Acquisition of Bahia Project expected to supply the raw materials needed by the Company's US facility for the production of advanced rare earth materials used in EVs, clean energy, and defense technologies.

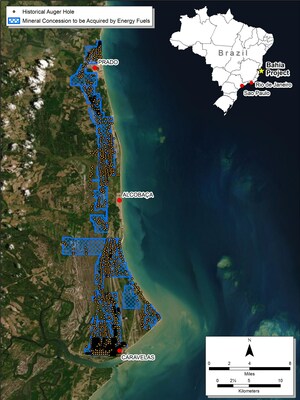

Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ( "Energy Fuels" or the "Company" ) is pleased to announce that it has completed its previously announced acquisition (the " Closing ") of seventeen (17) mineral concessions between the towns of Prado and Caravelas in the State of Bahia, Brazil totaling 15,089.71 hectares (approximately 37,300 acres or 58.3 square miles) (the " Bahia Project "). The Closing followed the Brazilian Government's approval of the transfers to Energy Fuels' wholly owned Brazilian subsidiary Energy Fuels Brazil, Ltda. At the Closing, the Company paid the mineral owners the remaining $21.9 million cash.

As previously reported, the Bahia Project is a well-known heavy mineral sand (" HMS ") deposit that has the potential to supply 3,000 – 10,000 metric tons (" MT ") of natural monazite concentrate per year for decades to Energy Fuels' White Mesa Mill in Utah (the " Mill ") for processing into high-purity rare earth element (" REE ") oxides and other materials. As used herein, the term "monazite concentrate" refers to an HMS concentrate containing roughly 80% to 90% monazite. While Energy Fuels' primary interest in acquiring the Bahia Project is the REE-bearing monazite, the Bahia Project is also expected to produce large quantities of high-quality titanium (ilmenite and rutile) and zirconium (zircon) minerals that are also in high demand. REE production is highly complementary to Energy Fuels' existing US-leading uranium business, as monazite and other major REE-bearing minerals naturally contain uranium that will be recovered and other impurities that will be removed at the Mill before further processing into advanced high-purity REE materials.

3,000 – 10, 000 MT of monazite concentrate contains roughly 1,500 – 5, 000 MT of total REE oxides (" TREO "), including 300 – 1, 000 MT of neodymium-praseodymium (" NdPr ") and significant commercial quantities of dysprosium (" Dy ") and terbium (" Tb "). The Company is focused on monazite at the current time, as it has superior concentrations of these four (4) critical REEs compared to other REE-bearing minerals. These REE's are used in the powerful neodymium-iron-boron (" NdFeB ") magnets that power the most efficient electric vehicles (" EV "), along with uses in other clean energy and defense technologies. For reference, a typical EV utilizes roughly one (1) to two (2) kilograms of NdPr oxide in its drivetrain. Based on this assumption, monazite concentrate from the Bahia project alone is expected to supply enough NdPr oxide to power 150,000 to 1 million EVs per year. The uranium contained in the monazite, which is expected to be comparable to typical Colorado Plateau uranium deposits, will also be recovered at the Mill.

Update on Growing Monazite Supply Portfolio:

The acquisition of the Bahia Project is a part of the Company's efforts to build a large and diverse book of monazite concentrate supply for its rapidly advancing REE processing business. The Company expects to procure monazite concentrates through Company-owned mines like the Bahia Project, joint ventures or other collaborations, and open market purchases, like the Company's current arrangement with The Chemours Company (" Chemours "). The Company is currently in advanced discussions with several additional current and future monazite producers around the world to supply Energy Fuels' initiative.

Energy Fuels, through its White Mesa Mill in Utah , is currently the only U.S. company extracting REE's and producing commercial quantities of partially-separated mixed REE carbonate (" RE Carbonate "), which it extracts as a coproduct, along with its uranium production from monazite. This is the most advanced REE material being produced in the US today at scale, since it is a high-purity product ready for REE separation without further processing, refining or purification. The Company is currently selling all its RE Carbonate to a separation facility in Europe for further processing into advanced REE products further down the supply chain, including metals, alloys, and magnets. Though as discussed below, the Company is currently modifying and enhancing its existing circuits and facilities at the Mill with the expected ability to produce separated REE oxides (or oxalates) from these process streams starting as soon as later this year. The Company is also recovering the uranium that naturally occurs in monazite for use in carbon-free nuclear energy.

