Highlights

- Transformational opportunity to acquire up to a 70% interest in 10 highly-prospective uranium projects in the Athabasca Basin and collaborate with Denison Mines (TSX: DML, NYSE American: DNN)

- Foremost Lithium to change its name to Foremost Clean Energy Ltd.

- David Cates, Denison's President and CEO, is expected to join Foremost's Board of Directors

Foremost Lithium Resource & Technology Ltd. ( NASDAQ: FMST ) ( CSE: FAT ) (" Foremost Lithium ", " Foremost " or the " Company ") is pleased to announce today that it has executed a property acquisition agreement (the " Option Agreement ") with Denison Mines Corp. (" Denison "), which grants Foremost an option to acquire up to 70% of Denison's interest in 10 uranium exploration properties, along with other ancillary agreements (collectively, the " Transaction "). Pursuant to the Transaction, Foremost will provide Denison with consideration, including cash, stock, andor future exploration spending commitments by Foremost. The Transaction is subject to regulatory approvals. In connection with the Transaction, Foremost intends to change its name to "Foremost Clean Energy Ltd." Full details of the terms of the Transaction and the name change are outlined below under " Key Terms of the Transaction and Name Change" .

" We are pleased to announce a transformative transaction with Denison, a clear leader in the uranium sector. Uranium prices have seen significant strength in recent years driven by the global demand for clean energy, which has been reinforced by supportive government policies and geopolitical events underscoring the need for reliable western uranium supply. The Athabasca Basin is recognized as one of the world's leading uranium jurisdictions, with numerous producing mines and high-profile development projects. This collaboration will advance significant near-term exploration and development efforts across numerous high-quality exploration projects to maximize the properties' potential for the benefit of both Foremost and Denison shareholders," stated Foremost's President and CEO, Jason Barnard. Further, Barnard added, "On behalf of the entire team, I'd like to warmly welcome David Cates to our Board. As Denison's current President and CEO, Mr. Cates will be an invaluable member adding his extensive experience and a proven track record in the Canadian uranium mining space. As a junior explorer, having the support of Mr. Cates and Denison will provide Foremost a competitive advantage. We are confident that Foremost is entering a new chapter of growth, and enhanced outcomes, for the benefit of both companies' shareholders. We look forward to working with Mr. Cates as we steer and support our Company's expansion towards its goal of being a new leading uranium explorer in the Athabasca Basin ."

David Cates, President and CEO, commented, " Denison is pleased to work with Foremost to enhance the potential for discovery on an excellent portfolio of uranium exploration properties that would otherwise receive little attention from Denison with our current focus on development and mining stage projects. We are impressed with Foremost's leadership team and technical capabilities and are excited to see high-potential exploration work being carried out on these properties in the coming years."

Transformational Transaction Covering High-Potential Uranium Properties

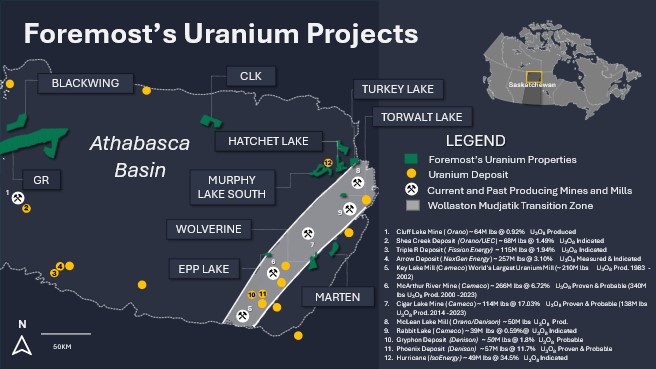

The project portfolio subject to the Option Agreement consists of 10 properties comprised of 45 claims covering an aggregate area of 332,378 acres (134,509 hectares) within the Athabasca Basin region of northern Saskatchewan (the " Exploration Properties "), which is known for its prolific history of large high-grade uranium discoveries and operating mines—currently producing ~20% of the world's primary uranium supply 1 . Many of the Exploration Properties are proximal to some of the world's highest-profile uranium operations, such as the McClean Lake mill and Cigar Lake mine, and consist of projects at different stages of exploration, from grassroots exploration to those with significant historical exploration and drill-ready exploration targets.

