August 13, 2024

The Directors of Thor Energy Plc (“Thor”) (AIM, ASX: THR, OTCQB: THORF) are pleased to announce that, further to the announcement on 24 November 2022 in relation to the Farm-in Funding Agreement and the announcement on 24 April 2024 in relation to the Completion of Stage 1 Earn-In Commitment, a joint venture Agreement (“JV”) with ASX-listed Investigator Resources Limited (“IVR”), operating as Fram under the Heads of Agreement (“HoA”), has been formalised for the Molyhil and Bonya (EL29701 only) Projects, in the Northern Territory.

Highlights:

- JV formed with IVR completing by spending $1,000,000 on the tenements (Stage 1 commitment) and the transfer of 25% interest in the Molyhil tenements and the sale of Thor’s 40% interest in Bonya tenement EL29701 (Table 1 and 2).

- The initial interest for the parties is 25% Fram and 75% Molyhil.

- IVR will now issue Thor A$250,000 worth of IVR shares upon the formalisation of Fram’s 25% JV interest.

- Fram can opt to continue to earn up to 80% interest by spending up to, a further $7,000,000 on the Tenements via a three-stage process.

- The JV at Molyhil will allow Thor to focus on its priority USA Uranium assets and Alford East Copper-REE Project while retaining a meaningful interest in the Molyhil Project.

Nicole Galloway Warland, Managing Director of Thor Energy, commented:

“The Directors are delighted that the Stage 1 Commitment has been completed and that Fram is progressing with developments on this exciting tungsten/molybdenum deposit. The increase in the mineral resource endowment is underpinning feasibility work at Molyhil.

“The commitment shown by Fram in diligently working through all aspects of this deposit is to be applauded.

“The Molyhil divestment and Bonya sale (EL29701) will support the Company’s focus on its priority US uranium assets, where we see the most significant and nearest-term value potential for Thor’s shareholders.”

Key Transaction Details

Formation of the Joint Venture

Under the execution of the Stage 1 obligations, a JV Agreement was executed between Fram and Molyhil on 13 August 2024 (“JV Commencement Date”). The initial JV interests of the parties are 25% Fram and 75% Molyhil in Molyhil, with the 40% sale of Bonya EL29701 (Table 1 and 2).

Stage 1 Joint Venture Consideration

On the formalisation of Fram’s 25% JV interest, IVR will issue Thor A$250,000 worth of IVR shares at a deemed price equal to the higher of the Volume Weighted Average Price for the 15-day trading period immediately preceding the 25% earn-in date, or A$0.05 per share.

Stage 2 Earn-In

Fram shall, within 28 days of the JV Commencement Date, give Molyhil written notice of its intention to earn a further 26% interest in the Molyhil Tenements (“Stage 2 Earn-In Notice”), bringing its total interest to 51%.

If Fram issues a Stage 2 Earn-In Notice, Fram must spend A$2,000,000 (which amount is in addition to the Stage 1 Commitment) on exploration on or before the third anniversary of the JV Commencement Date (“Stage 2 Commitment”) to earn the additional 26%.

Upon Fram meeting the Stage 2 Commitment, Fram will be entitled to a 51% interest in the Tenements.

Stage 3 Earn-In

Fram shall, within 28 days of the Stage 2 Completion Notice, give Molyhil written notice of its intention to earn a further 29% interest in the Tenements (“Stage 3 Earn-In Notice”), bringing its total interest to 80%.

If Fram issues a Stage 3 Earn-In Notice, Fram must spend A$5,000,000 (an amount additional to the Stage 1 and Stage 2 Commitments) on exploration on or before the sixth anniversary of the JV Commencement Date (“Stage 3 Commitment”) to earn the additional 26%.

Upon Fram meeting the Stage 3 Commitment, Fram will be entitled to an 80% interest in the Tenements.

