August 28, 2025

Empire Metals Limited, the AIM-quoted and OTCQB-traded exploration and development company, is pleased to report significant progress in metallurgical testwork at its Pitfield Project in Western Australia ('Pitfield' or the 'Project'). These results confirm that the weathered ore at Pitfield can be processed using conventional separation and refining techniques, delivering industry-leading recoveries and a high-purity titanium dioxide (TiO₂) product.

Highlights

- Exceptional flotation performance: Recoveries of 77% (rougher stage) and 90% (cleaning stage) from fine, weathered ore samples.

- Outstanding leach results: Direct acid bake and hot-water leach achieved 98% titanium dissolution, leaving inert quartz residues.

- High recoveries: Overall titanium recovery from flotation feed to final product is circa 67% and expected to improve with further optimisation of the mineral separation stages.

- High-purity final product: TiO₂ grading 99.25% with negligible impurities, suitable for titanium sponge metal or pigment production.

- Cost and environmental advantages: Low Fe₂O₃ (~5%) reduces acid consumption, minimises waste, and supports higher recoveries over typical ilmenite feedstock processing.

- Simplified, expedited development pathway: Amenability to standard mineral separation eliminates the need for a costly bespoke demonstration plant, enabling a lower-cost continuous pilot programme using accredited commercial laboratories.

Shaun Bunn, Managing Director, said:

"These results mark a step change in Pitfield's development. We now have clear evidence that the ore is ideally suited to conventional mineral separation and refining, producing a high-purity titanium product with strong recoveries. This sets Pitfield apart from ilmenite-based projects, which typically face lower recoveries, higher costs, and significant environmental challenges.

"Pitfield already stands out for its exceptional scale, continuity of high-grade near-surface mineralisation, and Tier 1 location with access to infrastructure. With this breakthrough in process development, we can now demonstrate a highly efficient and environmentally responsible route to producing multiple high-value titanium products."

Metallurgical Testwork Summary

Empire has committed substantial financial resources to developing a metallurgical flowsheet that can economically extract titanium and produce a high value titanium product: such as TiO2 pigments, and/or feedstock for the TiO2 pigment or titanium sponge metals industries.

The approach to flowsheet development has included:

- Extensive mineralogical investigations on exploration samples, testwork feed samples and testwork products

- Wide ranging literature reviews, including industry and cross-industry research

- Idea generation and testing of concepts and conditions in the laboratory

- A fast-tracked separate work programme to prove that an impurity free high grade product can be made from samples taken at Pitfield.

Initial mineralogical and metallurgical testwork was undertaken on the fresh, titanite-rich bedrock mineralisation at Pitfield and returned encouraging results. Following the identification of the extensive in-situ weathered cap, which independently represents a generational-scale mining opportunity, subsequent testwork programmes have been directed toward this material. The weathered cap contains mainly anatase and rutile, and is distinguished by its soft, friable texture, elevated titanium grades, and near-surface exposure which offer significant advantages from both a mining and processing perspective.

Empire has employed two full time process engineers to work on the process flowsheet development, both of whom have extensive experience in mineral separation and elemental extraction (hydrometallurgy). In addition, Empire has contracted with two titanium expert consultants, each of which has over 40 years' experience in the industry. The process development programme is also supported by further specialist input from the technical team at Strategic Metallurgy, scientists from Federal Government agencies and process engineers from local Engineering & Process Design Consultants.

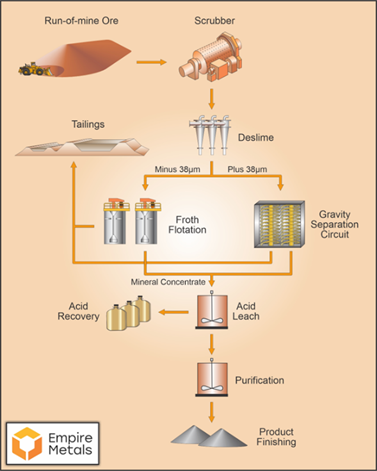

Testwork results achieved to date are encouraging and support the conceptual process flowsheet that was announced 4 September 2024 "Positive Results Achieved from Initial Processing Testwork on Pitfield Titanium Ore" (refer Figure 1).

