May 09, 2024

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is excited to announce preparations for our diamond drilling program at our 100% owned Mkuju Uranium Project.

- Tanzanian Mining Commission has approved BR Drilling Limited, the Company’s preferred contractor for the drilling at the 100% Owned Mkuju Uranium Project.

- The rainy season has ended. Mobilization, earthworks, and camp set-up now underway in preparation of the drilling campaign.

- Drilling will start in June at the promising SWC target where surface trenches gave vertical intervals including 2.55m @ 2017ppm U3O8, 0.75m @ 7139ppm U3O8, 2.35 @ 1636ppm U3O8 and 1.4m @ 3945ppm U3O81.

- Results achieved at the SWC target will define the fluidity of the drill program across the three target areas of SWC, Mtonya and Likuyu North.

The 2024 drilling program on the Mkuju Uranium Project is the result of the analysis of multiple geophysical surveys, historical data, and trenching to ensure that we have located the key target areas with the highest potential to intercept and extend uranium mineralization.

Drilling all-set commence in June now that the approval from the Tanzanian Mining Commission has been received and that the Rainy Season in Tanzania has ended.

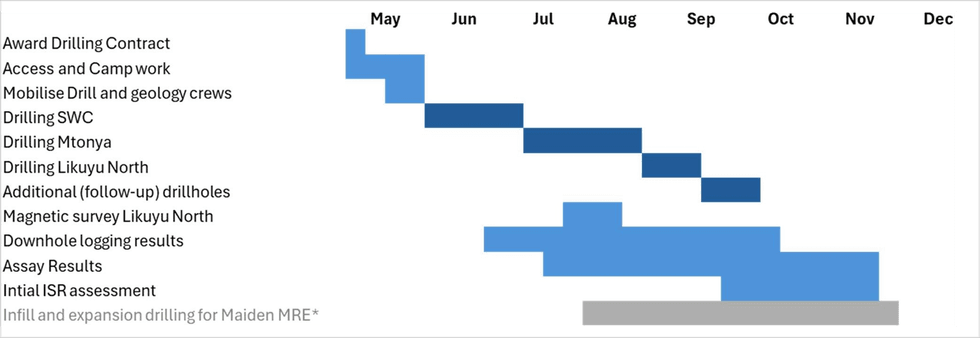

The 2024 Drilling Program will include initial core drilling at the SWC target where 2023 trenches intersected up to 7139ppm U3O8. At Mtonya and Likuyu North, drilling will test potential extensions and new zones to the existing uranium deposits. Earthworks, camp establishment and equipment and crew mobilization are underway. Figure 1 provides an indicative timeline for the exploration.

The SWC target – summary and Gladiators planned drilling

The SWC target presents a promising opportunity for uranium exploration. In 2008, shallow auger holes were drilled, revealing excellent uranium intersections, but further exploration at the target was sidelined by Mantra Resources as they focused on their Nyota Uranium deposit to the north.

In 2023 Gladiator carried out trenching to confirm and understand the uranium mineralization and encountered high grade uranium in 4 of the 5 trenches2. Vertical channel samples across the gently dipping layer included:

- 2.55m @ 2017ppm U3O8,

- 0.75m @ 7139ppm U3O8,

- 2.35 @ 1636ppm U3O8 and

- 1.4m @ 3945ppm U3O8.

Gladiators drilling will test the potential down-dip extension of this mineralization, described in the announcement dated 26 December 2023. Figure 2 is a conceptual cross-section through the SWC target showing the North and South Limb zones. Figure 3 provides a map of the North Limb zone with planned drillholes marked.

Click here for the full ASX Release

This article includes content from Gladiator Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00