Project Background

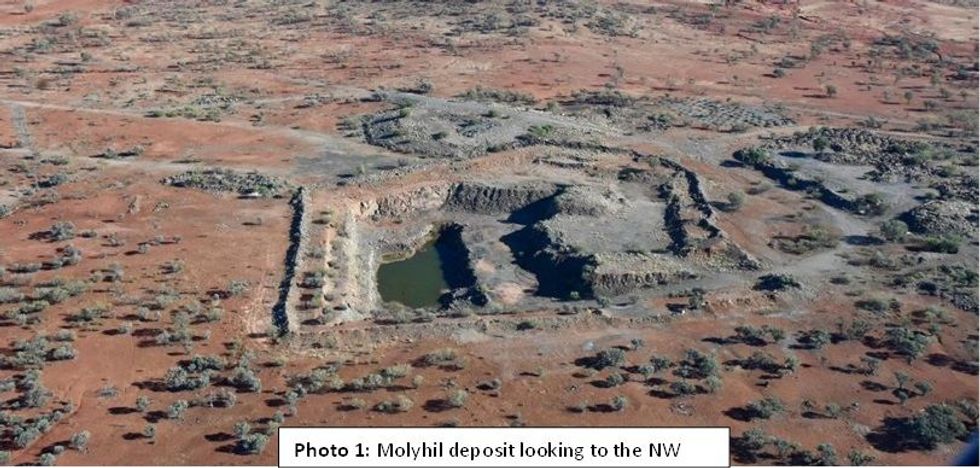

The Molyhil tungsten-molybdenum deposit is located 220km north-east of Alice Springs (320km by road) within the prospective polymetallic province of the Proterozoic Eastern Arunta Block, in the Northern Territory (Figure 1).

As announced on (ASX/AIM: 31 May 2024), Thor reported a revised Mineral Resource Estimate comprising Measured, Indicated, and Inferred Mineral Resources, totalling 4.65 million tonnes at 0.26% WO3 (Tungsten trioxide), 0.09% Mo (Molybdenum), and 0.04% Cu (Copper) using a 0.05% WO3 cut-off.

The Bonya tungsten and copper tenement (EL29701) is located approximately 30km to the northeast of Molyhil (Figure 1). Thor, in JV with Arafura, held a 40% equity interest in the tenements.

Click here for the full ASX Release

This article includes content from Thor Energy PLC, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

02 February

Project Update

Tungsten West (LON:TUN), the mining company focused on restarting production at the Hemerdon tungsten and tin mine ("Hemerdon" or the "Project") in Devon, UK, is pleased to provide an update on its Project Financing initiatives and operational activities, against the backdrop of favourable... Keep Reading...

29 January

Top Australian Mining Stocks This Week: Apollo Minerals Triples on Tungsten Exploration Permit Decision

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Companies with news focused on tungsten, gold, bauxite and lithium took the top five spots this week.Critical minerals continue to be a... Keep Reading...

28 January

Redmoor - Continuation of High-Grade Tungsten and Identification of High-Grade Tin Zones

Latest drill results confirm strong WO3, Sn and Cu mineralisation; mineralised continuity within the Redmoor SVS high-grade zones; & validity of historical results

Strategic Minerals plc (AIM: SML; USOTC: SMCDF), an international mineral exploration and production company, is delighted to announce that its wholly owned subsidiary, Cornwall Resources Limited ("CRL"), has received assay results from drillhole CRD036 - the first from Pad 2 within the Redmoor... Keep Reading...

22 January

Viking Acquires Extensive Historical Data for Linka Project

Viking Mines Ltd (ASX: VKA) (“Viking” or “the Company”) is pleased to announce that it has completed a strategic acquisition of a comprehensive historical technical dataset covering the Linka Project in Nevada, USA. The dataset was purchased for US$35,000 (~A$50,000) and contains extensive... Keep Reading...

21 January

Tivan Secures Molyhil Project to Expand Australian Critical Minerals Portfolio

Tivan (ASX:TVN,OTCPL:TNGZF) said on Monday (January 19) has completed its acquisition of the Molyhil tungsten-molybdenum project in the Northern Territory, further growing its Australian critical minerals portfolio.Amounting to AU$8.75 million, the acquisition will provide Tivan 100 percent... Keep Reading...

14 January

High Grade Assays up to 1.3% WO3 from Linka Tungsten Project, USA

Viking Mines Ltd (ASX: VKA) (“Viking” or “the Company”) is pleased to announce that it has received initial assay results from four samples collected for metallurgical testwork from the Linka Project located in Nevada, USA. Linka is one of six tungsten projects being acquired (Figure 4).2 Viking... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00