Figure 1. Conceptual Process Flowsheet.

Recent testwork has been focused on the fine, saprolite ores from the Thomas prospect. Testwork results to date suggest that Empire can expect to achieve an overall recovery of circa 65-75%, and produce a high-purity, +99% TiO2 product. This is based on early stage testwork with limited optimisation, and the success to date is a good indicator that the Pitfield ores are non-refractory and free of deleterious contaminants that affect product quality (such as U, Th, Cr, P and V).

Whilst it is difficult to provide comparable projects to Pitfield, given its scale, grade and unique ore characteristics, the processing route being evaluated for Pitfield has similar stages to that found in the well-established heavy mineral sands industry. For instance, the ilmenite within the mineral sands is first separated (by gravity and magnetics) and the ilmenite concentrates are then beneficiated by a combination of reduction roast and leach to produce synthetic rutile. This in turn becomes feedstock to the TiO2 pigment or Ti sponge metal producers, both of which use strong oxidants (Cl gas or sulphuric acid) and high temperatures to transform the feedstock into pigments or TiCl4.

The whole process of recovering titanium from ilmenite; concentrating, beneficiation and then transforming it into a high-purity product is inefficient (generally low recoveries), expensive (high energy consumption and expensive consumables) and environmentally unfriendly (substantial Fe residues to dispose of from the breakdown of the ilmenite). The unique ore characteristics of Pitfield provide an opportunity to design a new processing route that is more efficient, lower cost and has greater optionality over the products it can produce than that currently experienced by the ilmenite processors, who account for 95% of the titanium supply chain.

Metallurgical Samples

Samples being used for the testwork programme have been collected from drilling programmes conducted across the deposit. These include drill core samples from diamond drilling, and bulk samples from air core drilling programmes. Samples have been collected from both exploration targets - Cosgrove ('COS') and Thomas ('TOM'). Separate Saprolite ('SAP') and Weathered Sandstone ('WS') zones have been identified. Some of the testwork samples are a blend of the two zones and some have been kept separate to understand the performance of the weathering profile.

Mineralogy

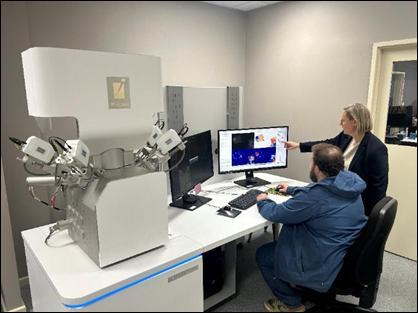

A number of mineralogy techniques are being used to develop the understanding of the Pitfield mineralogy and morphology. SEM based TIMA analysis has been undertaken at Automated Mineralogy Incubator (AMI) on exploration samples, testwork feed samples and testwork products.

|

Figure 2. Mineralogist at AMI discussing Pitfield TIMA analysis results with Empire Metallurgist

Key information collected from TIMA analysis on testwork feed samples and exploration samples includes the titanium and gangue minerals present, the grain sizes, and the mineral association.

Testwork product samples have also been analysed using TIMA to understand the deportment of the different titanium minerals and effectiveness of each of the processing steps. More than 100 samples have been analysed using TIMA, including geology samples, testwork feed samples and testwork products.

XRD analysis has also been used on a range of samples. This has been used to help with mineral identification that SEM cannot determine - such as the crystal structure of titanium oxide minerals, identifying them as either anatase or rutile.

Microprobe analysis, at CSIRO in Melbourne, has been used on a small number of samples: to measure impurities in titanium minerals in particular.

Testwork - Flowsheet Development

Some early testwork programmes were undertaken using fresh mineralisation from Pitfield, however once an understanding of the mineralogy and volume of the weathered zone was developed, the focus shifted to this material.

Comminution and Mineral Separation

Several comminution tests have been completed on drillcore samples to investigate potential for low energy input comminution such as scrubbers and log washers. The optimal regrind liberation size range and the energy input required, which appears to be very low, continues to be investigated.