Generally, the most prospective exploration ground in the eastern portion of the Athabasca Basin is proximal to the Wollaston-Mudjatik Transition Zone (" WMTZ" ) and has already been staked by existing uranium producers, developers, and explorers. As illustrated in Figure 1 below, the Transaction offers Foremost a unique opportunity to acquire a sizeable portfolio of well-situated properties (including several situated along the WMTZ) to facilitate a pivot towards a future focus on uranium exploration in a top jurisdiction.

Figure 1. Detailed Map of Exploration Properties being Acquired by Foremost

Eastern Properties

Seven (7) of the Exploration Properties are situated within the Eastern portion of the Athabasca Basin region, in proximity to significant existing regional infrastructure, including: Murphy Lake South, Hatchet Lake, Turkey Lake, Torwalt Lake, Marten, Wolverine and Epp Lake (collectively, the " Eastern Properties "). Several of the Eastern Properties host previously identified uranium mineralization in geological settings similar to other known uranium discoveries. Historical drilling has focused primarily on unconformity targets, which provides Foremost further opportunity for continued exploration of potential basement style mineralization. Hatchet Lake is currently undergoing an active summer drilling and evaluation program, while several of the projects contain drill-ready targets from previously conducted exploration programs. The Eastern Properties are highlighted by the following projects:

- Murphy Lake South : conductive corridors that host significant high-grade uranium mineralization may extend onto the property; unconformity depth of ~350m

- Hatchet Lake : historical mineralization has been identified along the Richardson trend; uranium and base metal enrichment has also been encountered on the property with untested areas identified for follow up

- Torwalt Lake: Adjacent to the McClean Lake Operation and within 5km of multiple uranium deposits; potential to identify Key Lake or Collins Bay analogues

Blue Sky Properties

Three (3) of the Exploration Properties are located in the northwestern portion of the Athabasca Basin region (the " Blue Sky Properties "), representing an area of comparative under-exploration and high potential for new discovery, including Blackwing, GR and CLK, which encompass ~250,000 acres (101,634 hectares). These three projects are virtually unexplored. Holes drilled to date at CLK have intersected uranium mineralization, and regional geological surveys compiled by the Government of Saskatchewan indicate the potential for favourable geological settings for uranium mineralization at each property. The Blue Sky Properties are highlighted by the following:

- Blackwing and GR : both projects are situated on regional structures; Black Bay Fault and Grease River Shear – the Black Bay Fault hosts multiple Beaverlodge-style deposits in the Uranium City area

- CLK : only two historic drill holes are known to have been completed on the property, each of which intersected uranium mineralization, including CLG-D1 (up to 8,600 ppm U) and CLG-D5 (up to 510 ppm U)

Collaboration with Denison

Denison (TSX: DML) (NYSE American: DNN) is a leading Athabasca Basin-focused uranium mining, development, and exploration company. Denison's current focus is advancing the Wheeler River project, which represents the largest undeveloped uranium mining project in the infrastructure rich eastern portion of the Athabasca Basin. Denison has a significant team of technical experts based in its office in Saskatoon, Saskatchewan, and this best-in-class team is ideal for supporting Foremost with its technical, operating and corporate initiatives. Upon completion of Phase 1 of the Option Agreement, Denison will be the largest shareholder of Foremost, holding ~19.95% of the shares outstanding and will retain an ownership interest in the Exploration Properties. Additionally, David Cates, President and CEO of Denison, is expected to join Foremost's Board of Directors.

Foremost expects to act as project operator during the term of the Option Agreement and will conduct the exploration programs with its geological team led by Dahrouge Geological Consulting, under the guidance of Jody Dahrouge. Mr. Dahrouge has a long history of uranium exploration and discovery, which includes the generation of several projects on behalf of Strathmore Minerals Corp. and its successors, including the J Zone (now the Tthe Heldeth Túé deposit) on the Waterbury Lake property, the JR Zone on the Patterson Lake North property and the Triple R Zone at the Patterson Lake South property. As a past President and COO of Fission Energy Corp. (" Fission Energy "), Jody played a key role in the acquisition and exploration of Fission Energy's exploration property portfolio, which culminated with the eventual acquisition of Fission Energy by Denison in 2013.