Update on Ongoing Sonic Drilling Program at the Bahia Project:

Prior to Closing on the Bahia Project, the Company commenced a sonic drilling program on the property to further define and quantify the HMS resource, particularly at depth. Under the previous owners, 3,300 vertical exploration auger holes were drilled on the property indicating significant concentrations of titanium (ilmenite and rutile), zirconium (zircon), and rare earth elements (monazite) at and near the surface. However, due to inherent limitations, historic augur drilling averaged only 5.7 meters in depth.

Utilization of a sonic drill allows for relatively undisturbed collection of sediments both above and below the water table. The limited sonic drilling completed by Energy Fuels over the past few months is confirming that the mineral bearing sands are expected to continue at depth. The Company expects to finalize Phase 1 sonic drilling at the Bahia Project this month totaling 2,250 meters. Following drilling, the Company will begin sampling and sending the material to labs for testing, including metal assay, mineralogic characterization, and process testing. The Company plans to announce Phase 1 drilling results this year and start Phase 2 drilling in Q3-2023. Once data from both drill programs are available, the Company plans to engage industry leaders to calculate an initial mineral resource estimate for use in an S-K 1300 (US) compliant Initial Assessment and an NI 43-101 ( Canada ) compliant Technical Report.

Update on Production of Separated NdPr Products at the White Mesa Mill & Plans for Future REE Separation:

The Company is currently separating lanthanum (" La ") and cerium (" Ce ") from its commercial RE Carbonate stream utilizing existing Mill infrastructure to produce an RE Carbonate product with higher concentrations of NdPr and "heavy" REEs. Energy Fuels is also proceeding with the modification and enhancement of its infrastructure at the Mill (" Phase 1 ") to expand its "light" REE separation facilities to be capable of producing commercial quantities of separated NdPr oxide (or oxalate) by later this year or early 2024, followed by planned further enhancements to expand NdPr production capability (" Phase 2 ") and to produce separated Dy, Tb and potentially other REE materials in the future (" Phase 3 ") from monazite and potentially other REE-bearing process streams.

Earlier this year, the Company began construction on its "Phase 1" REE separation facilities, which includes modifications and enhancements to the solvent extraction (" SX ") circuits at the Mill. "Phase 1" is expected to have the capacity to process approximately 8,000 to 10, 000 MT of monazite concentrates per year from the Mill's process streams, producing roughly 4,000 to 5, 000 MT TREO, containing roughly 800 to 1, 000 MT of recoverable separated NdPr oxide (or oxalate) per year. Because Energy Fuels is utilizing existing infrastructure at the Mill, "Phase 1" capital is expected to total only about $25 million . "Phase 1" is expected to be operational later this year or early 2024, subject to receipt of sufficient monazite supply and successful construction and commissioning. If these milestones are achieved, Energy Fuels believes it will be the 'first to the market' among US companies with commercial quantities of separated NdPr available to EV, renewable energy, and other companies for offtake.

During "Phase 2", Energy Fuels expects to expand its NdPr separation capabilities, with an expected capacity to process roughly 15,000 to 30, 000 MT of monazite concentrates per year and expected recovery of roughly 7,500 to 15, 000 MT of TREO, containing roughly 1,500 to 3, 000 MT of NdPr oxide per year, or sufficient NdPr for 750,000 to 3.0 million EVs per year. "Phase 2" is also expected to add a dedicated monazite "crack-and-leach" circuit to the Mill's existing leach circuits. Currently, the Mill is utilizing its main uranium processing circuits to process monazite and extract the REEs and uranium. A dedicated leach circuit will allow the Mill to simultaneously process monazite in the new dedicated circuit and to process other mined uranium and uranium/vanadium ores in the main circuit. The Company expects to complete "Phase 2" in 2026, subject to licensing, financing, and receipt of sufficient monazite feed.

