January 17, 2024

Elixir Energy Limited (Elixir or the Company) is pleased to provide an update on the next stages of its Daydream-2 appraisal well in its 100% owned Grandis Gas Project (ATP 2044), located in the Taroom Trough of the Bowen Basin, Queensland.

HIGHLIGHTS

- Very positive log results for recently discovered deep permeable zone

- Extent of this new play could be significant

- Stimulation and testing phase due to commence imminently

Following the rig release announced on 20 December 2023, Elixir’s technical team and various service providers have been evaluating the data gathered to date. Further inputs are due in the weeks to come from external laboratories.

The discovery of the presence of porous and permeable sandstone reservoirs at 4,200 metres in the Daydream-2 well - which produced gas to surface - has great significance for Elixir’s Grandis Project

- and for the greater Taroom Trough. Daydream-2 was drilled to a total depth of 4,300 metres, which Elixir understands to be the deepest well in Queensland in over a decade.

During the drilling of Daydream-2 in December 2023, the well intersected a sandstone interval with significantly better than prognosed reservoir properties. Porosity of greater than 10% was logged, which is generally unusual for this depth onshore, other than in certain locations such as the Permian section of the Perth Basin.

The petrophysical log analysis and the recovery of gas indicates that there are three sandstone reservoirs in this section that are gas saturated. The gross thickness of these sands extends over ~12 metres.

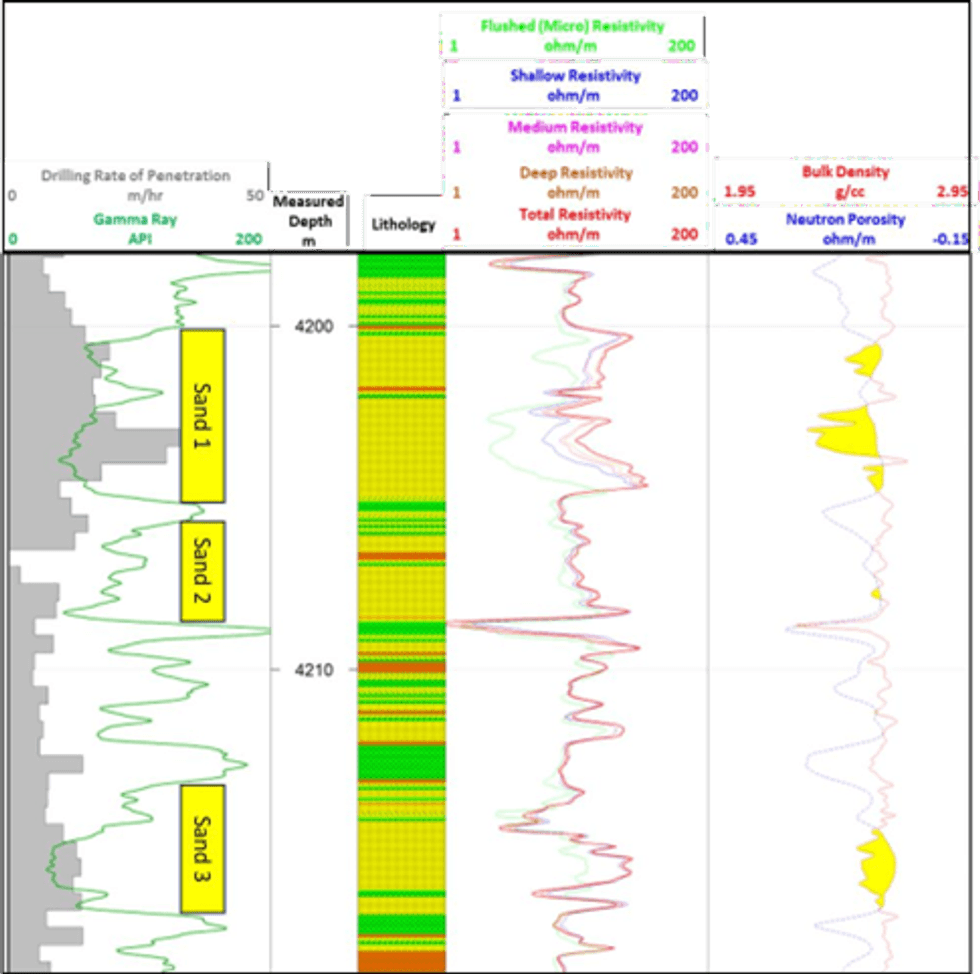

The log character of the zone reveals significant information about the sands, namely:

1. The sands have sharp bases and are generally fine upwards, indicating they were deposited in a channelised fluvial depositional setting.

2. A good “resistivity profile” is noted between the shallowest and deepest readings. This is considered a good indicator of permeable rock and is particularly evident in Sand 1.

3. The yellow highlighted cross-over of the neutron and density logs is generally an indicator of gas producing reservoir sandstone in the Cooper and Bowen Basins.

Stratigraphic correlations show a similarity with the Lower Lorelle Sandstone identified in the well reports from the Dunk-1 well drilled by BG Group around a decade ago – located in PCA 305 (Shell – 100%) some 26 kilometres away – see map below.

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00