Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI) is pleased to provide an update on its Yessi vein exploration program at the San Jose Mine in Mexico.

Paul Weedon, Senior Vice President of Exploration, commented, "Drilling on the Yessi vein, since the initial discovery hole in August 2023, has continued to establish a well-defined system, with recent results such as 1,327 g/t Ag Eq over an estimated true width of 3.0 meters from 604.85 meters in SJO-1444 and 1,036 g/t Ag Eq over an estimated true width of 8.1 meters including 2,910 g/t Ag Eq in SJO-1460 highlighting the potential for high-grade shoots. In addition, wide intervals such as the 179 g/t Ag Eq over an estimated true width of 17.5 meters in SJO-1455A highlight the potential for broad zones of mineralization".

Yessi vein drilling highlights include :

| SJO-1444 : | 1,327 g/t Ag Eq over an estimated true width of 3.0 meters from 604.85 meters, including 5,135 g/t Ag Eq over an estimated true width of 0.3 meters from 605.90 meters | |

| SJO-1447 : | 295 g/t Ag Eq over an estimated true width of 4.8 meters from 649.50 meters | |

| SJO-1455A : | 179 g/t Ag Eq over an estimated true width of 17.5 meters from 460.10 meters, including 236 g/t Ag Eq over an estimated true width of 7.7 meters from 475.05 meters | |

| SJO-1458: | 453 g/t Ag Eq over an estimated true width of 4.8 meters from 446.30 meters | |

| SJO-1460 | 1,036 g/t Ag Eq over an estimated true width of 8.1 meters from 463.30 meters, including 2,910 g/t Ag Eq over an estimated true width of 2.4 meters from 472.15 meters Ag Eq is calculated using a factor of 80:1. Please see Appendix 1 for further details. | |

