April 02, 2025

New Age Exploration (ASX: NAE) (NAE or the Company) is pleased to announce the commencement of drilling at its Lammerlaw Project in New Zealand. The drill program is Phase 1 of a two-phase program to test nine high-priority targets identified through extensive geochemical surveys, geological mapping, and geophysical data interpretation.

HIGHLIGHTS

- Drilling underway at NAE’s Lammerlaw Project in New Zealand, targeting high-priority gold and antimony anomalies

- Nine high-priority drill targets identified from geochemical surveys, geological mapping, and historical mining data. See previous releases for details.

- Significant mineralisation potential with a 2km antimony strike and historical production of high-grade stibnite and gold

- Results to guide next exploration phase of drilling

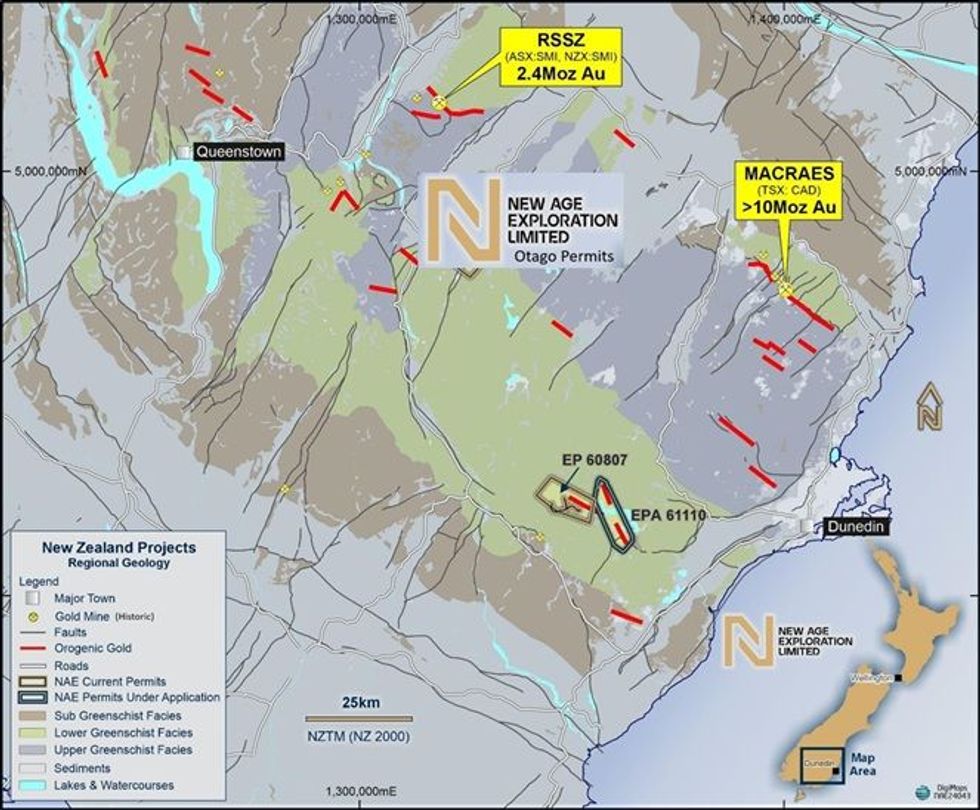

The phase 1 drilling programme at Lammerlaw, Permit 60807 (Figure 1), is focused on confirming the style of mineralisation that gives rise to gold, antimony, and tungsten anomalies identified in soil sampling and at historical workings. The Lammerlaw Project hosts several west-northwest mineralised zones sub-parallel to foliation in schist and airborne geophysical trends. The mineralised zones are defined by NAE soil samples, a compilation of previous exploration data, survey of historic workings and are approximately 4 km long.

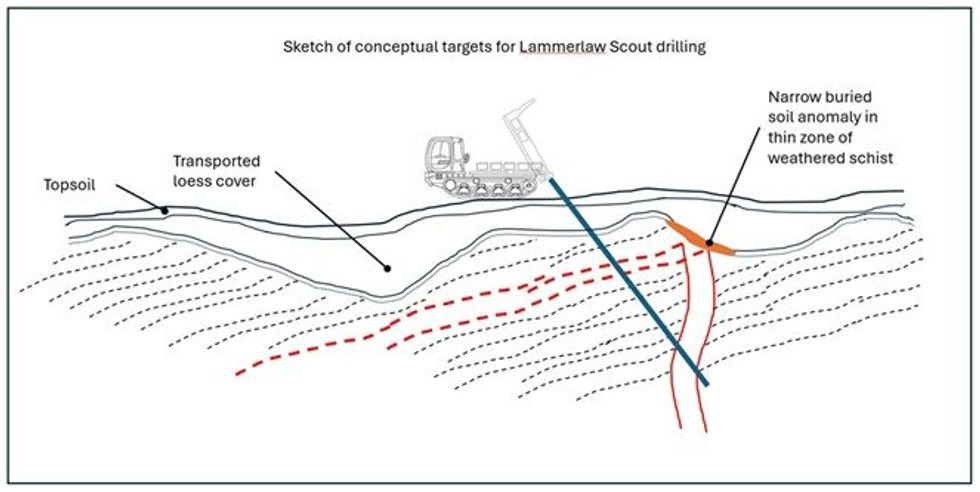

The Lammerlaw permit is primarily covered by a layer of loess (windblown silt), typically 1-5m deep, that sits on a thin zone of weathered schist and conceals mineralization. Hand augers are used for soil sampling to penetrate the loess. This means that most soil anomalies are buried and cannot be found by surface sampling, and the thin zone of weathered schist means that supergene mineralisation is not well developed.

NAE Executive Director Joshua Wellisch commented:

"We are excited to commence drilling at the Lammerlaw Project, where historical mining and modern exploration have highlighted the strong potential for high-grade gold and antimony mineralisation. This drill program is a key step in advancing the project and unlocking value for our shareholders."

The Phase 1 drilling programme will test 5 of the 9 identified targets, compiled from historic data and NAE soil sampling and which include high-grade discoveries of Au and Sb, along with data from historical production reported previously.

Each of the selected drill holes will test two types of conceptual targets which could relate to Au, As, Sb or W mineralisation (Figure 2):

1. Mineralisation can occur in shear zones parallel to schist foliation similar to Macreas or Rise n Shine mineralisation. This mineralisation style can be relatively subtle and will likely be detected in pXRF and assay results after drilling is completed

2. Mineralisation can occur in brittle vein structures oriented vertically or at a high angle to schist foliation. This mineralisation style can be detected through mineral analysis during on-site drill hole logging.

Soil anomalies derived from either mineralisation style (shear zone or high-angle vein) deliver the same or similar results. Historical mining records indicate that at least some of the mineralisation within the Lammerlaw permit is hosted in brittle vein structures. NAE is the first company to test the concept of shear zone mineralisation parallel to the schist in the Lammerlaw area.

The targets (Figure 3) include zones where several types of mineralisation indicators are aligned. Typically, the mineralisation indicators include historical workings, soil samples with elevated Au values, often coincident elevated As and Sb values and occasionally elevated W values. Once the targets are selected, drill hole locations are sited to intersect both target types within approximately 100m of drilling.

Click here for the full ASX Release

This article includes content from New Age Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

New Age Exploration

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00