April 30, 2025

Empire Metals (LON:EEE, OTCQB:EPMLF) is an exploration and resource development company focused on Australia, gaining global recognition for its discovery and swift advancement of what is believed to be the world’s largest titanium deposit.

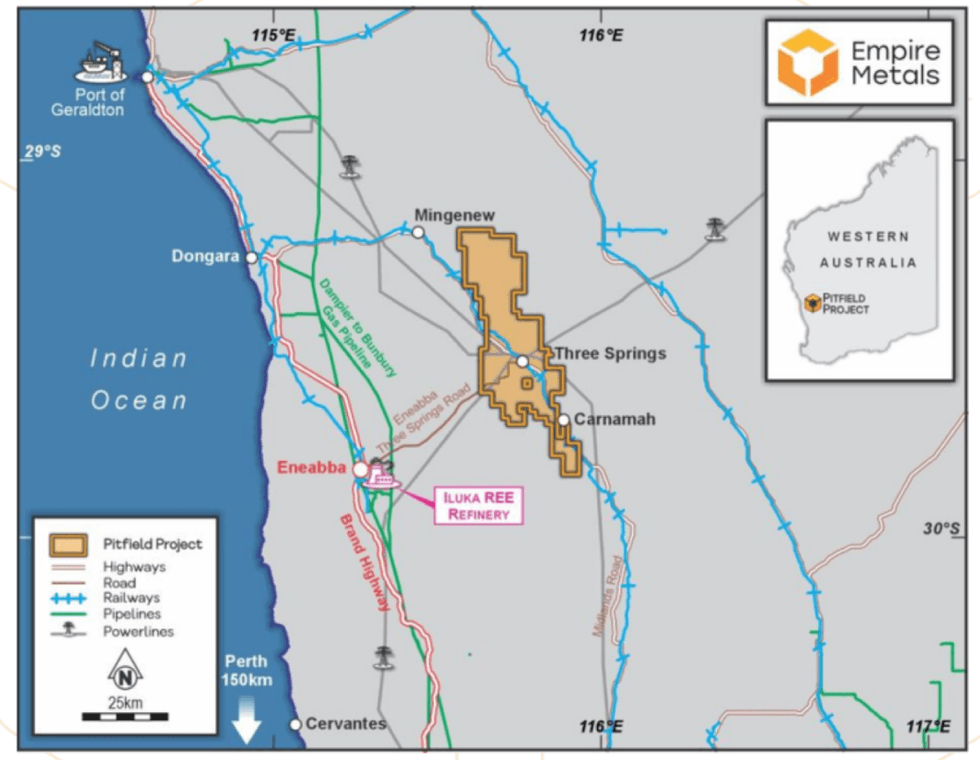

The company’s primary focus is the Pitfield project in Western Australia — a premier mining jurisdiction. With over 1,000 square kilometres of land and a titanium-rich mineral system extending 40 kilometres in strike length, Pitfield is shaping up to be a district-scale discovery with the potential to significantly influence the global titanium supply chain.

Pitfield’s prime location in Western Australia

Pitfield’s prime location in Western AustraliaEmpire’s focus on titanium comes at a pivotal time, as it is officially recognized as a critical mineral by both the EU and the US for its essential role in aerospace, defence, medical, clean energy, and advanced industrial applications. Demand for titanium dioxide — the most widely used form — is surging, while global supply is increasingly constrained by geopolitical risks, resource depletion, and environmental challenges. With over 60 percent of supply concentrated in countries like China and Russia, Western markets face growing vulnerabilities.

Company Highlights

- The flagship Pitfield project is the world’s largest known titanium discovery. It’s a district-scale “giant” titanium mineral system, characterised by high-grade, high-purity titanium mineralisation exhibiting exceptional continuity.

- Titanium is in a global supply deficit and recognized as a critical mineral by the EU and US.

- Drill intercepts at Pitfield include up to 202 meters at 6.32 percent titanium dioxide (TiO2) from surface, confirming vast scale and grade.

- Empire Metals operates in one of the world’s most secure, mining-friendly jurisdictions: Western Australia.

- The company is led by an experienced, agile team, with proven expertise in exploration, mine development, and value creation across multiple commodities.

- With a number of key development catalysts planned for 2025, including a maiden resource estimate, bulk sampling for scale-up of metallurgical testwork, and product optimisation, Empire remains significantly undervalued relative to its peers.

This Empire Metals profile is part of a paid investor education campaign.*

Click here to connect with Empire Metals (LON:EEE) to receive an Investor Presentation

EPMLF

The Conversation (0)

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

3h

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00