November 21, 2023

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) (the "Company" or "Fathom") is pleased to announce assay results from the seven-hole, September drill program completed at the historic Gochager Lake deposit within the Company's 22,620 Ha Gochager Lake Project.

Highlights:

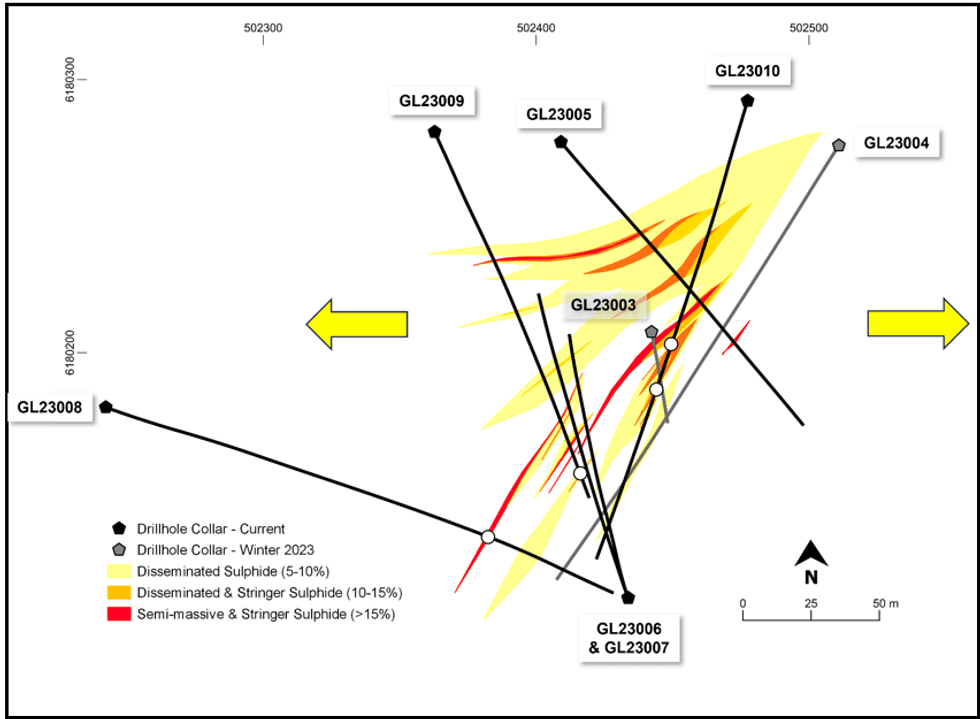

- Continuous nickel-copper-cobalt mineralization occurs in broad halos which host steeply oriented chutes of very conductive, semi-massive sulphide mineralization grading ~1-3% nickel.

- Drilling continues to confirm that zones of >1% nickel are associated with zones of high conductivity as defined by borehole electromagnetic surveys (BHEM).

- Massive sulphide vein intersected in GL23008 returned 3.25% Ni / 0.64 meters. Very strong and complex off-hole conductivity (BHEM) responses from this drillhole suggest additional mineralization of this type and grade occurs proximal to this intercept.

- Semi-massive sulphide mineralization intersected at approximately 335 meters below surface remains open to depth.

- Nickel tenor calculations suggest Gochager Lake mineralization tenor of approximately 3.5% (Ni100), which is comparable to nickel tenors within the Sudbury Nickel Camp.