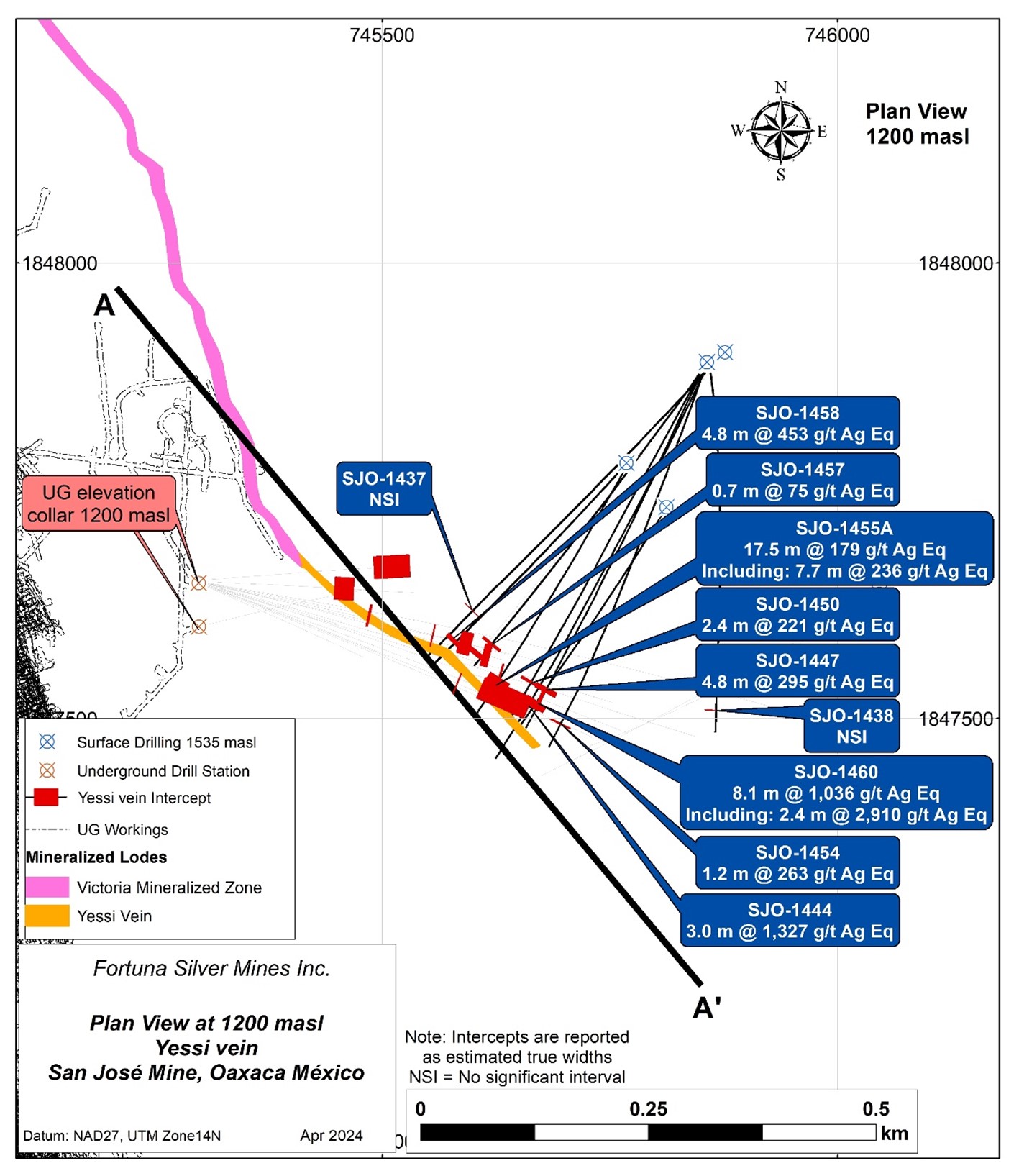

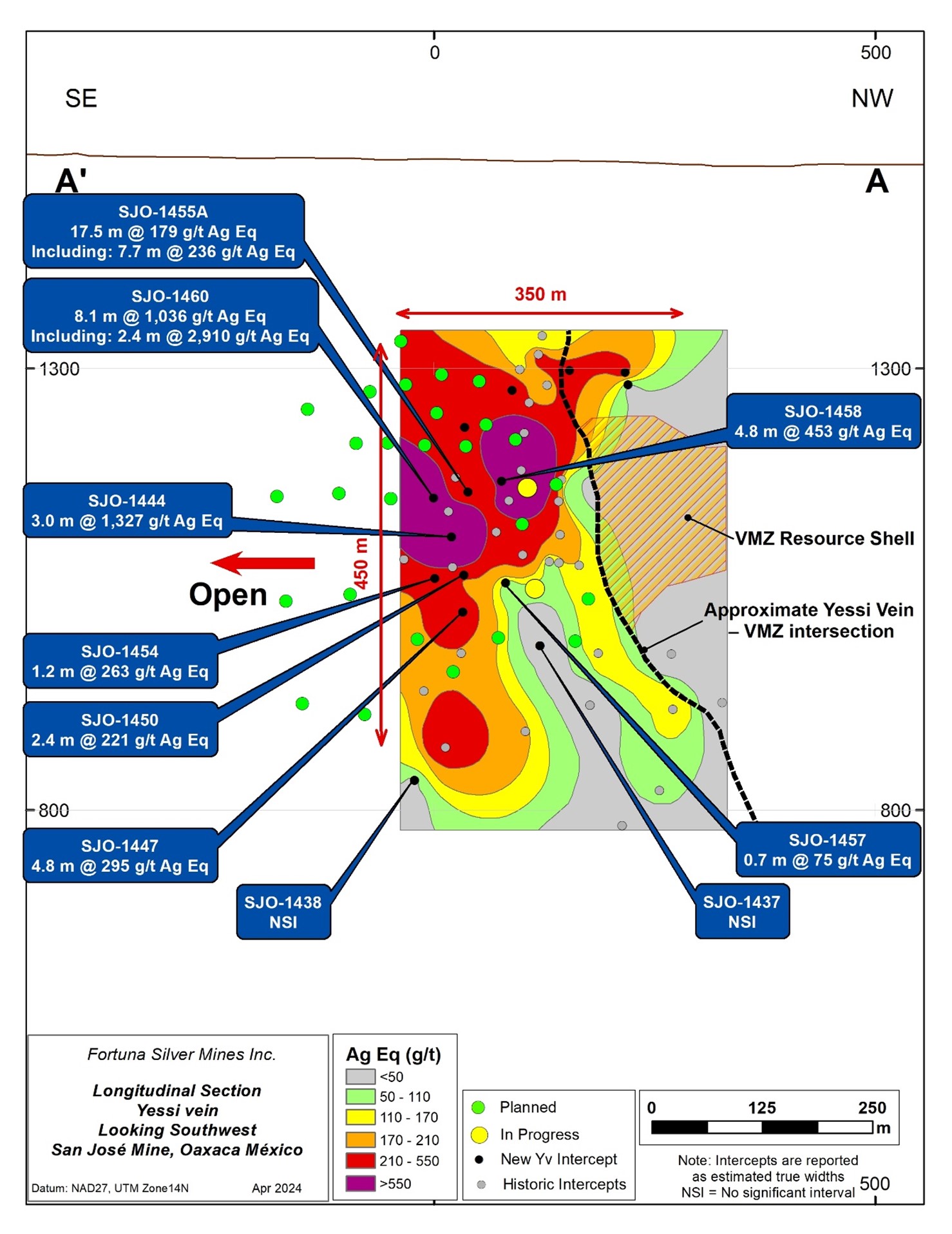

Drilling on the Yessi vein has continued with the dual objectives of firstly testing for the limits of the Yessi vein and secondly infilling the drill spacing to support initial resource estimations and mining studies. The Yessi vein has now been successfully drill tested over a 350-meter strike and a 450-meter vertical profile where it remains open up- and down-dip, as well as along strike to the southeast. The current phase of the program consisted of 10 additional holes for a total of 6,622 meters.

Geological and structural logging of the drill core has confirmed the vein geometry as trending north-northwest, intersecting and merging with the north-south orientated Victoria Mineralized Zone ("VMZ") towards the west. Evidence is also emerging of higher-grade shoots within the structure demonstrating a moderate south-easterly plunge and often associated with high gold grades. Vein development is consistently associated with extensive alteration and brecciation with veining characterised by fine veinlets and fragments suggesting several phases of emplacement.

Additional drilling with three drill rigs will continue to test the depth, strike and infill of the current Yessi vein extent. Refer to Appendix 1 for full details of the Yessi vein drill holes and assay results.

Figure 1: Yessi vein plan view

Figure 2: Yessi vein long section (looking south)

Quality Assurance & Quality Control (QA - QC)

San Jose Mine, Mexico

All diamond drilling (DD) drill holes at the San Jose Mine were drilled with either NQ sized diameter or HQ sized diamond drill bits reducing to NQ sized diameter with greater depth. Following detailed geological and geotechnical logging, all diamond drill core samples are split on-site by diamond sawing. One half of the core is submitted to the internal laboratory located