A wide range of unit processes are being investigated for mineral separation utilising whole-of-ore samples as well as separated coarse and fine fraction samples.

Testwork on the coarse fraction has focused on gravity and enhanced gravity separation, testing shaking tables, spirals, and a Multi Gravity Separator (MGS). The shaking table tests and MGS tests were completed at batch scale (~5-20kg), whilst the spiral tests were undertaken on a much larger, bulk scale (~300-600kg).

Testwork on the fine fraction looked at enhanced gravity (MGS) and froth flotation. A range of flotation reagents and conditions are being tested. Relevant examples exist in the non-sulphide flotation industry, including anatase flotation from kaolin clay minerals in the kaolinite industry.

Whole-of-ore testwork is in the planning stages for comparison against gravity separation performance. This testwork will focus on grinding, flotation and then further treatment of the flotation concentrate assessing a number of different separation processes.

Key results to date include:

· Fine fraction "rougher" flotation on a TOM SAP sample has achieved 67- 77% TiO2 recovery and up to 19% TiO2 concentrate grade. Similar recovery performance was achieved on a COS WS sample fines fraction with a "rougher" flotation recovery of 68%.

· Cleaner tests on rougher concentrate from the TOM SAP rougher flotation test achieved a 90% stage recovery at 32%TiO2 concentrate grade. This equates to an overall float recovery of circa 70%.

· Bulk scrubber testwork on TOM SAP sample resulted in 51% of the mass and 72% of the contained TiO2 to the fines fraction, using a hydro cyclone. Similar results were seen on a smaller scale scrubber test using drillcore material, with 53% of the mass and 66% of the TiO2 reporting to the fines fraction, using a 38µm screen.

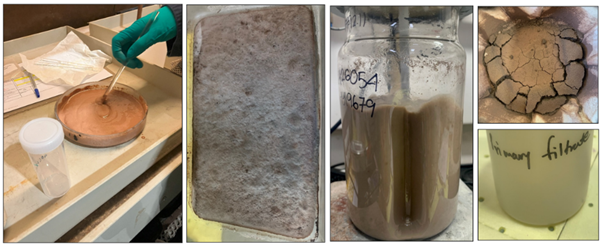

|

| ||

Figure3. (L-R): Bulk Scrubber test in progress at AML, Batch slimes fraction rougher flotation test at ALS.

Elemental Extraction and Product Finishing

A wide range of concepts are being explored for extraction of titanium from the mineral concentrate. These range from conventional processes, already applied in the titanium industry or other comparable industries, to more novel processes that have been developed through laboratory research and pilot scale testing.

A base case of sulphuric acid bake water leach, followed by titanium hydrolysis and calcination has been tested by Empire. This is based on the conventional sulphate route for TiO2 pigment production, which is usually applied to ilmenite concentrates. A range of other lixiviants and decomposition and leach conditions have been identified and are planned to be tested as part of the ongoing development programme.

Product finishing testwork aims to take titanium from the leach solutions and produce a final product. It is closely tied to the elemental extraction, so in some cases is being tested as part of that testwork programme. There is a range of product options: separate research testwork is being undertaken to develop and understanding of the various TiO2 pigments and Ti chemicals that Pitfield can produce and the markets in which these products are required.

Around 15 leach tests have been completed to date, including five product finishing tests. A number of product process options are as yet untested: further testwork is budgeted and is currently in the planning stage.

Elemental extraction results achieved to date include:

- Acid bake water leach tests on rougher flotation concentrate have achieved 98% TiO2 extraction to the liquor phase.

- Titanium hydrolysis and calcination has been successfully applied to the leach liquor after iron conversion, producing a low-impurity TiO2 product containing 99.25% TiO2.

- Recovery in the hydrolysis stage requires further testwork as the conditions applied in the tests and has not yet been optimised. Hydrolysis is a standard process used in sulphate pigment industry, and high recoveries (greater than 95%) are achieved on a commercial scale.

|

Figure 4. Elemental Extraction testwork (L-R): Acid-Concentrate mixing pre-acid bake, Acid bake product, initial stages of water leach, water leach residue and filtrate.

