May 03, 2024

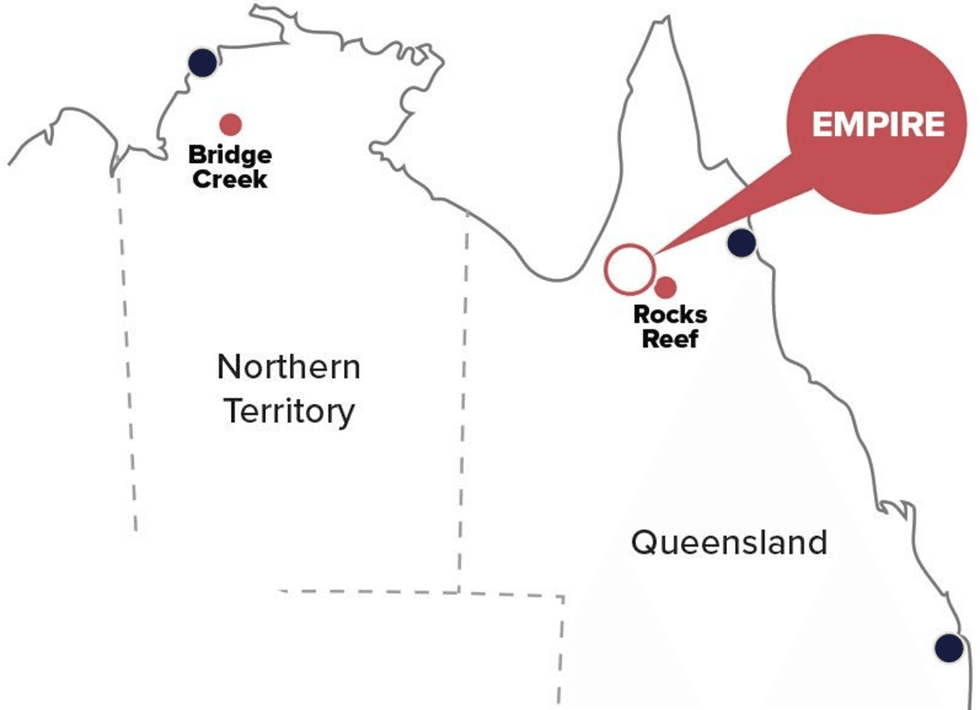

Far Northern Resources (ASX:FNR) focuses on three gold and base metals projects – two based in Northern Queensland (Empire and Rocks Reef) and one in the Northern Territories (Bridge Creek). Far Northern Resources debuted on the ASX on April 12, 2024, and secured AU$6 million in funding.

The company's Empire Project is located 34 kilometres west of Chillagoe in North Queensland covering 252 hectares, on granted mining lease 20380. The claims boast a rich exploration history, marked by substantial drilling conducted across various phases. This culminated in the determination of a 2019 mineral resource estimate of 22,505 oz of gold on the Empire Stockworks gold deposit.

Far Northern is planning a 20,000-meter drilling program over the next two years, which will consist: of 5,000+ meters for Empire; 2,500 to 5,000 meters for Bridge Creek; and 2,500 meters planned at Rocks Reef in the China Wall prospect.

Company Highlights

- Far Northern Resources (FNR) is a newly listed Australia-based gold and base metals exploration company. The company was listed on the ASX on April 12, 2024, following the completion of its IPO in which it raised AU$4 million.

- The company has three projects across Northern Queensland and the Northern Territories – Empire, Bridge Creek and Rocks Reef. Empire and Bridge Creek are significantly advanced, drill-ready with JORC-compliant resources.

- The flagship project Empire has undergone extensive exploration work culminating in a 2019 mineral resource estimate of 22,500 oz gold. The company intends to undertake 5,000 meters of drilling at Empire over the next two years which should lead to further expansion of the resource base.

- At Bridge Creek, FNR is planning a 2,500- to 5,000-meter drilling program, which aims to enhance inferred resources to indicated status, as well as extend the mineralization both along the strike and at depth.

- The Rock Reefs property presents a prospective upside for FNR with historical exploration confirming the presence of a mineralized vein system at the China Wall prospect. FNR is planning a 2,500-meter drill program at the China Wall prospect.

- The presence in relatively attractive mining jurisdictions in Australia positions the company to capitalize on opportunities in Australia's resource sector and deliver superior returns to its shareholders.

This Far Northern Resources profile is part of a paid investor education campaign.*

Click here to connect with Far Northern Resources (ASX:FNR) to receive an Investor Presentation

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

18h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

23h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00