Key Terms of the Transaction

Under the terms of the Option Agreement, Foremost may acquire up to 70% of Denison's interest in the Exploration Properties. Denison currently has 100% ownership in all of the properties except for Hatchet Lake, where Denison currently owns 70.15%, subject to a joint venture with Eros Resources Corp. In the case of Hatchet Lake, Foremost may earn up to a 51% interest in the joint venture, representing slightly over 70% of Denison's current ownership interest. The Option Agreement outlines three (3) phases, as summarized below:

| Phase 1: | To earn an initial 20% interest in the Exploration Properties (14.03% for Hatchet Lake), on or before October 7, 2024 (the " Effective Date "), Foremost's obligations include:

|

| Phase 2: | To earn an additional 31% interest in the Exploration Properties (21.75% for Hatchet Lake), on or before 36 months following the Effective Date, Foremost's obligations include:

|

| Phase 3: | To earn an additional 19% interest in the Exploration Properties (15.22% for Hatchet Lake), on or before 36 months following the successful completion of Phase 2, Foremost's obligations include:

|

Upon the successful completion of the Option Agreement, the parties would enter into a formal joint venture agreement in respect of the Exploration Properties where the initial ownership interests of Foremost and Denison will be determined based on satisfaction of conditions pursuant to the Option Agreement.