During "Phase 3", Energy Fuels expects to add "heavy" REE separation capabilities, including the production of Dy, Tb, and potentially other REE oxides and advanced materials. The Company will also evaluate the potential to produce La and Ce products. Monazite concentrates naturally contain higher concentrations of "heavy" REEs, including Dy and Tb, versus other REE-bearing ores, like bastnaesite, mainly due to the presence of another REE-bearing phosphate mineral called "xenotime." "Phase 3" is expected to enable Energy Fuels to produce separated Dy, Tb, and potentially other "light" and "heavy" products. The Company also expects to have additional "heavy" REE feedstock stockpiled from "Phase 1" and "Phase 2." During these earlier phases, the Company expects to produce NdPr oxide (or oxalate) and a samarium-plus (" Sm+ ") "heavy" REE concentrate, which the Company will either sell or stockpile as feed for "Phase 3" REE separation. For reference, the monazite concentrates the Company has analyzed to date contain roughly 1% to 3% Dy and Tb, so 10, 000 MT of monazite concentrate contains roughly 100 to 300 MT of Dy and Tb. The Company expects to complete "Phase 3" in 2027, subject to licensing, financing, and receipt of sufficient feed.

Mark S. Chalmers , President and CEO of Energy Fuels stated: "Energy Fuels has achieved yet another important milestone for our expanding rare earth business through our acquisition of the Bahia Project. We look forward to further defining the heavy mineral sand resource through our sonic drilling program and moving forward toward mining in the most prospective areas of the project. Using conservative development and market assumptions, we expect to receive monazite concentrates from the Bahia Project at a very low cost within the next few years. By receiving monazite feeds from a variety of sources, including mineral projects that we own, like the Bahia Project, and open market purchases, like from Chemours and others, we expect to be a low-cost US producer of advanced REE materials.

"As we continue to build our book of monazite supply through acquisitions of projects like Bahia and other transactions, we are also moving faster down the rare earth supply chain than any other U.S. company to produce more advanced rare earth materials at our White Mesa Mill in Utah . We are currently expanding our SX separation circuit at the Mill that is expected to enable us to commercially produce NdPr oxide or oxalate by later in 2023 or early 2024. NdPr is a key ingredient in permanent rare earth magnets used in EVs, wind energy, and defense technologies. Later in 2026 and 2027, we expect to increase the scale of our NdPr production and add 'heavy' REE separation capabilities, including the ability to produce Dy, Tb and potentially other products, subject to securing additional monazite supplies.

"Of course, uranium production remains our core business, where we continue to make excellent progress on resuming production at our mines. As the largest US producer of uranium, Energy Fuels recently sold 300,000 pounds of uranium into the newly established strategic US uranium reserve where we earned total gross proceeds of $18.5 million , and we have nuclear utility contract deliveries beginning this year. We look forward to providing markets with further updates on both our REE and uranium business segments.

"With our leading position as a uranium producer in the US, our US-leading vanadium production capability, our rapidly advancing US-leading REE production capability, and our evaluation of radioisotopes for use in emerging cancer treatment therapeutics, Energy Fuels is truly becoming a leading producer of critical minerals in the United States ."

ABOUT Energy Fuels

Energy Fuels is a leading US-based critical minerals company. The Company mines uranium and produces natural uranium concentrates that are sold to major nuclear utilities for the production of carbon-free nuclear energy. Energy Fuels recently began production of advanced rare earth element (" REE ") materials, including mixed REE carbonate, and plans to produce commercial quantities of separated REE oxides in the future. Energy Fuels also produces vanadium from certain of its projects, as market conditions warrant, and is evaluating the recovery of radionuclides needed for emerging cancer treatments. Its corporate offices are in Lakewood, Colorado , near Denver, and substantially all its assets and employees are in the United States . Energy Fuels holds two of America's key uranium production centers: the White Mesa Mill in Utah and the Nichols Ranch in-situ recovery (" ISR ") Project in Wyoming. The White Mesa Mill is the only conventional uranium mill operating in the US today, has a licensed capacity of over 8 million pounds of U 3 O 8 per year, has the ability to produce vanadium when market conditions warrant, as well as REE products, from various uranium-bearing ores. The Nichols Ranch ISR Project is on standby and has a licensed capacity of 2 million pounds of U 3 O 8 per year. The Company recently acquired the Bahia Project in Brazil , which is believed to have significant quantities of titanium (ilmenite and rutile), zirconium (zircon) and REE (monazite) minerals. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the US and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels' common shares is the NYSE American under the trading symbol "UUUU," and the Company's common shares are also listed on the Toronto Stock Exchange under the trading symbol "EFR." Energy Fuels' website is www.energyfuels.com .

