March 17, 2025

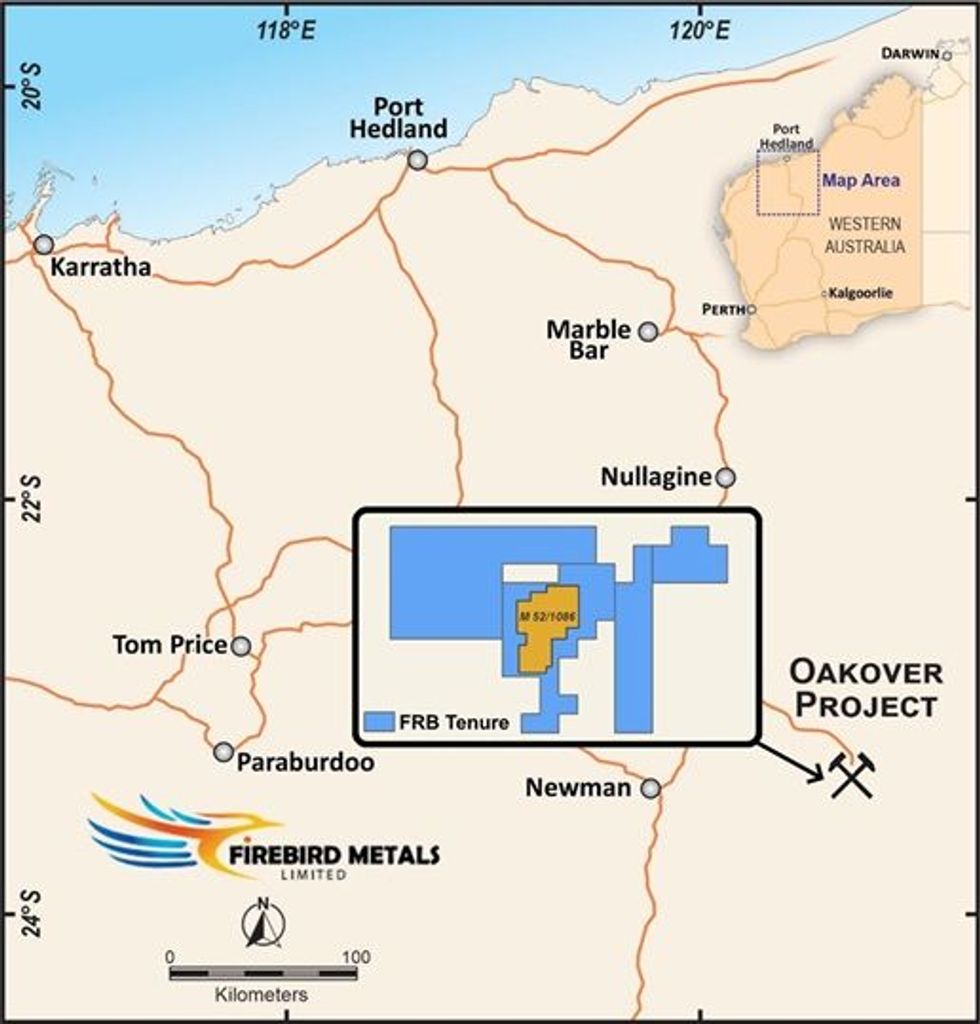

Australian-owned Firebird Metals Limited (ASX: FRB, Firebird or the Company) is pleased to announce that it has been granted Mining Lease 52/1086 for the Company’s 100% owned Oakover Manganese Project, located 85km east of Newman.

HIGHLIGHTS

- Firebird has been granted Mining Lease ML 52/1086 for the Oakover Manganese Project

- Receipt of the Mining Lease is conditional on the Company’s development of a mining proposal, requiring approval from the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS)

- Environmental surveys and mining studies supporting the mining proposal are progressing

- The Mining Lease covers a large area of 3,429.8 ha, including the Sixty Sixer, Jay Eye and Karen Pits, as well as proposed processing plant, tailings storage and waste dump

- Oakover is a large, near surface, gently dipping manganese project, with a Mineral Resource Estimate (MRE) of 176.7 Mt at 9.9% Mn including an Indicated Resource of 105.8 Mt at 10.1% Mn1

- Oakover forms part of Firebird’s long-term vertical integration strategy to grow into a low-cost manganese-based cathode material business, leveraging its world-class team, unique processes and technology and its own mineral resources

- The successful development of Oakover will ultimately provide Firebird with a 100% owned and secure feedstock supply for its manganese sulphate processing reinforcing its strong and competitive position in the battery materials market.

Firebird Managing Director, Mr Peter Allen, commented: “The granting of Mining Lease 52/1086 is a significant milestone for Firebird and the Oakover Project, marking an important step in our long- term downstream processing and vertical integration strategy.

“Oakover is a large and near-surface manganese project with robust economics and an 18-year Life-of- Mine. Our vision is to become a global leader in the manganese industry by seamlessly integrating our mining operations and innovative downstream processing solutions, to support the advancement of the Li-ion and Na-ion battery sectors. The location of our proposed manganese sulphate plant in China, places us at the forefront of this market and with the integration of Oakover will allow us to maintain a competitive advantage by ensuring a 100% owned and secure supply of high-quality manganese feedstock.

“Securing this lease brings us closer to that goal, providing a foundation for out stage two, low-cost manganese-based cathode material operations which is underpinned by the successful development of Oakover.”

The granted Mining Lease is conditional on receiving approval from the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) for a mining proposal.

The Company’s long-term strategy is to grow into low-cost manganese-based cathode material business, leveraging its world-class team, unique processes and technology and its own mineral resources. The Oakover Project boasts a Mineral Resource Estimate1 of 176.7 Mt at 9.9% Mn, with 105.8 Mt at 10.1% Mn in an Indicated category.

Through the execution of this strategy, Firebird aims to secure a natural cost advantage in LMFP cathode production, particularly by integrating manganese sulphate (MnSO₄) from its proposed production plant in China.

Oakover development programs will remain focussed on completing environmental surveys and reports as well as mining studies to feed into the mining proposal.

Click here for the full ASX Release

This article includes content from Firebird Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FRB:AU

The Conversation (0)

27 September 2023

Firebird Metals

Building Western Australia’s Next Major Manganese Mine for the EV Battery Market

Building Western Australia’s Next Major Manganese Mine for the EV Battery Market Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00