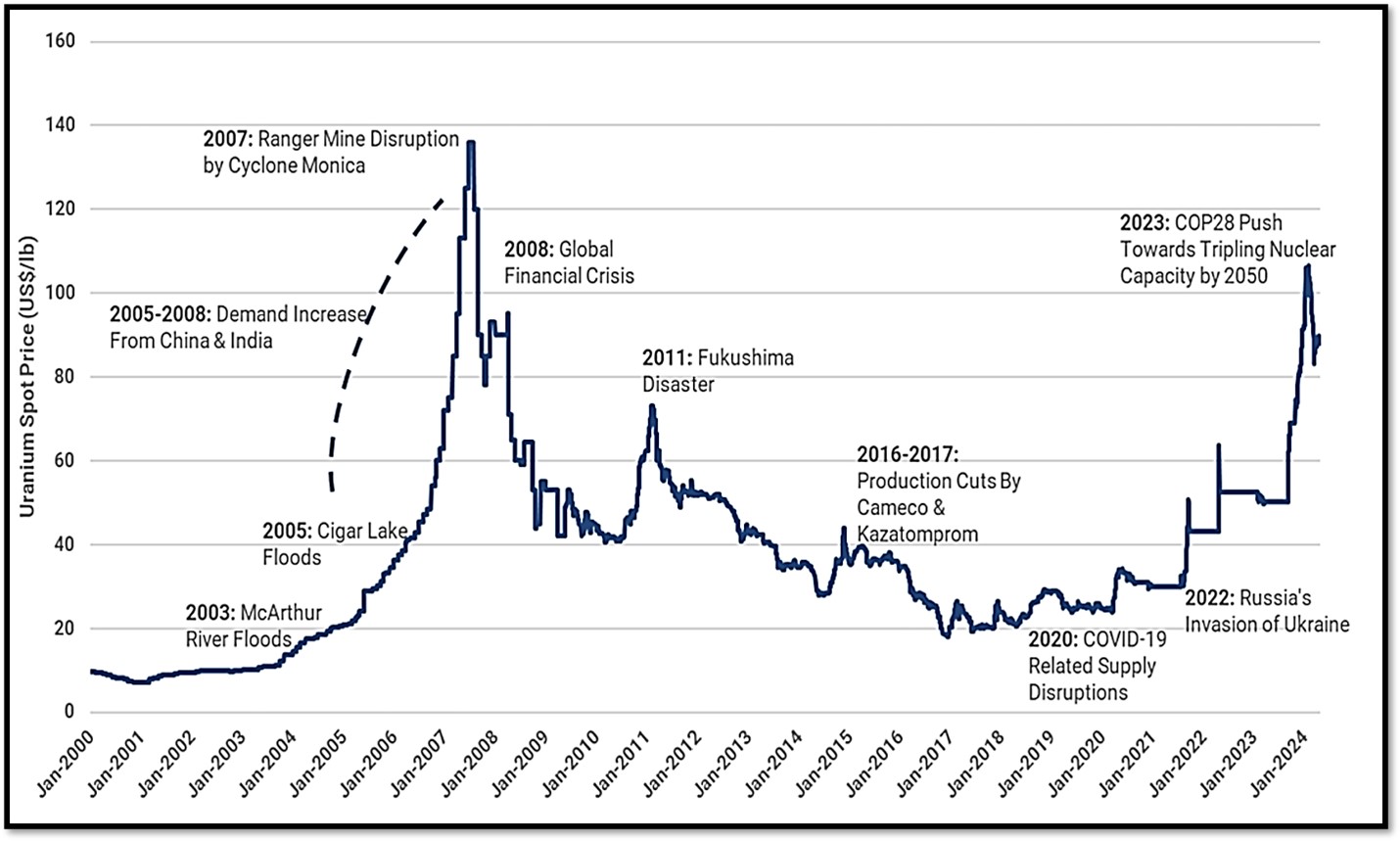

Uranium Overview

The global clean energy transition has increased the need for alternative fuel sources with nuclear power prevailing as a crucial component to meet the demand for a green economy. " Market sentiments on uranium are positive including equity markets, and particularly look favourable for uranium developers " wrote Sehaj Anand, a research analyst for FactSet (What's Driving the Bull Run in Uranium, May 2024). The commodity price rose above US$100/lb U 3 O 8 last year, the highest since 2007, after a decade-long decline from US$143/lb U 3 O 8 to US$18/lb U 3 O 8 and is currently sitting at ~US$80/lb U 3 O 8 .

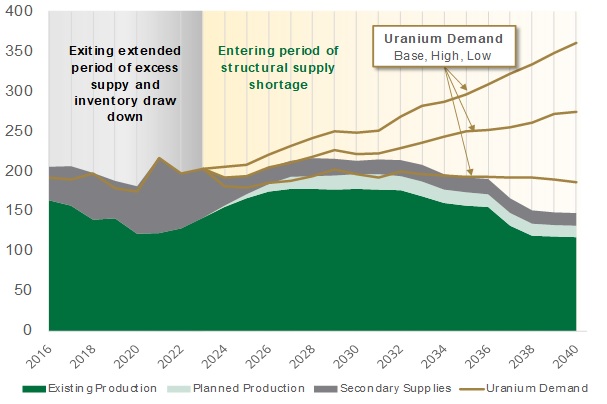

Uranium: Supply vs Demand

The supply side's future outlook is forecasted to underserve the demand side. Some of the factors contributing to an increase in the demand for uranium globally include: the desire to phase out dependence on fossil fuels, depressed uranium prices over the past decade and mine closures and/or disruptions. Trade sanctions on Russia are affecting enriched uranium supply to the West and civil unrest in Niger have sparked a global urgency to secure reliable sources of uranium.

Figure 2. Uranium Spot Prices History with Key Events

Source: Factset UxC CME

Most recently, uranium producers, developers, and physical uranium holding companies have continued to buy physical uranium, putting a further strain on the uranium supply. With the scarcity of nuclear fuel, there is a growing sense of urgency to secure sufficient uranium supply, adding additional pressure on the overall uranium market 2 .

Figure 3. Global Uranium Supply and Demand (million pounds U 3 O 8 - per UxC Q3'24)

Note: Data in this slide has been derived from UxC's Uranium Market Outlook dated Q3'2024, including supply & demand estimates and market balance figures. Source: Denison Investor Presentation – September 2024.

Market Outlook

Nuclear energy has the lowest carbon footprint for power generation compared to any other source and is the most reliable option for carbon-free baseload electricity generation 3 . At the 2023 United Nations Climate Change Conference or Conference of the Parties of the UNFCCC (more commonly known as COP 28), a total of 22 countries agreed to target tripling nuclear capacity by 2050 as countries focus on energy security and affordability. The biennial Nuclear Fuel Report said demand for uranium is expected to rise to 83,840 tonnes by 2030 and 130,000 tonnes by 2040, from 65,650 in 2023. 4

Name Change

With Foremost's business activities to be focused on exploration efforts to discover source fuel for clean energy solutions, including both uranium and lithium, the Board of Directors have unanimously agreed to change the Company's name to "Foremost Clean Energy Ltd." Foremost will continue trading under the same symbols, "FMST" as listed on the Nasdaq, and "FAT" as listed on the CSE, subject in each case to regulatory approval. The CUSIP number assigned to the Company's shares following the name change will be CUSIP (34546R100 ) and ISIN ( CA34546R1001 ).

The CSE will publish a bulletin announcing the effective date of the change in Foremost's name. The Company's common shares are anticipated to commence trading on both the CSE and Nasdaq under its new name and CUSIP number at market open on or about Sept 27 , 2024. No action is required to be taken by shareholders with respect to the name change. Outstanding share certificates are not affected by the name change and do not need to be exchanged.

