supported by a modest initial capital requirement of C$301M , that includes a C$51M contingency.

- Grade, Recovery, Strip Advantage: Among highest-grade open-pit developments in the Americas 2 (1.2 g/t Mill Head Grade), 95.4% gold recovery, and only 3:1 waste-to-resource ratio.

- De-Risked Pathway: 97% Indicated ounces incorporated in the Updated PEA mine plan, reconciled with historical production; supported by established infrastructure, well-developed community relations, and a clear permitting pathway that builds on existing EIS.

- Growth Potential: Resource expansion at Box and Athona plus multiple advanced targets (Frontier Lake, Golden Pond , Triangle).

- Premier Jurisdiction: Saskatchewan ranks #1 in Canada and #7 globally for mining investment attractiveness (Fraser Institute, 2024).

" The Updated PEA demonstrates the exceptional economics of Goldfields, establishing it as a significant development asset within Canada's gold mining sector, while underscoring the disconnect between the project's intrinsic value and Fortune Bay's market valuation ," commented Dale Verran , CEO of Fortune Bay. "With 97% of ounces in the mine plan classified as Indicated and supported by extensive historical datasets, established infrastructure and a valid EIS, Goldfields is comparatively de-risked for a PEA-stage project and is uniquely positioned for near-term development. We are now focused on securing additional permits, advancing key de-risking PFS studies, and preparing for resource-growth drilling. We are also evaluating alternative options for an accelerated production pathway."

The Company will be hosting a Live Webinar at 12PM EDT Thursday September 25, 2025 to present the Updated PEA results. Follow this link to subscribe: http://bit.ly/46F05kf

Description of the Updated PEA

The Updated PEA outlines a development approach for Goldfields' current mineral resource through conventional open-pit mining and onsite gold recovery at a 4,950 tpd processing facility.

This assessment positions Goldfields for expedited advancement toward mine development. While different production scenarios were considered, all of which demonstrate robust economics, the Updated PEA focuses on a mine plan tailored to accelerate the path to production—maintaining throughput below 5,000 tpd to proceed without requiring a federal impact assessment. This expedited pathway is underpinned by established infrastructure, a de-risked resource base with 97% of ounces in the Indicated category, and the benefit of a Provincially-approved Environmental Impact Statement ("EIS") from 2008 for a 5,000 tpd open-pit operation.

The Updated PEA was prepared by Ausenco Engineering Canada ULC ("Ausenco") in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The Updated PEA NI-43-101 Technical Report will be filed on SEDAR ( www.sedar.com ) within 45 days of this News Release.

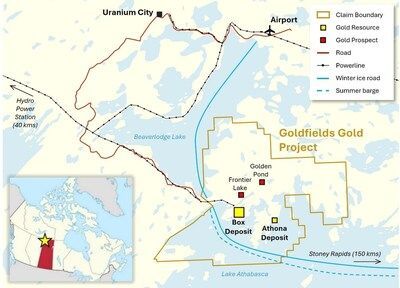

Project Overview

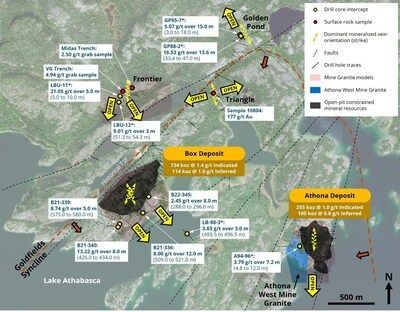

The 100% owned Goldfields Project ("Goldfields" or the "Project") is located approximately 13 kilometres south of Uranium City, Saskatchewan . Goldfields hosts the Box and Athona gold deposits, as well as additional gold showings within the prospective Goldfields Syncline. The Box deposit was historically mined underground between 1939 and 1942, producing 64,000 ounces of gold.

The Project is located within a historical mining area and benefits from established infrastructure, including a road and hydro-powerline to the Box deposit. Nearby facilities and services in Uranium City include bulk fuel, civils contractors, and a commercial airport.

