April 17, 2024

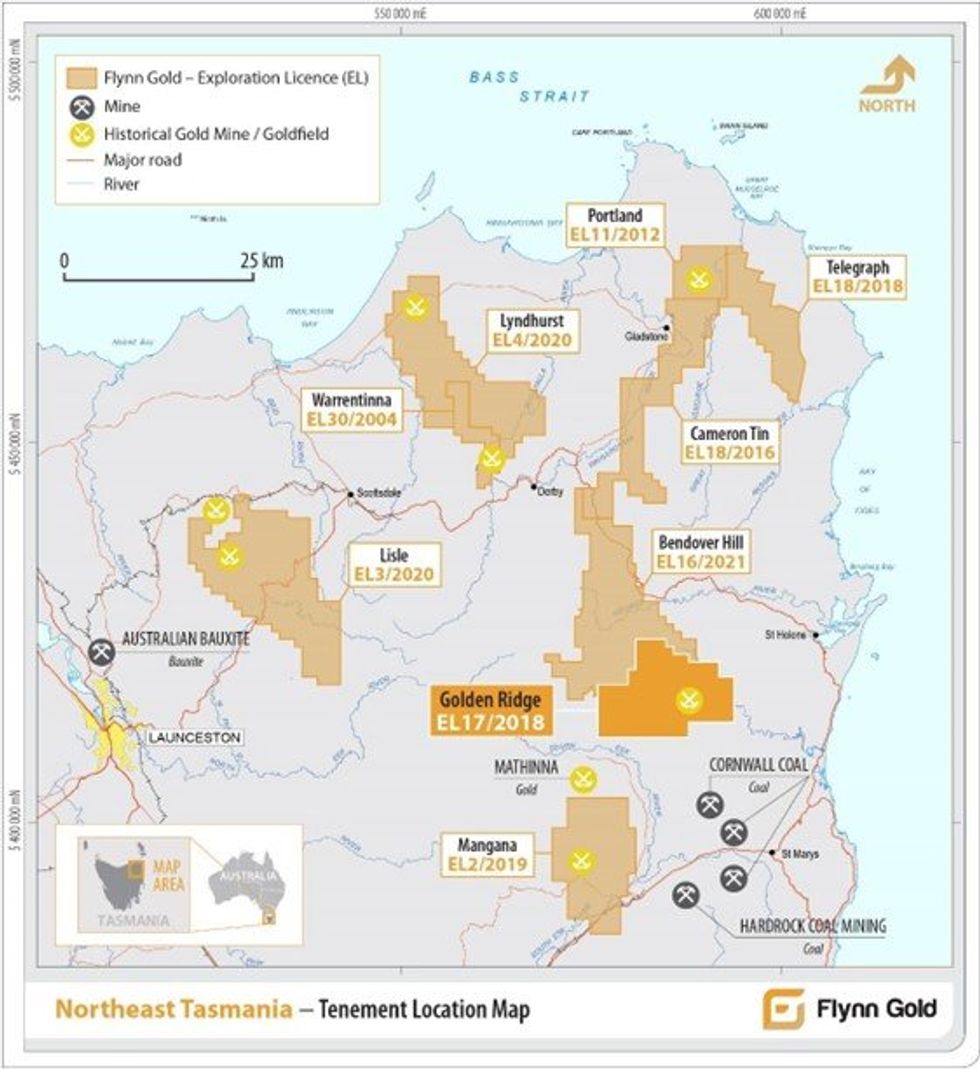

Flynn Gold Limited (ASX: FG1, “Flynn” or “the Company”) is pleased to provide an update on activities at the Company’s 100% owned Golden Ridge Project located in Northeast Tasmania (Figure 1).

Highlights

- Phase 3 drilling has commenced at Trafalgar high-grade gold prospect

- Previously reported drilling included multiple intersections grading >100g/t Au, including:

- TFD001:

- 5.0m @ 12.56g/t Au, incl. 0.4m @ 150.0g/t Au from 202.0m

- TFDD003:

- 1.2m @ 65.9g/t Au, incl. 0.5m @ 143.0g/t Au from 57.5m

- TFDD005:

- 12.3m @ 16.8g/t Au, incl. 0.7m @ 152.5g/t Au from 120.3m

- TFDD013:

- 4.0m @ 23.7g/t Au, incl. 0.5m @ 169.8g/t Au from 25.9m

- TFD001:

- New geological vein model for Trafalgar indicates multiple sub- parallel high-grade veins

- An initial 1,500m drill program is planned that will comprise infill and extension drilling targeting down-dip and along-strike extensions to previous high-grade gold intercepts

- For further information or to post questions go to the Flynn Gold Investor Hub at https://investorhub.flynngold.com.au/link/DP4MXy

Geological modelling of the multiple high-grade veins intersected in drilling at the Trafalgar Prospect in 2022/23 has been completed. The next phase of diamond drilling (Phase 3) has commenced to test in-fill and extensional drilling targets generated from the new geological model.

Managing Director and CEO, Neil Marston commented,

“Since the completion of drilling at the Trafalgar prospect at Golden Ridge in 2023, Flynn Gold has been undertaking geological modelling of the high-grade gold intersected in multiple vein sets.

“This modelling work, in combination with our recent soil sampling activities, demonstrates the potential for extensive gold mineralisation at Golden Ridge.

“Based on the latest information we have designed a program of drill holes with the goal being to target down-dip and along-strike extensions to previous high-grade gold intercepts.

“As gold prices hit record highs, it’s an exciting time for our team to be drilling this new Tasmanian gold discovery.”

Trafalgar Prospect – Geological Vein Model

A 3D geological vein model was recently completed for the Trafalgar prospect. The model interprets 3 main gold mineralised veins, accompanied by a network of subsidiary mineralised splay veins and sheeted vein swarms bifurcating off the main veins (see Figure 2).

All of the main mineralised veins transect the granodiorite – hornfelsed metasediments contact, with gold mineralisation hosted in both the granodiorite and metasediment host rocks.

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

10h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

23h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00