at the San Jose Mine. The laboratory at the mine has been accredited by the Standard Council of Canada (ISO 17025: 2017) for preparation, drying, gravimetry, fire assay, Inductively Coupled Plasma and Atomic Absorption processes. The remaining half core is retained on-site for verification and reference purposes. Following preparation, the samples are assayed for gold and silver by standard fire assay methods and for silver and base metals by Inductively Coupled Plasma and as well as three acid digestion at the same internal laboratory. The QA - QC program includes the blind insertion of certified reference standards and assay blanks at a frequency of approximately 1 per 20 normal samples as well as the inclusion of duplicate samples for verification of sampling and assay precision levels.

Qualified Person

Paul Weedon, Senior Vice President of Exploration for Fortuna Silver Mines Inc., is a Qualified Person as defined by National Instrument 43-101 being a member of the Australian Institute of Geoscientists (Membership #6001). Mr. Weedon has reviewed and approved the scientific and technical information contained in this news release. Mr. Weedon has verified the data disclosed, including the sampling, analytical and test data underlying the information or opinions contained herein by reviewing geochemical and geological databases and reviewing diamond drill core. There were no limitations to the verification process.

About Fortuna Silver Mines Inc.

Fortuna Silver Mines Inc. is a Canadian precious metals mining company with five operating mines in Argentina, Burkina Faso, Côte d'Ivoire, Mexico, and Peru. Sustainability is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental protection, and social responsibility. For more information, please visit our website .

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com | www.fortunasilver.com | X | LinkedIn | YouTube