Location of the Goldfields Project

Base Case Economic Results

The Updated PEA is preliminary in nature, given that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

The Updated PEA for Goldfields is based upon a subset of mineral resources comprising 97% indicated mineral resources and 3% inferred mineral resources .

| General Inputs | | LOM |

| Gold Price | US$/oz | $2,600 |

| Exchange Rate | US$:C$ | 0.74 |

| Production | | |

| Strip Ratio | Waste:Resource | 3:1 |

| Mill Head Grade | g/t | 1.2 |

| Mill Gold Recovery | % | 95.4 |

| Mine Life | yr | 13.9 years |

| Total Material Mined | Mt | 100.2 |

| Average Annual Mined Material | ktpa | 7,190 |

| Total Mill Feed | Mt | 25.2 |

| Average Annual Mill Feed | ktpa | 1,807 |

| Total Payable Au | koz | 896 |

| Average Annual Payable Au | koz | 64 |

| Average Annual Payable Au (Years 1-4) | koz | 99 |

| Revenue & Earnings Metrics | | |

| Total Revenue | C$M | $3,144 |

| Average Annual Revenue | C$M | $226 |

| EBITDA | C$M | $1,685 |

| Average Annual EBITDA | C$M | $121 |

| Operating Costs per Ounce | | |

| Cash Costs per Ounce | US$/oz Au | $1,207 |

| All-In Sustaining Cost (AISC) per Ounce | US$/oz Au | $1,330 |

| Royalty NSR | % | 2 % |

| Capital Cost | | |

| Initial Capex | C$M | $301 |

| Sustaining Capex | C$M | $142 |

| Closure Cost | C$M | $15 |

| Before-Tax Economics | | |

| NPV (5%) | C$M | $839 |

| IRR | % | 54.7 % |

| Payback | yr | 1.4 |

| NPV (5%) / Initial Capex | - | 2.8 |

| After-Tax Economics | | |

| NPV (5%) | C$M | $610 |

| IRR | % | 44.0 % |

| Payback | yr | 1.7 |

| NPV (5%) / Initial Capex | - | 2.0 |

| Notes: | |

| • | Cash Costs per ounce reflect direct mining, processing, site general & administrative, refining, transport, and royalty costs, divided by payable gold ounces. |

| • | All-in Sustaining Costs (AISC) per ounce include cash costs plus sustaining capital, sustaining exploration, and site-level closure costs, divided by payable gold ounces. Growth capital, corporate G&A, financing costs, and income taxes are excluded. |

| • | Initial Capex represents upfront expenditures to construct and commission the mine, plant, and supporting infrastructure. |

| • | Sustaining Capex represents ongoing capital expenditures required to maintain production during the life of mine. |

| • | Payback Period represents the number of years from start of production to achieve cumulative positive after-tax free cash flow, including sustaining capital. |

| • | Non-IFRS financial measures are presented for additional information and benchmarking purposes only. They do not have standardized definitions under IFRS and may not be directly comparable to similar measures reported by other issuers. |

After-Tax Unlevered Free Cash Flow (Base Case US$2,600 /oz)

Sensitivity

After-Tax Sensitivity Summary

| Gold Price (US$/oz) | US$2,100 | Base Case | US$3,100 | Spot Gold US$3,650 1 |

| NPV 5% | $303 | $610 | $916 | $1,253 |

| IRR | 27.3 % | 44.0 % | 59.0 % | 74.2 % |

| NPV 5% /CAPEX | 1.01 | 2.03 | 3.04 | 4.16 |

| Payback (Years) | 2.60 | 1.67 | 1.25 | 0.98 |

| 1. Gold spot price as of September 19, 2025 |

After-Tax NPV 5% Sensitivity

| Gold Price (US$/oz) | After-Tax NPV 5% | Initial CAPEX | Total OPEX | FX | |||

| -20 % | +20 % | -20 % | +20 % | -20 % | +20 % | ||

| US$2,100 | $303 | $360 | $247 | $441 | $165 | $625 | $88 |

| US$2,600 | $610 | $667 | $553 | $747 | $472 | $1,008 | $344 |

| US$3,100 | $916 | $973 | $860 | $1,054 | $779 | $1,391 | $600 |

| US$3,650 | $1,253 | $1,310 | $1,196 | $1,390 | $1,116 | $1,812 | $881 |

After-Tax IRR Sensitivity

| Gold Price (US$/oz) | After-Tax IRR Base Case | Initial CAPEX | Total OPEX | FX | |||

