June 27, 2023

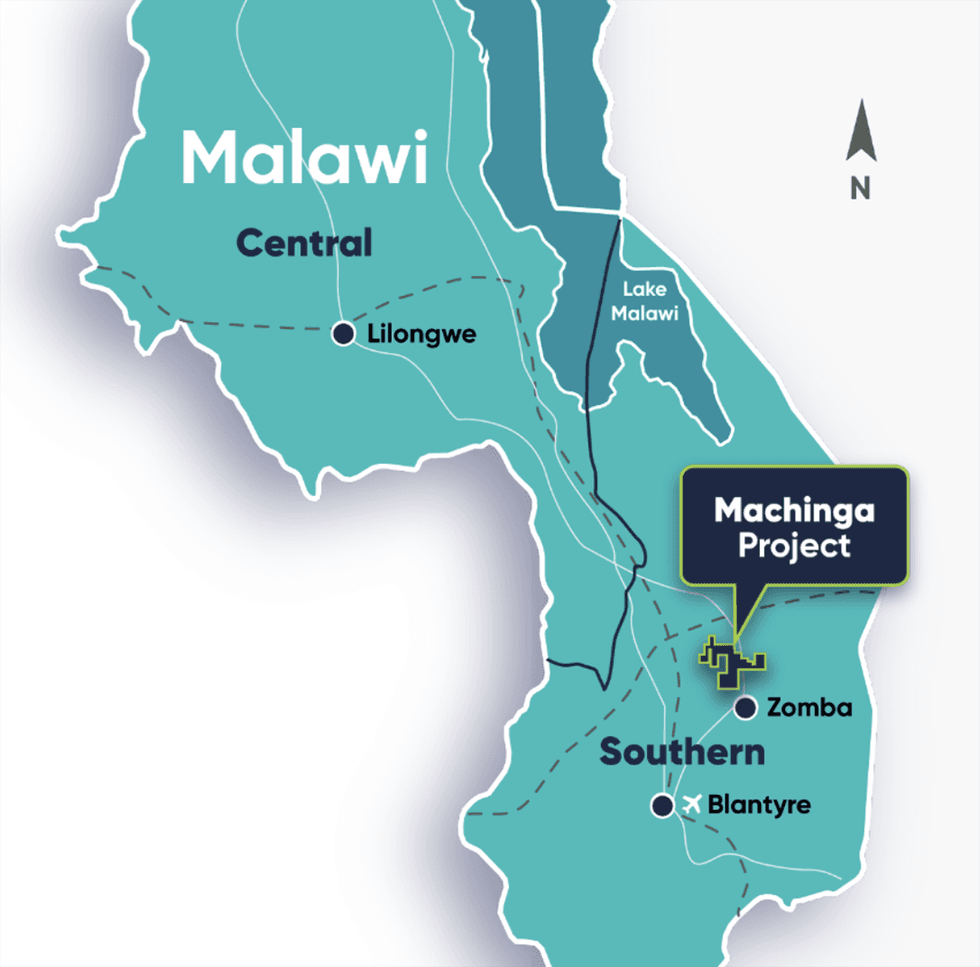

DY6 Metals (ASX:DY6) holds a 100 percent interest in three highly prospective critical metals projects in Malawi - home to considerable mineral wealth and one of the most stable jurisdictions in Southern Africa. As global demand for REEs is expected to increase by as much as 600 percent over the next several decades, DY6 Metals aims to ramp up rare earths production with maiden drilling already underway at its flagship Machinga Heavy Rare Earth project.

Located within the Chilwa Alkaline Province (the same province that hosts Lindian’s Kangankunde project), Machinga's original exploration license, covering 42.9 square kilometers, was acquired in light of uranium channel radiometric anomalies located by a country-wide airborne survey in the 1980s. The anomaly present in Machinga is continuous along a strike of roughly 7 kilometers.

Machinga hosts high-grade, near-surface heavy rare earth oxides as well as niobium, tantalum and zirconium potential. Radiometric anomalies within the project indicate that there is significant potential for DY6 to discover additional REE mineralization across the wider project area.

Company Highlights

- DY6 Metals is an ASX-listed company with 100-percent ownership of three highly-prospective heavy rare earth and critical metals projects in Southern Malawi.

- The company recently completed a successful $7-million initial public offering.

- DY6 employs an experienced management team which includes geotechnical experts and mining professionals.

- All three of DY6's projects feature near-surface, high-grade historical drillings and/or workings, and all three are significantly underexplored with considerable potential to define new mineralised zones.

- Initial exploration of DY6's projects will focus on significant historical REE drill results.

- Malawi as a mining jurisdiction is incredibly prospective for rare earth elements. In recent years, multiple resource companies have been engaged in comprehensive exploration and development within the region, including:

- Malawi is also known for its excellent operating infrastructure, mining-friendly regulations, and push for renewable energy.

This DY6 Metals profile is part of a paid investor education campaign.*

Click here to connect with DY6 Metals (ASX:DY6) to receive an Investor Presentation

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00