Forward-looking Statements

This news release contains forward-looking statements which constitute "forward-looking information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 (collectively, "Forward-looking Statements"). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this news release may include, without limitation, statements about the Company's plans for its mines and mineral properties; changes in general economic conditions and financial markets; the impact of inflationary pressures on the Company's business and operations; statements indicating that recent drilling on the Yessi vein highlights the potential for high-grade shoots and for broad zones of mineralization; the objectives of the Yessi vein exploration program, which includes infilling the drill spacing to support initial resource estimation; statements regarding evidence of higher-grade shoots at VMZ; the Company's business strategy, plans and outlook; the merit of the Company's mines and mineral properties; the future financial or operating performance of the Company; the Company's ability to comply with contractual and permitting or other regulatory requirements; approvals and other matters. Often, but not always, these Forward-looking Statements can be identified by the use of words such as "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "planned", "reflecting", "will", "anticipated", "estimated" "containing", "remaining", "to be", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others, operational risks associated with mining and mineral processing; uncertainty relating to Mineral Resource and Mineral Reserve estimates; uncertainty relating to capital and operating costs, production schedules and economic returns; uncertainties related to new mining operations such as the Séguéla Mine; risks relating to the Company's ability to replace its Mineral Reserves; risks associated with mineral exploration and project development; uncertainty relating to the repatriation of funds as a result of currency controls; environmental matters including obtaining or renewing environmental permits and potential liability claims; uncertainty relating to nature and climate conditions; risks associated with political instability and changes to the regulations governing the Company's business operations; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in countries in which the Company does or may carry on business; risks associated with war, hostilities or other conflicts, such as the Ukrainian – Russian conflict and the Israel – Hamas war, and the impacts such conflicts may have on global economic activity; risks relating to the termination of the Company's mining concessions in certain circumstances; developing and maintaining relationships with local communities and stakeholders; risks associated with losing control of public perception as a result of social media and other web-based applications; potential opposition to the Company's exploration, development and operational activities; risks related to the Company's ability to obtain adequate financing for planned exploration and development activities; property title matters; risks relating to the integration of businesses and assets acquired by the Company; impairments; risks associated with climate change legislation; reliance on key personnel; adequacy of insurance coverage; operational safety and security risks; legal proceedings and potential legal proceedings; the possibility that the appeal in respect of the ruling in favor of Compañia Minera Cuzcatlan S.A. de C.V. reinstating the environmental impact authorization (the "EIA") at the San Jose Mine will be successful; uncertainties relating to general economic conditions; risks relating to a global pandemic, which could impact the Company's business, operations, financial condition and share price; competition; fluctuations in metal prices; risks associated with entering into commodity forward and option contracts for base metals production; fluctuations in currency exchange rates and interest rates; tax audits and reassessments; risks related to hedging; uncertainty relating to concentrate treatment charges and transportation costs; sufficiency of monies allotted by the Company for land reclamation; risks associated with dependence upon information technology systems, which are subject to disruption, damage, failure and risks with implementation and integration; risks associated with climate change legislation; labor relations issues; as well as those factors discussed under "Risk Factors" in the Company's Annual Information Form for the year ended December 31, 2023. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to the accuracy of the Company's current Mineral Resource and Mineral Reserve estimates; that the Company's activities will be conducted in accordance with the Company's public statements and stated goals; that there will be no material adverse change affecting the Company, its properties or its production estimates (which assume accuracy of projected head grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labor and contractor availability and other operating or technical difficulties); the duration and effect of global and local inflation; geo-political uncertainties on the Company's production, workforce, business, operations and financial condition; the expected trends in mineral prices, inflation and currency exchange rates; that the appeal filed in the Mexican Collegiate Court challenging the reinstatement of the EIA will be unsuccessful; that all required approvals and permits will be obtained for the Company's business and operations on acceptable terms; that there will be no significant disruptions affecting the Company's operations and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all Mineral Reserve and Mineral Resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and Mineral Reserve and Mineral Resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

Appendix 1: Yessi vein, San Jose Mine, Mexico

| HoleID | Easting (NAD27_14N) | Northing (NAD27_14N) | Elev (m) | EOH 1 Depth (m) | UTM Azimuth | Dip | Depth From (m) | Depth To (m) | Drilled Width (m) | Est. True Width (m) | Au (ppm) | Ag (ppm) | Ag Eq 2 ( ratio 80 ) ppm | Vein 3 |

| SJO-1437 | 745876 | 1847901 | 1540 | 799 | 224 | -53 | NSI 4 | Yv | ||||||

| SJO-1438 | 745859 | 1847888 | 1539 | 816 | 172 | -64 | 425.60 | 428.35 | 2.75 | 1.8 | 1.46 | 242 | 359 | Hw |

| incl | 427.00 | 428.35 | 1.35 | 0.9 | 2.34 | 403 | 590 | |||||||

| NSI | Yv | |||||||||||||

| SJO-1444 | 745855 | 1847890 | 1539 | 702 | 205 | -45 | 604.85 | 608.80 | 3.95 | 3.0 | 6.68 | 793 | 1,327 | Yv |

| incl | 605.90 | 606.35 | 0.45 | 0.3 | 27.15 | 2,963 | 5,135 | |||||||

| incl | 606.35 | 607.25 | 0.90 | 0.7 | 4.79 | 720 | 1,103 | |||||||

| incl | 607.25 | 608.30 | 1.05 | 0.8 | 7.81 | 875 | 1,500 | |||||||

| incl | 608.30 | 608.80 | 0.50 | 0.4 | 2.02 | 254 | 416 | |||||||

| SJO-1447 | 745855 | 1847890 | 1539 | 726 | 205 | -51 | 649.50 | 657.70 | 8.20 | 4.8 | 1.41 | 182 | 295 | Yv |

