September 02, 2024

Moab Minerals Limited (ASX: MOM) (Moab or the Company) is pleased to provide an update of activities at the Manyoni Uranium Project in Tanzania, Africa.

Highlights:

- An extensive core drilling program (60 holes) has commenced at the Manyoni Uranium Project.

- Objective of 60-hole Stage One drilling is to verify historical drill results, obtain additional geologic and bulk density information, and carry out preliminary metallurgical test-work to ascertain the optimum processing pathway for the project.

- Strategically located just 5km north of Manyoni town, the Manyoni Uranium Project enjoys convenient access to modern railway and sealed highway infrastructure, as well as readily available power and water resources.

- The Manyoni Uranium Project was previously explored, and extensively drilled, by Uranex Ltd from the early 2000’s until 2013. The project did not proceed due to the low price of uranium at that time.

- Mineral Resource Estimation will be carried out by Snowdens/Optiro following successful completion of the Stage One program.

- Phase two drilling, involving a further 100 holes, will follow on and is designed to locate extensions to the known mineralisation at Manyoni.

Moab Managing Director, Mr Malcolm Day, commented: “I visited the Manyoni Uranium Project last week and am excited to report that drilling has started. The Company only settled the transaction on 9th July and in less than two months has been able to ‘hit the ground running’. The drilling program is expected to run over the next few months with most of the assay results available in November/December. I look forward to updating shareholders in coming months in regard the advancement of the Manyoni Uranium Project”.

About the Manyoni Uranium Project

Tanzania Uranium Projects (Moab 94.00%)

On 12 March 2024, the Company announced the acquisition of a package of advanced uranium projects in Tanzania (refer ASX Announcement 12 March 2024) (Acquisition). The Company completed the Acquisition on 9 July 2024.

