November 03, 2024

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to provide an update on a new resource booking for its 100% owned ATP 2077, located in the Taroom Trough in Queensland, Australia.

HIGHLIGHTS

- Prospective resources of 712 billion cubic feet (2U) booked in Sub-Block B of ATP 2077

- Farmout campaign for the Diona Block (Sub-Block C of ATP 2077) well under way

- Updated contingent resources for ATP 2044 expected before year end

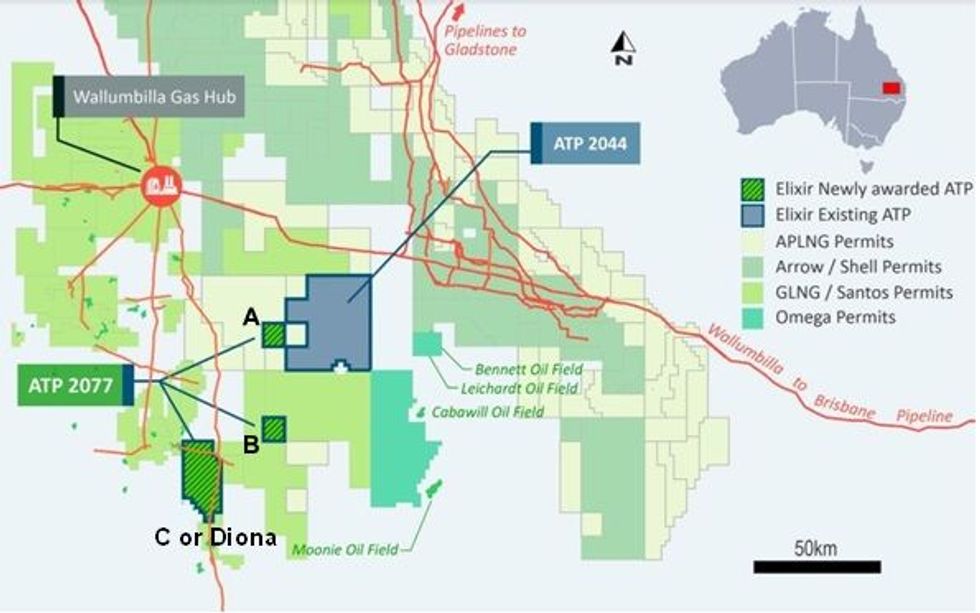

Although one licence, ATP 2077 is broken into 3 geographically separate sub blocks (see map below). Sub-Block A is located immediately proximate to ATP 2044 and contains similar Taroom Trough geology. A contingent resource booking was announced when the block was awarded (see ASX announcement of 19 August 2024). Sub-Block B also overlies the Taroom Trough, however given the further distance from Project Grandis the resource here is considered prospective in nature - at this stage. Sub-Block C lies outside the Taroom Trough, is immediately adjacent to existing gas infrastructure and is prospective for shallower conventional oil and/or gas drilling targets.

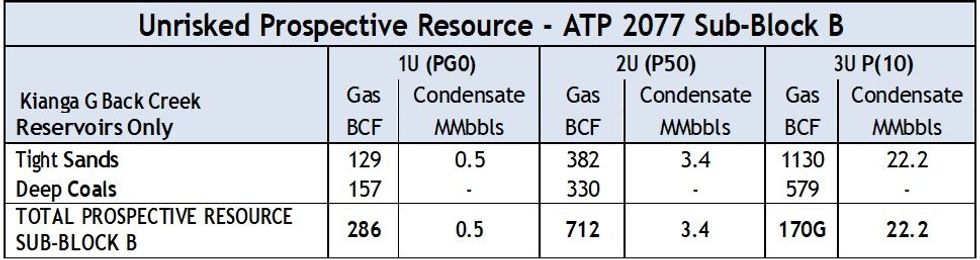

Based on recent internal technical work undertaken, Elixir has booked a prospective resource estimate for ATP 2077 Sub-Block B – see table below.

Notes to Prospective Report Table:

1. These are un-risked prospective resources that have not been risked for geological success or the chance of development. The chance of success for tight sands and deep coal was estimated at 65% and 27% respectively. Both targets are considered trapped in an unconventional setting. The chance of commercial development is estimated at 50% for each.

2. Each reservoir target was evaluated probabilistically and the totals added arithmetically.

3. Prospective Resources have been assessed on the basis that they are unconventional in nature.

4. ATP is an Authority To Prospect, which allows a company to explore for hydrocarbons in Queensland.

5. Prospective Resources are those estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) related to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further explorations appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons. These Prospective Resource estimates are for the tight sandstones and deep Permian coals within Block B only. The estimates assume the same Basin Centered Gas (BCG) play is present, and similar reservoir parameters to ATP 2044 have been used. The block is mature for drilling, and exploration drilling may occur in the years to come.

6. Elixir’s technical team analyzed seismic, drilling, logging and test data to make these estimates. Specific analysis undertaken included seismic interpretation, geological correlations, core analysis, wireline petrophysics, chromatographic gas analysis and production test analysis.

7. Further detailed notes on the background to the preparation of the Prospective Resource Report are set out in Appendix 1.

In ATP-2077 Sub-Block C (also known as the Diona Block), Elixir is currently conducting farmout negotiations under which it is seeking an incoming party to fund the cost of an exploration well. The Company will provide an update on these in due course.

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00