| incl | 649.50 | 650.15 | 0.65 | 0.4 | 1.62 | 244 | 374 | |||||||

| incl | 650.15 | 650.65 | 0.50 | 0.3 | 5.76 | 880 | 1,341 | |||||||

| incl | 650.65 | 651.50 | 0.85 | 0.5 | 1.74 | 190 | 329 | |||||||

| incl | 656.50 | 657.15 | 0.65 | 0.4 | 0.91 | 118 | 191 | |||||||

| incl | 657.15 | 657.70 | 0.55 | 0.3 | 3.60 | 438 | 726 | |||||||

| SJO-1450 | 745855 | 1847890 | 1539 | 628 | 209 | -50 | 614.70 | 617.75 | 3.05 | 2.4 | 1.03 | 138 | 221 | Yv |

| incl | 614.70 | 615.25 | 0.55 | 0.4 | 4.38 | 595 | 945 | |||||||

| incl | 630.00 | 630.35 | 0.35 | 0.3 | 1.74 | 207 | 346 | |||||||

| SJO-1454 | 745855 | 1847890 | 1539 | 688 | 201 | -48 | 650.70 | 652.30 | 1.60 | 1.2 | 1.12 | 173 | 263 | Yv |

| incl | 650.70 | 651.35 | 0.65 | 0.5 | 1.61 | 253 | 382 | |||||||

| incl | 652.00 | 652.30 | 0.30 | 0.2 | 1.01 | 168 | 249 | |||||||

| SJO-1455A | 745770 | 1847780 | 1535 | 543 | 209 | -53 | 460.10 | 486.95 | 26.85 | 17.5 | 0.90 | 107 | 179 | Hw |

| incl | 475.05 | 486.95 | 11.90 | 7.7 | 1.25 | 135 | 236 | |||||||

| 498.10 | 502.10 | 4.00 | 2.0 | 1.73 | 196 | 335 | Yv | |||||||

| incl | 498.10 | 500.10 | 2.00 | 1.0 | 2.89 | 335 | 566 | |||||||

| 516.00 | 518.30 | 2.30 | 1.1 | 1.22 | 162 | 260 | Yv | |||||||

| incl | 518.00 | 518.30 | 0.30 | 0.1 | 7.21 | 917 | 1,494 | |||||||

| SJO-1457 | 745857 | 1847890 | 1540 | 667 | 216 | -52 | 621.15 | 622.20 | 1.05 | 0.7 | 0.44 | 40 | 75 | Yv |

| SJO-1458 | 745868 | 1847780 | 1535 | 516 | 222 | -53 | 446.30 | 453.55 | 7.25 | 4.8 | 2.11 | 284 | 453 | Yv |

| incl | 446.30 | 446.85 | 0.55 | 0.4 | 2.61 | 285 | 494 | |||||||

| incl | 446.85 | 447.85 | 1.00 | 0.7 | 4.32 | 644 | 990 | |||||||

| incl | 451.35 | 452.35 | 1.00 | 0.7 | 4.59 | 508 | 875 | |||||||

| incl | 452.35 | 453.55 | 1.20 | 0.8 | 3.19 | 478 | 733 | |||||||

| SJO-1460 | 745812 | 1847732 | 1536 | 537 | 212 | -56 | 399.80 | 401.95 | 2.15 | 1.3 | 1.16 | 98 | 191 | Hw |

| 463.30 | 476.40 | 13.10 | 8.1 | 6.29 | 533 | 1,036 | Yv | |||||||

| incl | 463.30 | 464.95 | 1.65 | 1.0 | 3.67 | 531 | 825 | |||||||

| incl | 472.15 | 476.05 | 3.90 | 2.4 | 18.41 | 1,437 | 2,910 |

Notes:

1. EOH: End of hole

2. Ag Eq calculated using a factor of 80:1 using metal prices of US$1,950/oz for gold with 90% metallurgical recovery, and US$24.5/oz for silver with 91% metallurgical recovery

3. Vein: HW – Yessi vein hanging wall, Yv – Yessi vein main

4. NSI: No significant interval

5. All holes were drilled using diamond drilling tail

6. Depths and widths reported to nearest significant decimal place

A PDF accompanying this announcement is available at http://ml.globenewswire.com/Resource/Download/03b9b7bc-e157-4743-8949-8c3e3ec76242

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0cefe89d-2b7d-487b-8718-a34698d0b7e9

https://www.globenewswire.com/NewsRoom/AttachmentNg/f1ff5bde-488e-44de-83d3-d7e6fa773c7e