To see full details of the Option Agreement, Investor Rights Agreement, and other related documents in connection with the Transaction, please refer to the Company's filings under its profile on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov/edgar.shtm . The Company retained an arm's-length financial advisor in connection with the Transaction which will be entitled to a transaction fee equal to 4% of the anticipated transaction value, payable in common shares following the Effective Date. In addition, an arm's-length third party will be paid a finder's fee equal to 8% of the deemed value of the share consideration payable to Denison pursuant to the first phase of the Transaction, payable in common shares following the Effective Date. The Transaction, including the payment of the foregoing fees, and name change are subject to certain regulatory approvals, including those of the NASDAQ and the CSE. All Common Shares issued pursuant to the Transaction are subject to a hold period of four months and one day, in accordance with applicable Canadian Securities Laws.

About Denison

Denison is a uranium mining, exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. Denison has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. In mid-2023, the Phoenix FS was completed for the Phoenix deposit as an ISR mining operation, and an update to the previously prepared 2018 Pre-Feasibility Study ('PFS') was completed for Wheeler River's Gryphon deposit as a conventional underground mining operation. Based on the respective studies, both deposits have the potential to be competitive with the lowest cost uranium mining operations in the world. Permitting efforts for the planned Phoenix ISR operation commenced in 2019 and have advanced significantly, with licensing in progress and a draft Environmental Impact Study ('EIS') submitted for regulatory and public review in October 2022.

Denison's interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture ('MLJV'), which includes unmined uranium deposits (planned for extraction via the MLJV's SABRE mining method starting in 2025) and the McClean Lake uranium mill (currently utilizing a portion of its licensed capacity to process the ore from the Cigar Lake mine under a toll milling agreement), plus a 25.17% interest in the Midwest Joint Venture ('MWJV')'s Midwest Main and Midwest A deposits, and a 69.44% interest in the Tthe Heldeth Túé ('THT') and Huskie deposits on the Waterbury Lake Property ('Waterbury'). The Midwest Main, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. Taken together, Denison has direct ownership interests in properties covering ~384,000 hectares in the Athabasca Basin region.

Additionally, through its 50% ownership of JCU (Canada) Exploration Company, Limited ('JCU'), Denison holds interests in various uranium project joint ventures in Canada, including the Millennium project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

Denison has a market capitalization of approximately ~$2.1billion (~ US $ 1.6 billion)and its common shares are listed on the Toronto Stock Exchange (the 'TSX') under the symbol 'DML' and on the NYSE American exchange under the symbol 'DNN'.

Qualified Person

Technical information in this news release has been reviewed and approved by Jody Dahrouge, B.Sc., Sp.C., P. Geo who is a Qualified Person as identified by Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects and as defined by the Securities and Exchange Commission's Regulation S-K 1300 rules for resource deposit disclosure.

About Foremost

Foremost (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0) (WKN: A3DCC8), assuming the effectiveness of the Transaction, will be an emerging North American uranium exploration company with interests in 10 prospective properties spanning over 330,000 acres in the prolific, uranium-rich Athabasca Basin. As global demand for decarbonization accelerates, the need for nuclear power is crucial. Foremost expects to be positioned to capitalize on the growing demand for uranium through discovery in a top jurisdiction with the objective to support the world's energy transition goals. Alongside its exploration partner Denison, Foremost will be committed to a strategic and disciplined exploration strategy to identify resources by testing drill–ready targets with identified mineralization along strike of recent major discoveries.

Foremost also maintains a secondary portfolio of significant lithium projects at different stages of development spanning over 50,000 acres across Manitoba and Quebec. For further information please visit the company's website at www.foremostcleanenergy.com .

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @[foremostcleanenergy]

Linkedin: https://www.linkedin.com/company/foremost-lithium-resource-technology

Facebook: https://www.facebook.com/ForemostLithium

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute "forward-looking statements" as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect," "is expected," "anticipates" or "does not anticipate," "plans," "estimates" or "intends," or stating that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the Transaction, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company's ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company's filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company's most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov/edgar.shtm for further information respecting the risks affecting the Company and its business.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

___________________________________

1 https://investingnews.com/innspired/global-uranium-supply-athabasca-basin/

2 https://insight.factset.com/whats-driving-the-bull-run-in-uranium

3 https://www.energy.gov/ne/articles/nuclear-power-most-reliable-energy-source-and-its-not-even-close

4 https://www.nucnet.org/news/uranium-demand-expected-to-surge-by-28-by-2030-9-5-2023

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ab29c64-9b71-4214-b45c-5bf30775c661

https://www.globenewswire.com/NewsRoom/AttachmentNg/3edf9168-6456-473f-bb42-dd4c2c917b13

https://www.globenewswire.com/NewsRoom/AttachmentNg/03b19377-f5e5-4379-bf49-3567c0ca0c2b