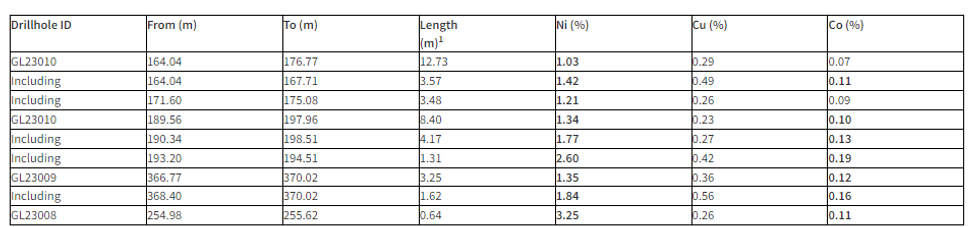

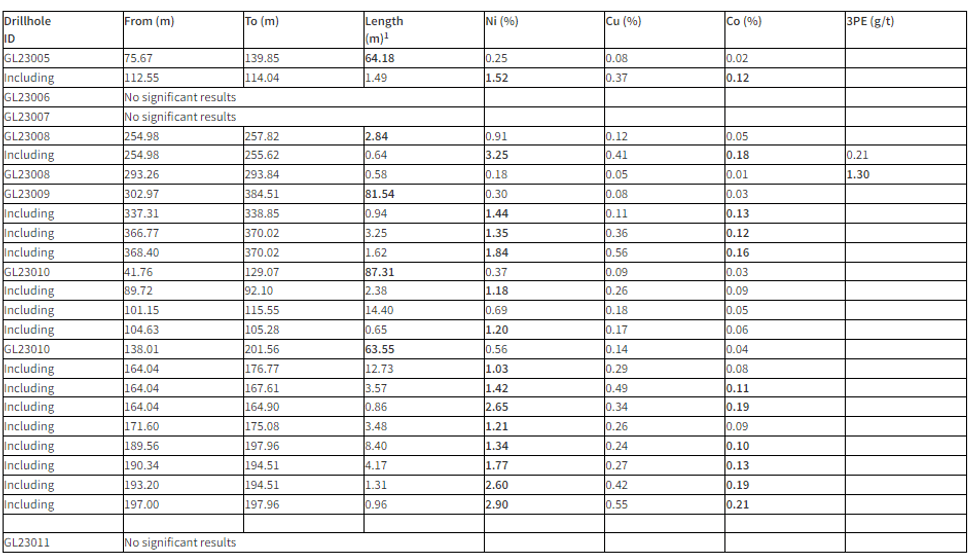

Drilling Highlights:

1 Reported drillhole intersections are down-hole intersection length and are not a true thickness. At present there is insufficient information to determine true thickness.

Ian Fraser, CEO and VP Exploration stated, "The September drill program was successful in providing insight into the steep orientation of the mineralization we intersected in GL23003 and, importantly, its orientation along strike. It is now very evident that steeply oriented chutes of semi-massive mineralization occur within broad halos of disseminated mineralization. This recent drill campaign intersected multiple halos of broad disseminated mineralization that all have the potential to host additional chutes of semi-massive sulphide nickel-copper-cobalt mineralization. BHEM surveys have detected numerous strong off-hole conductors within the broad disseminated mineralization halos. We are also extremely excited and encouraged by the presence of the massive sulphide vein in GL23008. Clearly, massive sulphides equate to high-grade nickel - 3.25% in this case - and the BHEM tells us there is very strong conductivity off-hole of GL23008. BHEM is also telling us we didn't drill deep enough in GL23008 and several other drillholes, as conductivity continues to increase to the end of the drillholes. We have made tremendous strides with only 9 drillholes drilled at the Gochager Lake project in 2023. We look forward to continuing this success as we prepare to execute the winter 2024 drill program which we are planning to initiate in Q1-2024."

Table-1

Drillhole Assay Summary:

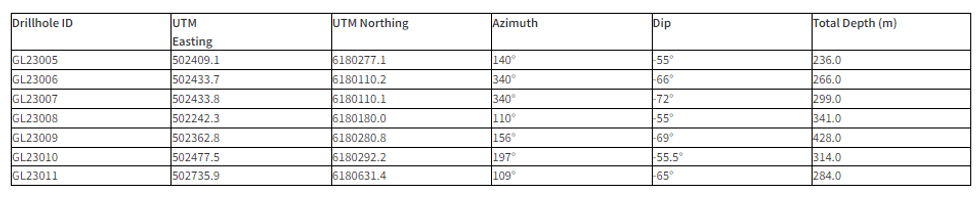

Table-2

Drillhole Location Details:

Discussion

Drillholes GL23006, GL23007 and GL23011 reported no significant results (Table-1). Drillholes GL23006 and GL23007 intersected multiple zones of weak mineralization >0.10% Ni - 0.25% Ni over thicknesses up to 17.89m. The BHEM probe of GL23007 recognizes the strong conductivity off-hole to the east and associated with semi-massive sulphide mineralization intersected in drillholes GL23003, GL23010. It now appears this chute of high-grade Ni mineralization has a north-northeast strike and not a northeast strike as originally anticipated. Drillhole GL23011 drilled ~ 400 meters to northeast of the deposit area, and not illustrated in Figure 1, was consistently anomalous in nickel (>100ppm and up to 1290ppm Ni). Gabbro, the Gochager Lake deposit host rock, was logged in the drillhole and the BHEM survey has identified 3 off-hole anomalies. GL23009 has significantly extended the historic Gochager Lake deposit to depth and the deposit remains wide open for expansion to depth. The drillhole intersected the zone of conductivity detected off-hole of historic drillhole GL18002 but based on the strength of the modelled conductivity it is not clear if the 3.25m of semi-massive sulphide mineralization (1.35% Ni) is the exact source of this conductivity. Strong off-hole conductivity has been interpreted in front of GL23009 where zones of disseminated mineralization occur between depths of 43m - 217m. The high-grade nickel mineralization intersected in GL23010 is contained within two discreet broad zones of disseminated mineralization (Table-1). The encompassing halos and higher-grade mineralized chutes within, remain open for expansion to surface and to depth. A third mineralized halo in GL23010 was intersected starting at a depth of 260.05m and continuing to 297.67m (0.21% Ni / 37.62m). Mineralization within this interval is very consistent and here to, BHEM conductivity was interpreted to be building to the bottom of the drillhole.