Daniel Kapostasy , P.G., Director of Technical Services for Energy Fuels , is a Qualified Person as defined by Canadian National Instrument 43-101 and has reviewed and approved the technical disclosure contained in this news release, including sampling, analytical, and test data underlying such disclosure.

CAUTIONARY STATEMENTS REGARDING FORWARD LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable securities laws in the United States and Canada . Forward-looking information may relate to future events or future performance of Energy Fuels. All statements in this release, other than statements of historical facts, with respect to Energy Fuels' objectives and goals, as well as statements with respect to its beliefs, plans, objectives, expectations, anticipations, estimates, and intentions, are forward-looking information. Specific forward-looking statements in this discussion include, but are not limited to, the following : any expectation as to the concentrations or quantities of uranium and heavy minerals, including monazite , NdPr, Dy and Tb contained in the Bahia Project; any expectation as to the potential annual supply of monazite sands from the Bahia Project to the Mill, the contained MT of TREO per year, or the number of years or decades of such potential supply; any expectation as to the number of EVs that can be powered by NdPr oxide produced from the Bahia Project; any expectation that drilling results at the Bahia Project will confirm that the mineral bearing sands continue at depth; any expectation as to the timing and results of the Company's drilling program at the Bahia Project and the timing of any announcements relating to drilling results; any expectation that the Company will complete an S-K 1300 compliant Initial Assessment and an NI 43-101 compliant Preliminary Economic Assessment relating to the Bahia Project and the timing of any such assessments; any expectation as to the timing of mining at the Bahia Project; any expectation as to the costs to the Company of monazite concentrates from the Bahia Project and the timing of receipt of any such concentrates; any expectation as to the Company's ability to build a large and diverse book of monazite concentrate supply ; any expectation as to the Company's ability to rapidly advance its REE processing business; any expectation that the Company will produce separated REE oxides (or oxalates) from its Mill process streams starting as early as next year ; any expectation that the Company will be a low-cost US producer of advanced REE material; any expectation that the Company will complete its Phase 1, Phase 2 and/or Phase 3 separation facilities on the time frames indicated, if at all; any expectation as to the expected throughput rates, production capability, REEs to be produced and capital and operating costs of such facilities ; any expectation that the Company will be the first to the market among US companies with commercial quantities of separated NdPr available to EV, renewable energy and other companies for offtake; any expectation that monazite concentrates will naturally contain higher concentrations of "heavy" REEs, including Dy and Tb versus other REE-bearing ores, like bastnaesite; any expectation as to the Company's ability to produce radioisotopes needed for emerging cancer treatments on a commercial basis or at all ; and any expectation that the Company will continue to be a leading US based uranium mining company and a leading producer of critical minerals in the United States . Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects", "predicts", "intends", "anticipates" or "believes", or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. This information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: technical difficulties; mining or processing difficulties and upsets; licensing, permitting and regulatory delays; litigation risks; competition from others; political actions or instability in foreign countries; and market factors, including future demand for and prices realized from the sale of uranium, vanadium and REEs. Forward-looking statements contained herein are made as of the date of this news release, and Energy Fuels disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management's estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/energy-fuels-completes-acquisition-of-rare-earth-and-heavy-mineral-project-in-brazil-301744927.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/energy-fuels-completes-acquisition-of-rare-earth-and-heavy-mineral-project-in-brazil-301744927.html

SOURCE Energy Fuels Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2023/13/c3264.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2023/13/c3264.html