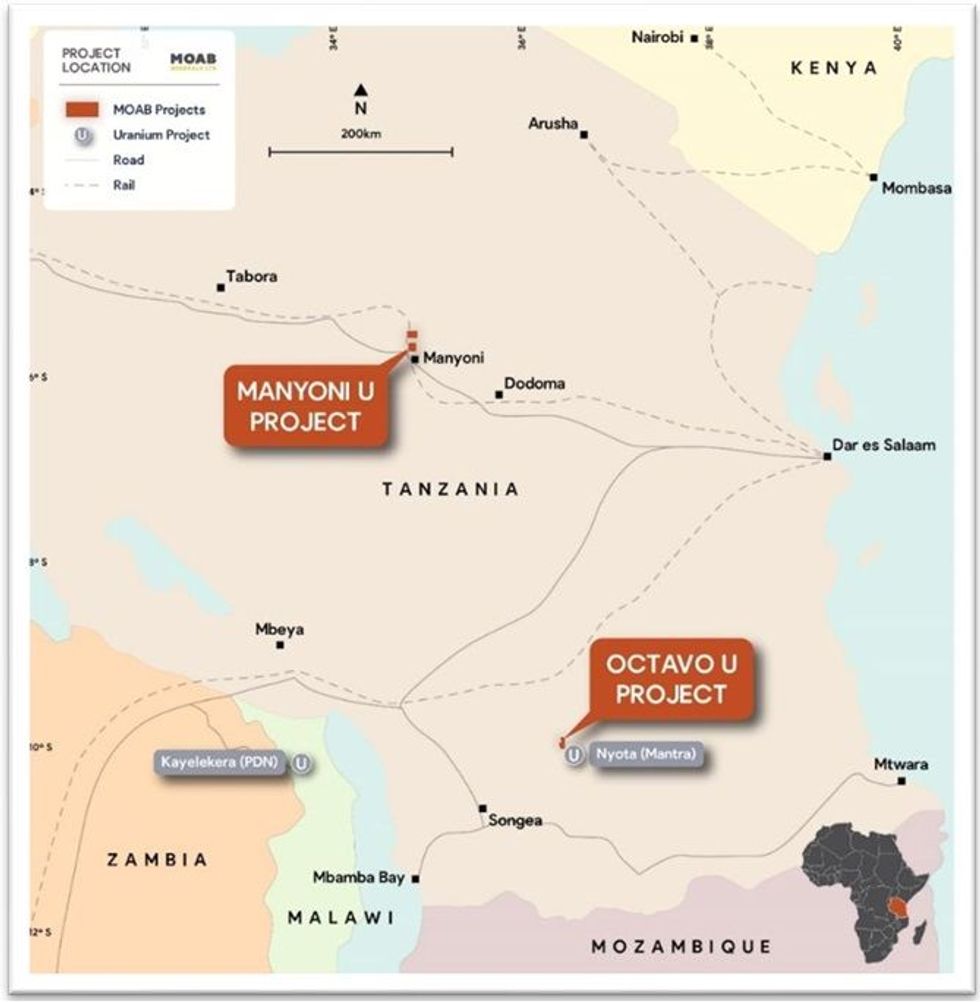

The Acquisition includes the Manyoni and Octavo Uranium Projects, covering a total of 216 km2. The projects are strategically located just 5km north of Manyoni town, the Manyoni Uranium Project enjoys convenient access to modern railway and sealed highway infrastructure as well as readily available power and water resources.

The Manyoni Uranium Project was previously explored, and extensively drilled, by Uranex Ltd from the early 2000’s until 2013.

Project Location

The Manyoni Uranium Project tenements are located in the Republic of Tanzania (pop. 65 million), Africa, approximately 100km northwest of the capital city of Dodoma (pop. 765,000). The location of the uranium project at Manyoni is shown in Figure 1 and Figure 2.

Geological Setting and Uranium Mineralisation

The tenements are located in the central part of the Tanzanian Archaean Shield, which is a stable platform of granite-gneiss terrane with marginal greenstone belts. Radiometrically “hot” granites have been subject to erosion over geological time and have contributed uranium and other metals into the pluvial streams and lakes which drain the shield.

In the Manyoni area the uranium is deposited in a shallow playa lake system as schröckingerite (in the lake sediments) and carnotite in the granitic saprolite below the lake sediments. The mineralisation varies from flat lying to shallowly dipping as it follows the direction of the palaeo- drainage to the south-east while the average depth to the top of mineralisation varies from 3m to 10m.

Validation Drilling (Stage One Drilling)

Moab has completed a substantial review of historic databases that were acquired from the property vendors. Moab has appointed Resource specialists Datamine/Optiro to assist the Company with planning a program of Validation drilling designed to verify historical drill results. A program of 60 drill holes involving PQ Triple Tube core drilling adjacent to old drill holes that contained uranium mineralisation is planned to commence in the 1st Quarter FY2024/2025. The objectives of the program include:

- Twinning of a statistically valid number of drill holes which provides the highest core recovery and sample quality. An estimated 60 drill holes to an average depth of 15m are planned. This program is designed to address historical assay reliability.

- Strict QA/QC controls will be implemented so as to provide a statistically valid means of verifying uranium grades.

- Bench scale metallurgical test work on a representative suite of bulk samples from the above drill program.

- Additional bulk density measurements to verify historical records and to expand the database for different mineralized domains.

- Improved understanding of the geological controls on uranium grade distribution.

It is estimated that this initial program will be completed in 2nd Quarter FY2024/2025. On completion of the Validation drilling program the information will be used to update the wire-frame model for mineralized domains thereby facilitating resource estimation, depending on results.

Exploration Drilling (Stage Two Drilling)

In addition to the above drilling, Moab is planning to undertake an exploration drilling program that is designed to locate extensions to the known mineralisation at Manyoni. This will be based on grid drilling on a 400m x 400m and 200m x 200m pattern around the known mineralisation. The Manyoni uranium mineralisation is at shallow depth, varying from 3m to 15m to the top of mineralisation, and flat lying. Moab has executed a drilling contract for a minimum of 1500m of PQTT core drilling covering Stages one and two drilling, with the option to drill an additional 1500m.

Click here for the full ASX Release

This article includes content from MOAB Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MOM:AU

The Conversation (0)

30 January

Quarterly Activities Report and Appendix 5B

Moab Minerals (MOM:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

27 January

Moab terminates agreement to acquire Sasare Project Zambia

Moab Minerals (MOM:AU) has announced Moab terminates agreement to acquire Sasare Project ZambiaDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities Report and Appendix 5B

Moab Minerals (MOM:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 March 2025

Uranium Assay Results for Manyoni Uranium Project

Moab Minerals (MOM:AU) has announced Uranium Assay Results for Manyoni Uranium ProjectDownload the PDF here. Keep Reading...

18 February 2025

Outstanding Uranium Assay Results at Manyoni Uranium Project

Moab Minerals (MOM:AU) has announced Outstanding Uranium Assay Results at Manyoni Uranium ProjectDownload the PDF here. Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00