June 19, 2024

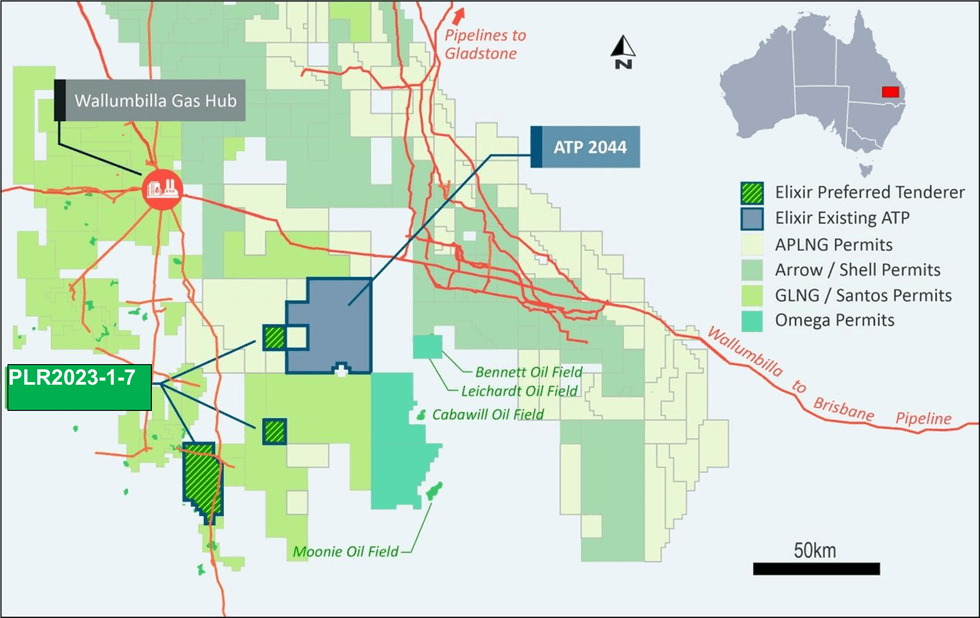

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to announce that it has been appointed as Preferred Tenderer in relation to a new exploration area in Queensland: PLR2023-1-7 (see map below). The area lies immediately adjacent to the Company’s Project Grandis in the Taroom Trough.

HIGHLIGHTS

- Elixir has been appointed by the Queensland Government as preferred tenderer for PLR2023-1-7

- The licence area is adjacent to Elixir’s Grandis Project and is prospective for both deep and shallow gas

PLR2023-1-7 covers 526 square kilometres and although just one licence is divided into 3 separate geographical areas. The North Eastern areas are located in the Taroom Trough and are prospective for the same deep gas plays as encountered in Project Grandis. These new areas cover 152 square kilometres and represent a 14% increase of Elixir’s acreage within the Taroom Trough, which to date has a 2C contingent resource booking of 1,297 Bcf (per ASX announcement of 29 May 2024).

The larger South-Western area, which covers 374 square kilometres is prospective for both shallow and deep gas targets.

Elixir will now proceed to obtain an Environmental Authority (EA) and complete any required native title process before being granted the final Authority to Prospect (ATP). This licence will not be subject to any domestic gas reservation. Elixir will own a 100% working interest in the ATP and will be the Operator.

Technical studies have already begun on all of the areas of the licence to address issues such as the potential addition of contingent and prospective resources, drill target(s) and potential partners once the licence is formally granted.

Elixir’s Managing Director, Mr Neil Young, said: “Naturally we are pleased to be recognized by the Queensland Government as the preferred tenderer for a new licence area which is highly complementary to our existing Grandis Gas Project position. That recognition in part at least acknowledges the good work undertaken by our team since we have entered Queensland two years ago.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00