| -20 % | +20 % | -20 % | +20 % | -20 % | +20 % | ||

| US$2,100 | 27.3 % | 37.0 % | 20.5 % | 34.0 % | 19.4 % | 44.8 % | 12.9 % |

| US$2,600 | 44.0 % | 56.7 % | 35.3 % | 49.7 % | 37.9 % | 63.3 % | 29.7 % |

| US$3,100 | 59.0 % | 74.3 % | 48.4 % | 64.1 % | 53.6 % | 80.2 % | 43.5 % |

| US$3,650 | 74.2 % | 92.2 % | 61.7 % | 78.9 % | 69.4 % | 97.5 % | 57.3 % |

Capital and Operating Costs

- Initial CAPEX: C$301 million , including contingency of C$51 million .

- Sustaining Capital: C$142 million over LOM.

- Operating Costs: C$41.0 /t milled, including mining (38%), processing (37%), and G&A (25%).

- Closure Costs: C$15 million at end of mine life.

Mineral Resources

An updated Mineral Resource Estimate ("MRE"), effective date September 11, 2025 , was completed as part of the Updated PEA to reflect a slightly lower cut-off grade due to increases in the gold price. Mineral resources are constrained within a conceptual open-pit shell. The updated MRE was prepared by SRK Consulting ( Canada ) Inc. ("SRK") in accordance with CIM Guidelines and NI 43-101. This updated MRE replaces the previous MRE with an effective date of September 1, 2022 , also completed by SRK, who used the same resource estimation procedures. SRK is also responsible for the development of the supporting mineralization models which were based upon structural and petrographic studies conducted by SRK.

The MRE reconciles to within 1% of historical mine production at Box when the historically reported process plant recovery of 96% is applied, providing additional confidence in the estimate.

Goldfields Mineral Resource Statement, effective date September 11, 2025 .

| Deposit | Category | Tonnes (Mt) | Au Grade (g/t) | Total Au (000's oz) |

| Box | Indicated | 16.2 | 1.41 | 734.3 |

| Athona | Indicated | 7.8 | 1.02 | 255.4 |

| | Total Indicated | 24.0 | 1.28 | 989.6 |

| Box | Inferred | 3.4 | 1.04 | 114.1 |

| Athona | Inferred | 4.0 | 0.78 | 100.1 |

| | Total Inferred | 7.4 | 0.90 | 214.2 |

| Notes: | |

| • | Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| • | Mineral resources are reported at a cut-off grade of 0.28 g/t gold, constrained within a conceptual open-pit shell. |

| • | Mineral resources are reported based on an updated gold price of US$2,600/oz. |

| • | All figures are rounded to reflect the relative accuracy of the estimate. |

Mining and Processing

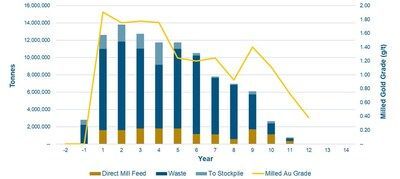

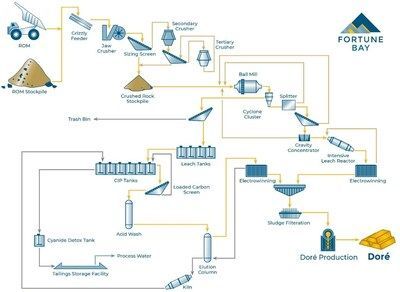

- Mining Method: Conventional open-pit mining with drill, blast, load and haul methods. Mine plan includes Box and Athona pits with phased pushbacks to optimize early higher-grade feed.

- Mine Life : 13.9 years, including 11 years of direct mill feed from pit operations and subsequent low-grade stockpile rehandling.

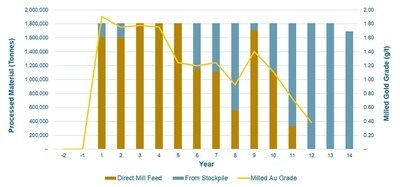

- Throughput: Average 1.8 Mtpa (4,950 tpd).