Product Potential

A fast-tracked separate work programme was undertaken to determine whether an impurity-free high grade product could be made from samples taken at Pitfield. The sample was processed through scrubbing, gravity separation, flotation, acid bake/water leach, impurity removal, titanium hydrolysis and calcination. The flowsheet used and conditions selected were based on industrial examples and literature. This work achieved a product grade of 99.25% TiO2: impurity levels, particularly colorformers which impact negatively on pigment quality, were below detection limits or very low. (Announcement "Exceptional High-Purity TiO2 Product Achievement" 9 June 2025).

Further work is ongoing to understand the TiO2 pigment market, optimise the test conditions and also understand the alternative product options, such as TiCl4 (the feedstock for making titanium sponge metal) or other titanium chemicals.

Figure5. Purification and Product finishing testwork (L-R): titanyl sulphate solution from leaching stage, hydrated TiO2 produced from hydrolysis, and the calcined TiO 2 product

Future metallurgical testwork

Empire has committed significant resources to enable the process flowsheet development programme to continue to proceed at pace. This includes not only the allocation of several full time Empire technical staff but also the use of various industry specialists who support the Empire team in managing the necessary metallurgical testwork and research programmes.

Over the coming months the Company will focus on optimising the mineral separation stages to further improve the flotation and gravity concentrate grades and recovery. Bulk metallurgical testwork has commenced, utilising large scale scrubbing, gravity and flotation test equipment at local mineral processing laboratories. This testwork will produce significant quantities of titanium mineral concentrates: allowing the testing of multiple downstream beneficiation options aimed at defining the optimal hydrometallurgical processing route.

Finished product optimisation, through research and laboratory testwork, is continuing and is aimed at further refining the +99% titanium product already achieved to date, looking at alternative titanium products for marketing purposes.

The next steps for the mineral separation flowsheet development will be further optimisation of the chemistry and conditions, larger scale batch testwork and then continuous piloting can be undertaken at a laboratory scale. Testwork to date has shown the Pitfield weathered ores amenability to conventional mineral separation, beneficiation and refining techniques, and this avoids the need to build a bespoke, demonstration plant. A simpler and lower cost continuous pilot plant operation can be established, utilising local, internationally accredited commercial metallurgical laboratories.

The Company aims to complete the bench and large scale batch metallurgical testwork phase by Q1 2026, which is when it expects to move toward continuous piloting of the process in order to provide the critical technical information for the development of a commercial process flowsheet and to enable the supply of bulk product samples to prospective end users.

The Pitfield Titanium Project

Located within the Mid-West region of Western Australia, near the northern wheatbelt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region's capital and major port. Western Australia is a Tier 1 mining jurisdiction, with mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines as well as a green energy hydrogen fuel hub, which is under planning and development (refer Figure 3).

Figure 3. Pitfield Project Location showing theMid-West Region Infrastructure and Services

Competent Person Statement

The scientific and technical information in this report that relates to process metallurgy is based on information reviewed by Ms Narelle Marriott, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Ms Marriott is a member of the AusIMM and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code 2012. Ms. Marriott consents to the inclusion in this announcement of the matters based on their information in the form and context in which it appears.

The technical information in this report that relates to the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr Faragher is a Member of the Australian Institute of Mining and Metallurgy. Mr Faragher has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

Empire Metals Ltd Shaun Bunn / Greg Kuenzel / Arabella Burwell | Tel: 020 4583 1440 |

S. P. Angel Corporate Finance LLP (Nomad & Broker) Ewan Leggat / Adam Cowl | Tel: 020 3470 0470 |

Shard Capital Partners LLP (Joint Broker) Damon Heath / Erik Woolgar | Tel: 020 7186 9950 |

St Brides Partners Ltd (Financial PR) Susie Geliher / Charlotte Page | Tel: 020 7236 1177 |

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Click here to connect with Empire Metals (OTCQB:EPMLF, AIM:EEE) to receive an Investor Presentation

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00