January 29, 2025

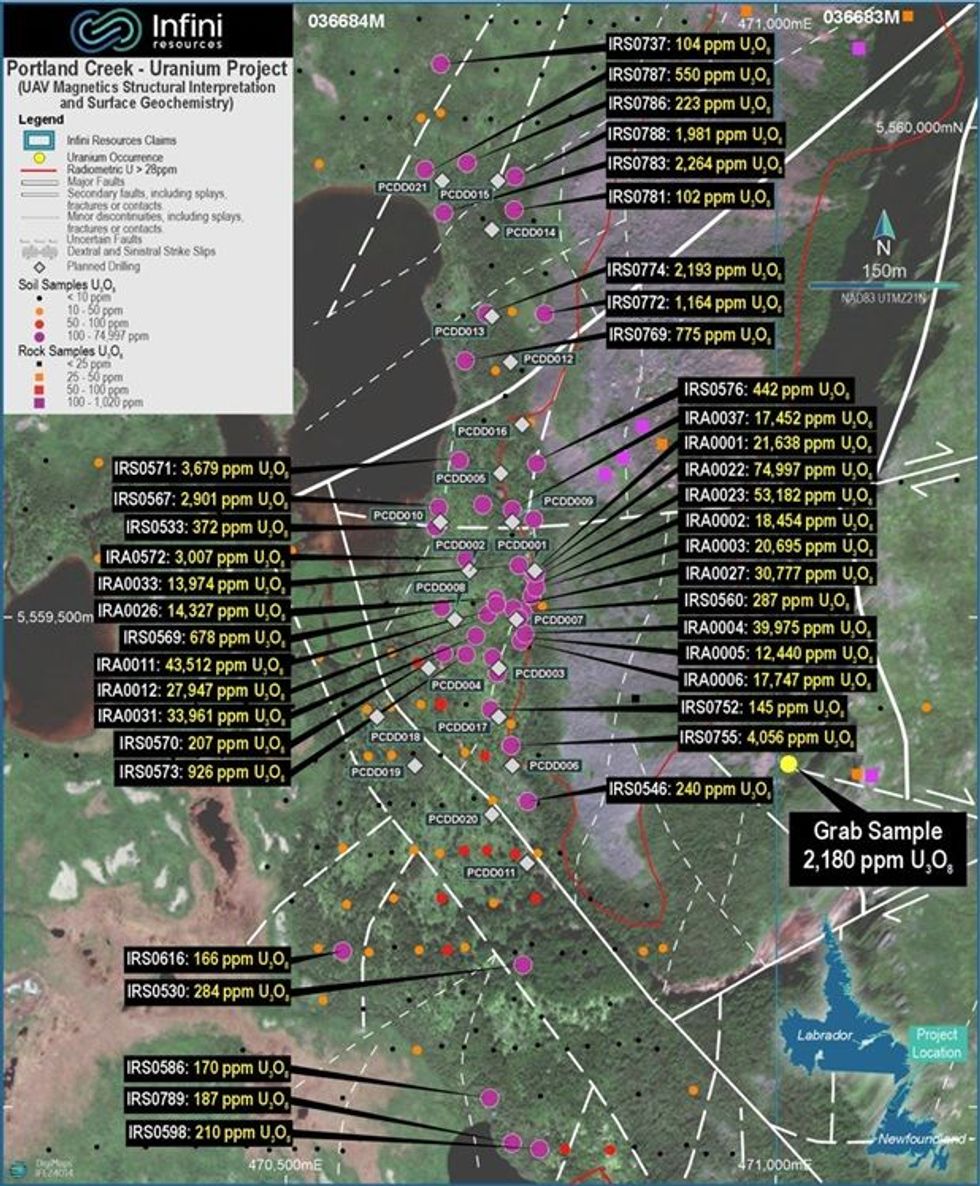

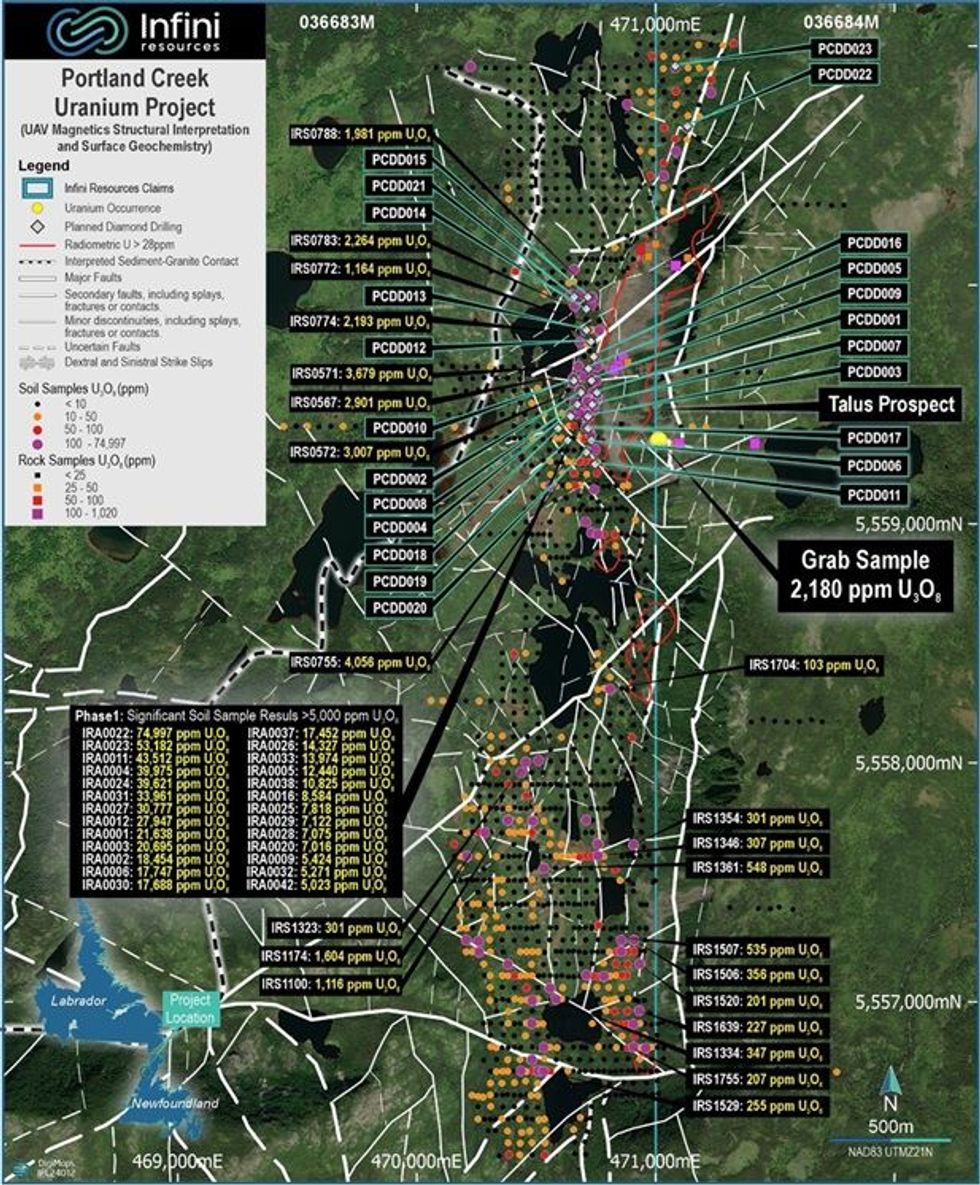

The highly anticipated maiden diamond drill program has commenced at Portland Creek to test stunning uranium soil geochemistry (peak 7.5% U3O8) coincident with a prolific shear corridor

Infini Resources Ltd (ASX: I88, “Infini” or the “Company”) is thrilled to announce the commencement of diamond drilling at its 100% owned Portland Creek Uranium Project in Newfoundland, Canada (ref announcement 16 December 2024).

Highlights

- Phase 1 diamond drilling will comprise up to 23 holes, targeting a high-grade uranium discovery in the tier-1 jurisdiction of Newfoundland, Canada

- The first priority one hole, PCDD001 is planned to be drilled to a depth of approximately 600m, testing the peak 74,997ppm U3O8 soil anomaly coincident with a 46.54 Pb 206-204 ratio and major demagnetized north-south fault zone at depth

- Site core logging and cutting facilities have been built and await the first batch of core from the field

- The staged program is anticipated to take 6-8 weeks to complete with the Company to update on progress

Infini’s Managing Director and CEO, Charles Armstrong said: "We’ve entered an incredibly thrilling chapter for the Company as we start drilling at our highly promising greenfield uranium prospect in Portland Creek, NL.

Myself and the Infini team are incredibly excited for the commencement of drilling, starting with our priority one diamond holes (1A). The anticipation is palpable as we target a high-grade soil anomaly right on top of a significant shear zone and three converging second-order faults.

The Talus prospect is just the beginning—one of many exciting targets within this expansive uranium corridor we’ve worked tirelessly to advance over the past year. The period ahead could mark a pivotal moment for the Company if this eagerly awaited maiden drill program uncovers a major uranium discovery in the tier-1 jurisdiction of Newfoundland, Canada. The excitement is real, and the potential is enormous."

Click here for the full ASX Release

This article includes content from Infini Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

I88:AU

The Conversation (0)

44m

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00