May 21, 2025

Rapid Lithium Limited (Rapid or Company) is pleased to announce that it has entered into a Share Purchase Agreement (SPA) with Silver Metal Group Limited (SMG) (formerly Thomson Resources Ltd) to acquire all of the shares in two subsidiaries of SMG, being Conrad Resources Pty Ltd and Webbs Resources Pty Ltd (Transaction) for a total consideration of A$6.50 million in cash and shares.

HIGHLIGHTS

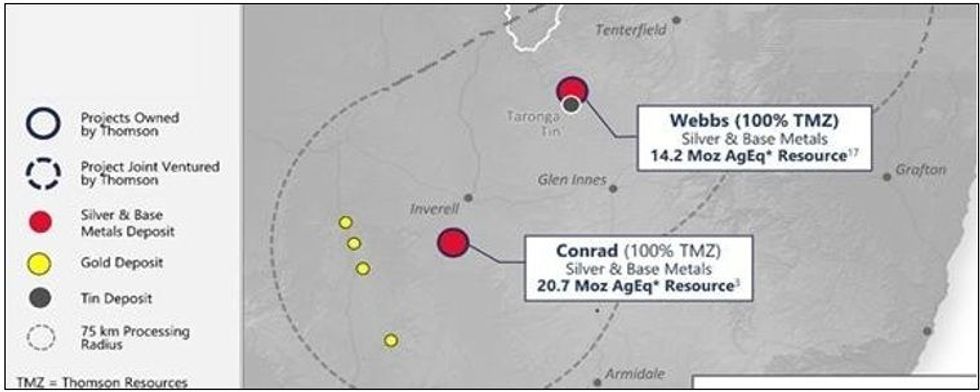

- Following completion of the Transaction, Rapid will own 100% of the Conrad and Webbs Silver Projects in the New England Fold Belt of NSW with a combined total of ~34.9 million silver equivalent ounces of high-grade silver assets.

- The Webbs Silver Projects has a JORC 2012 Mineral Resources Estimate of 2.2Mt at 205 g/t silver equivalent (AgEq) for a contained 14.2Moz AgEq1; and

- The Conrad Silver Project has a Mineral Resource of 3.33Mt at 193g/t AgEq for a contained 20.72 Moz AgEq2 which has also been reported under the JORC 2012 guidelines.

- Webbs was historically a high-grade silver mine, with production of 55,000t at 710g/t silver3.

- The Conrad Silver Project was historically the largest silver project in the NSW section of the New England Fold Belt with historic production of 3.5Moz silver at ~600g/t Ag2 and significant co- products of lead, zinc, copper and tin.

- The opportunity exists to unlock the potential of the Projects rapidly, as neither have had any modern exploration or drilling done in the last decade. Exploration for new, parallel and blind structures can deliver new silver discoveries in the district.

- RLL will rapidly implement programs at Webbs Silver Project with a focus to expand and upgrade the existing JORC Mineral Resource Estimate with targeted geophysics, drilling and metallurgical studies beginning in June 2025.

- Rapid adding to its portfolio of critical minerals, with a strong silver market adding to the compelling opportunity.

Commenting on this exciting opportunity, Rapid Lithium Managing Director, Martin Holland, said:

“We are very pleased to acquire these high-grade silver assets in a strong silver market. We believe there is an exciting opportunity to rapidly unlock the potential of these assets using modern exploration and expanding the resources. These are exciting times to be adding assets of this quality to our portfolio of critical minerals”.

Background of the Transaction

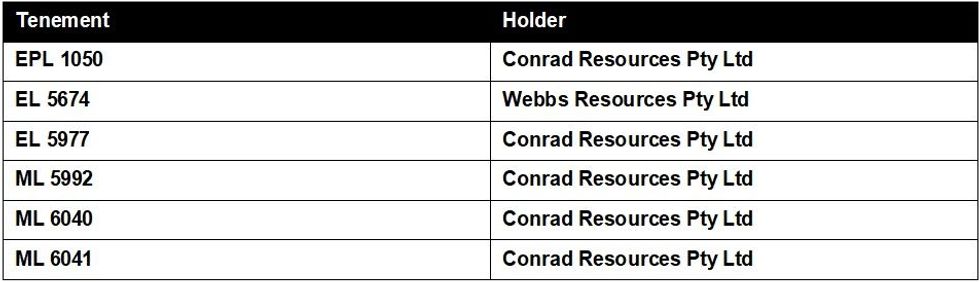

Conrad Resources Pty Ltd and Webbs Resources Pty Ltd own the following tenements which comprise the Conrad Silver Project and the Webbs Silver Project:

Location

The assets are located in the New England Fold Belt in Northern NSW, accessible by sealed road from Glen Innes and Inverell.

Webbs Silver Project

The Webbs Silver Project comprises a high-grade silver bearing lode system located in northern New South Wales. The Webbs Silver Project has a mineral resource estimation reported in accordance with JORC 2012 for a total of 14.2 Moz AgEq at 205 g/t AgEq1.

The work completed by SMG and others to date on the Webbs Silver Project deposit including validation of historic data, relogging and surface mapping, and updated grade-alteration modelling has not only significantly improved the understanding of controls on mineralisation at the Webbs Silver Project but has also highlighted a number of compelling targets for resource expansion and new exploration.1

Exploration programs focused on identifying parallel mineralised structures will commence immediately with a micro gravity survey covering the two main high grade silver rich lodes. Drill permitting is underway with six 500m deep diamond drill holes as a first priority will be drilled at the Webbs South and Webbs Main deposits to collect fresh samples for metallurgical testwork and structural information to allow a new JORC Mineral Resource Estimate to be completed as rapidly as possible. Further drilling will follow this work targeting strike and down dip extensions to grow the silver rich resources. Opportunity exists to use new geophysics technologies to search for blind parallel structures. A budget of A$2.5 million will be allocated to Webbs Silver Project to rapidly complete the work programs.

The Webbs Resource Statement1 consists of an Indicated Resource of 0.8 Mt at 179 g/t Ag, 0.18% Cu, 0.62% Pb, 1.19% Zn and an Inferred Resource of 1.3 Mt at 116 g/t Ag, 0.13% Cu, 0.5% Pb and 1.04% Zn. The resources were calculated at a 30 g/t Ag cut-off and reported to 225 m below surface.

Click here for the full ASX Release

This article includes content from Rapid Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21h

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00