- Production: 25.2 Mt of mill feed at average grade of 1.16 g/t Au, recovering 896,000 ounces of payable gold.

- Processing: Whole ore leach with gravity recovery and carbon-in-pulp (CIP), based on SGS Canada - Lakefield testwork from 2015. Average recoveries of 95.9% at Box and 93.5% at Athona.

Mine Plan Summary

Mill Feed Summary

Simplified Process Flowsheet

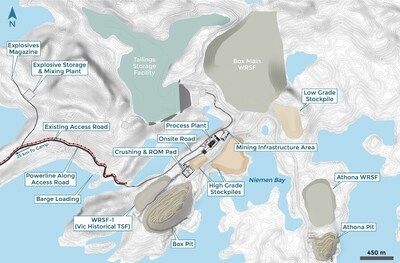

Infrastructure

The Project benefits from historical investment and proximity to existing infrastructure:

- Road access to Uranium City (25 km), with municipal infrastructure, commercial airport (year-round commercial flights) and civils contractors.

- Power to be supplied via refurbishment of existing (currently inactive) 115 kV line from hydro-power stations, with peak demand of 12 MW. Line assessment currently underway by SaskPower.

- Freshwater supply from nearby Lake Athabasca.

- Tailings storage facility ("TSF") designed for 21.9 Mt capacity, to be constructed in two phases.

- Waste rock storage facilities ("WRSF") and low-grade stockpiles integrated into mine plan.

Site Layout

Environmental, Social, and Permitting

- EIS approval granted in 2008 for an open-pit mine at Box and a 5,000 tpd processing facility remains valid.

- Additional approvals required for Updated PEA mine plan to address the time-lapse since original assessment work and changes in project footprint, including the addition of open-pit mining at the Athona deposit and the management of relatively larger volumes of waste rock and tailings.

- Environmental baseline studies have been initiated, to build upon and validate 10+ years of environmental data, with terrestrial and aquatic studies ongoing. The studies have been designed to establish a foundation for Provincial regulatory engagement and advancement in 2026.

- Well-developed community relationships, including Exploration Agreement ( Nov 2022 ) providing consent up to and including bankable feasibility study.

- Engagement on project development has been initiated with Indigenous Nations and local Municipalities, with initial meetings to commence Q4 2025.

- At this time, no material environmental or social risks have been identified that cannot be reasonably mitigated.

Key Opportunities

Accelerated Production Alternative: Onsite Concentrate Production

- Fast-Tracked Development: Unique to Goldfields, the Project benefits from its past-producing status and a valid 2008 EIS, enabling investigation of a fast-tracked, lower-capex route to production.

- High-Grade Concentrates: Prior SGS Canada - Lakefield testwork (2019) demonstrated exceptional potential—gravity coarse gold concentrates >1,000 g/t and subsequent sulphide flotation concentrates >200 g/t . New metallurgical studies (SGS - Sept, 2025) are underway to optimize recovery and assess marketability of high-grade gold concentrates.

- Capital & Timeline Benefits: A staged approach—initial gravity + sulphide concentrate production—could substantially reduce upfront capital requirements, shorten the development timeline, and advance Goldfields into production under the existing EIS framework.

Mineral Resource Growth: Exploration Drilling

- Resource Growth: Potential to expand the current mineral resources through exploration drilling, unlocking additional upside at Goldfields.

- Exploration Targets: Box (down-dip extensions; underground development potential), Athona (near-surface west), Frontier Lake (high-grade near-surface continuity), Golden Pond & Triangle (surface extensions).

Exploration Targets & Resource Growth Opportunities

| *Historical exploration and drilling results have not been verified and there is a risk that any future confirmation work and exploration may produce results that substantially differ from the historical results. The Company considers these results relevant to assess the mineralization and economic potential of the property. Drill hole mineralized intersections are lengths downhole and not true thicknesses. |

Next Steps

- Pre-Feasibility Study

As recommended by Ausenco, the Updated PEA supports advancing Goldfields through Pre-Feasibility Study ("PFS"). Proposed programs include metallurgical testing and process optimization; geotechnical and hydrogeological studies; mine, infrastructure, and tailings engineering; environmental baseline updates and permitting; resource expansion and exploration drilling. Work has commenced on a post-PEA waste rock characterization study and additional planning is underway to commence key further de-risking studies toward PFS. - Accelerated Production Alternative: Onsite Concentrate Production