The Company will spend the remainder of 2023 continuing to interpret the drilling and geophysical data sets accumulated in 2023. The Company's goal is to drill 3,000 to 5,000 meters in Q1-2024 at Gochager Lake to further delineate the broad mineralized halos and the more conductive and higher-grade mineralization occurring within these halos.

Quality Assurance / Quality Control (QA/QC) Disclosure Statement

Fathom implements an industry-standard QA/QC for all field and diamond drill programs. Fathom, through the services of TerraLogic Exploration Inc., inserts QA/QC samples in its diamond drill programs at a rate of one sample per approximately every 12-13 samples collected. Standards sourced from CDN Resource Laboratories and CCRMP were inserted into the sample stream at a rate of 1 in 30 samples. Additionally, lab duplicates (coarse rejects) were inserted and positioned in the sample sequence at a rate of 1 in 30 samples and positioned in the sample sequence alternating with standards to result in a QA/QC insertion rate of no less than 1 in 15 samples. Blanks were inserted at the start of every sample batch and additionally after samples of anticipated high-grade or high sulphide content.

Assaying is performed at ALS Canada Ltd. ("ALS"). ALS is an accredited laboratory (SCC - CAN-P-1579 and CAN-P-4E ISO/IEC 17025) and is independent of Fathom. All drill core samples are analyzed using a 4-Acid digestion followed by 33 element ICP-AES analyses (Code ME-ICP61). Over limit Ni, Cu results are further analyzed by 4-Acid ore grade elements ICP-AES process (Code ME-OG62). Analyses for Au, Pd and Pt utilized the ore grade Pt, Pd and Au by ICP-AES (Code PGM-ICP27). Total sulphur is analysed by (S-IR08).

Qualified Person and Data Verification

Ian Fraser, P.Geo., CEO, VP Exploration and a Director of the Company and the "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of the Company.

About Fathom Nickel Inc.

Fathom is an exploration company that is targeting magmatic nickel sulphide discoveries to support the rapidly growing global electric vehicle market.

The Company now has a portfolio of two high-quality exploration projects located in the prolific Trans Hudson Corridor in Saskatchewan: 1) the Albert Lake Project, a 90,000+ hectare project that was host to the historic and past producing Rottenstone deposit (produced high-grade Ni-Cu+PGE, 1965-1969), and 2) the Gochager Lake Project, 19,000+ hectare project host to a historic, NI43-101 non-compliant open pit resource; the Gochager Lake deposit,( of 4.3M tons at 0.295% Ni and 0.081% Cu2, defined 1967-1970), an analogous drill tested nickel occurrence of drill intersections >1.% Ni (Mal Lake last drilled in 19673), and the Borys Lake Zn-Cu-Pb+Ag occurrence.

2 - The Saskatchewan Mineral Deposit Index (SMID#0880) reports drill indicated reserves at the historic Gochager Lake Deposit of 4,262,400 tons grading 0.295% Ni and 0.081% Cu mineable by open pit. Fathom cannot confirm the resource estimate nor the parameters and methods used to prepare the reserve estimate. The estimate is not considered NI43-101 compliant and further work is required to verify this historical drill indicated reserve.

3 - Saskatchewan Mineral Deposit Index #0836

ON BEHALF OF THE BOARD

Ian Fraser, CEO & Vice-President Exploration

1-403-650-9760

Email: ifraser@fathomnickel.com

or

Doug Porter, President & CFO

1-403-870-4349

Email: dporter@fathomnickel.com

Forward-Looking Statements:

This news release contains "forward-looking statements" that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "seek", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances except in accordance with applicable securities laws. Actual events or results could differ materially from the Company's expectations or projections.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAWS

FNI:CC

The Conversation (0)

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00