March 28, 2023

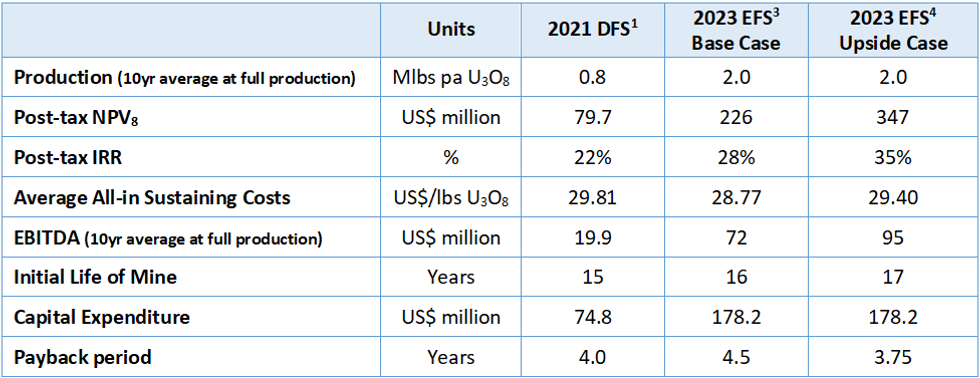

Aura Energy Limited (ASX: AEE, AIM: AURA, “Aura” or “the Company”) is pleased to announce the completion and delivery of the Enhanced Definitive Feasibility Study (“EFS”) for the Tiris Uranium Project (“Tiris” or the “Project”) in Mauritania. The EFS is based on the original 2021 study but now benefits from the recently updated Mineral Resource Estimate2 and revised throughput modelling that confirms an increase in steady-state production to 2.0 Mlbs pa U3O8 and the delivery of strong financial metrics and robust returns to shareholders over the life of the Project.

KEY POINTS:

- Average steady-state production increased by 150% from 0.8 Mlbs U3O8 to 2.0 Mlbs pa U3O8

- Strong financial metrics delivered from 60% of total Mineral Resources, headlined by a 180% increase in the Base Case post-tax NPV US$ 226M and IRR of 28%

- 57% cash margins from an AISC of US$ 28.77 / lb U3O8

- Initial capital cost of US$ 87.9 million with an additional capital of US$ 90.3 million to produce 2.0 Mlbs pa U3O8

- Government stakeholder agreement and major permits in place

- 16-year project life with near-term exploration upside

A proportion of the production target for the 2023 EFS is based on Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources, and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised.

Commenting on the updated DFS, Aura Energy Managing Director Dave Woodall said:

“The EFS confirms the strong financial case for the Tiris Uranium Project. The Tiris Project is unique with its low capital intensity, low operating costs, competitive all-in-sustaining cost and key regulatory approvals in place. With a relatively short timeline for commercial production, the focus is now on the consideration of a Final Investment Decision as early as Q4 2023, which would see commissioning in late 2024 for commercial production in early 2025.

“What differentiates Tiris is the ore quality that allows free-dig shallow open pit mining. Aura does not require expensive drill and blast operations or capital-hungry infrastructure for crushing and screening. Following simple scrubbing and screening the Project will have a leach feed grade of >2,000 ppm U3O8 resulting in a downsizing of the leaching circuit that drives competitive operating costs and creates a competitive advantage for Aura Energy in a strengthening uranium market.”

Enhanced Definitive Feasibility Study Highlights

The key highlights from the EFS are:

- 150% increase in average steady-state production to 2.0 Mlbs U3O8

- Proven processing with simple free dig mining

- Rapid beneficiation that delivers >2,000 ppm U3O8 leach feed grade

- High confidence production scheduled with 76% Proved and Probable Reserves, and 24% Inferred Mineral Resources.

- Low initial capital cost and high capital efficiency from any future expansion

- Excellent cash margins driven by an AISC of US$ 28.77 / lb

- 18-month construction period provides rapid path to production following FID

- 15-year mine life with significant resource growth potential

The Tiris Uranium Project is located in the Tiris Zemmour region, an emerging uranium province approximately 1,450 km from the Mauritanian capital of Nouakchott. The Project is owned by Aura Energy, through its 85% owned Tiris Resources with its Mauritanian Government partner, the National Agency for Geological Research and Mining Heritage (ANARPAM).

The key differentiating feature of the EFS, compared to the 2021 DFS is the increase in production. The Project now plans to deliver a life of mine production of 25.5 Mlbs U3O8, an increase of 110%, taking advantage of the recently announced 52% increase in Measured and Indicated Resources to 29.6 Mlbs U3O8, (62.1Mt at 216 ppm U3O8, at a 100ppm grade cut-off).

The effect of this increased production is enhanced project economics, delivering a Base Case NPV8 of US$226 million, and an exceptional Base Case IRR of 28%, with further capacity to improve as nearby Resource growth, is targeted.

Beyond this Base Case Scenario, a long-term Upside Side was calculated using the Trade Tech Forward Availability Model (FAM2) forecast pricing of US$79/lb U3O8. This Upside Case forms the second scenario illustrated in this EFS demonstrating the leverage to forecast growth in the global uranium market by the World Nuclear Association. With an Upside Case NPV8 of US$347 million and a remarkable Upside Case IRR of 35%, this second scenario indicates that the Tiris Project could be one of the most exciting conventional mining uranium projects in development.

Further project optimisation will be investigated as part of the FEED study which has commenced using the outcomes of the EFS. Additional areas of optimisation within the recovery of the U3O8 are under investigation and require further engineering to optimise the production profile.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

3h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00