Evaluation of the technical and commercial pathway for this staged development is ongoing utilising the existing permit framework and the encouraging gravity and concentrate testwork obtained to date. Following completion of the SGS testwork currently in progress, the evaluation is expected to be expanded to cover blended samples as well as variability testing across the two deposits. - Mineral Resource Growth: Exploration Drilling

A 2,000–3,000 metre (15–20 holes) drilling program is planned to test growth potential beyond the Updated PEA mine plan. - Permitting

- Advance environmental and permitting work to align the Updated PEA mine plan with regulatory requirements. This includes completing ongoing baseline studies to support regulatory engagement in 2026.

- Continuing proactive community engagement under the current Exploration Agreement, with initial project development meetings beginning in Q4 2025.

Qualified Persons

The technical and scientific information in this news release has been reviewed and approved by Gareth Garlick P.Geo ., Vice-President Technical Services of the Company, who is a Qualified Person as defined by NI 43-101. Mr. Garlick is an employee of Fortune Bay and is not independent of the Company under NI 43‑101.

The following Qualified Persons have reviewed the technical information contained in the Updated PEA and in this News Release in their area of expertise and are considered "independent" of Fortune Bay and the Project:

- Kevin Murray , P.Eng., Ausenco Engineering Canada ULC

- Mohammad Ali Hooshiar , P.Eng., Ausenco Engineering Canada ULC

- James Millard , P.Geo., Ausenco Engineering Canada ULC

- Marc Schulte , P.Eng., Moose Mountain Technical Services

- Cliff Revering , P.Eng., SRK Consulting

- Ron Uken , Pr.Sci.Nat., SRK Consulting

References

2. Average gold grades for open-pit mineral reserves and resources for projects in the Americas is sourced from S&P Capital IQ.

About Ausenco

Ausenco is a global company redefining what's possible. The team is based out of 21 offices working across five continents to deliver services worldwide. Combining deep technical expertise with a 30-year track record, Ausenco delivers innovative, value-add consulting, studies, project delivery, asset operations and maintenance solutions to the minerals and metals and industrial sectors ( www.ausenco.com ).

About Fortune Bay

Fortune Bay Corp. (TSXV:FOR,OTC:FTBYF; FWB:5QN; OTCQB:FTBYF) is a gold exploration and development company advancing high-potential assets in Canada and Mexico. With a strategy focused on discovery, resource growth and early-stage development, the Company targets value creation at the steepest part of the Value Creation Curve—prior to the capital-intensive build phase. Its portfolio includes the development-ready Goldfields Project in Saskatchewan , the resource-expansion Poma Rosa Project in Mexico , and an optioned uranium portfolio in the Athabasca Basin providing non-dilutive capital and upside exposure. Backed by a technically proven team and tight capital structure, Fortune Bay is positioned for multiple near-term catalysts. For more information, visit www.fortunebaycorp.com or contact info@fortunebaycorp.com .

On behalf of Fortune Bay Corp.

"Dale Verran"

Chief Executive Officer

902-334-1919

Cautionary Statement

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions, and expectations. They are not guarantees of future performance. Words such as "expects", "aims", "anticipates", "targets", "goals", "projects", "intends", "plans", "believes", "seeks", "estimates", "continues", "may", variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements, and include, but are not limited to, statements with respect to: the results of the Updated PEA, including future Project opportunities, future operating and capital costs, closure costs, AISC, the projected NPV, IRR, timelines, permit timelines, and the ability to obtain the requisite permits, economics and associated returns of the Project, the technical viability of the Project, the market and future price of and demand for gold, the environmental impact of the Project, and the ongoing ability to work cooperatively with stakeholders, including Indigenous Nations, local Municipalities and local levels of government. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward- looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate Indigenous Nations and local Municipalities, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. For more information on Fortune Bay, readers should refer to Fortune Bay's website at www.fortunebaycorp.com .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Fortune Bay Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/23/c4359.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/23/c4359.html