Copper Price Update: Q1 2022 in Review

Here’s an overview of the main factors that impacted the copper market in Q1 2022, and what’s ahead for the rest of the year.

Click here to read the latest copper price update.

Following a 2021 that saw prices reach an all-time high, copper continued its upward trend with some volatility in the first quarter of 2022.

Low inventories, new supply coming into the market, Chinese demand and the Russia/Ukraine war were all factors impacting the space during the first three months of the year.

With Q2 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices.

Copper price update: Q1 overview

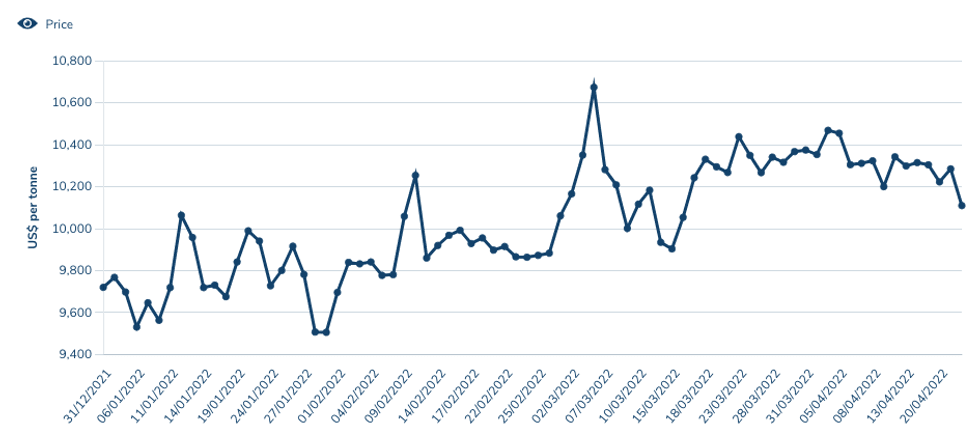

Copper kicked off 2022 trading at US$9,720.50 per metric ton (MT) and was able to remain above the US$9,500 threshold for the entire quarter.

Copper's price performance in Q1 2022.

Chart via the London Metal Exchange.

By the end of January, prices had reached their lowest point of the quarter, with copper changing hands at US$9,506 as concerns over Chinese demand escalated.

"The recent COVID-19 outbreak in China clearly threw a curveball into the seasonal demand pick-up," Wenyu Yao of ING said in a recent note. "Multiple cities have had different degrees of snap lockdowns, causing disruptions to logistics. However, the net impact on metals is still less clear cut."

Prices started to climb again in mid-February, supported by low inventories in exchange houses around the world.

“Falling inventories of the red metal globally pointed to a new supply squeeze with stocks in major Chinese, UK and US exchanges reportedly representing just three days of global supply,” FocusEconomics analysts said in a March report. “Moreover," they added, "tailwinds from China — accelerating credit growth and a seemingly stabilizing property sector — further supported prices.”

In late February, Russia’s invasion of Ukraine raised uncertainty in global markets, including copper — Russia is the seventh largest copper country in the world by production.

“The biggest surprise has been that copper prices have not changed much in Q1, while many other commodities have shot higher in response to the Russian invasion of Ukraine,” Dan Smith of Commodity Markets Analytics told INN. “Copper rose by 6 percent, but this is compared to a 24 percent jump in the aluminum price.”

Copper’s highest point of the quarter came on March 4, when the base metal was sitting at US$10,674.

"The fallout from the war exacerbated ongoing supply tightness in the global copper market, amid fears of supply disruptions due to international sanctions being rolled out against Russia," analysts at FocusEconomics said. "This, coupled with historically low copper stockpiles, falling Chilean output in early 2022, rising energy costs and healthy global demand, all boded well for copper prices."

Despite the increased volatility seen since January, copper prices rose almost 7 percent in the first quarter, and ended the three month period trading at US$10,375.

Copper price update: Supply and demand dynamics

At the end of last year, most analysts were expecting prices to remain high, despite forecasting an increase in mine supply and a slowdown in economic activity that could impact demand for copper.

China, the world’s top copper consumer, saw COVID-19 cases rise in Q1 and imposed new lockdown measures to contain the virus. This has been creating significant headwinds for demand, as construction activity has slowed and consumer spending is being hampered, Smith said.

“We expect this to be a short-term problem, though, and Chinese demand should accelerate once more in the year ahead as government stimulus starts to feed through and lockdowns are eased,” he added.

China currently accounts for 55 percent, or around 13 million MT, of global refined consumption.

“At the moment, measures to contain COVID-19 in China are making it difficult to move raw materials and finished products around the country,” Robert Edwards of CRU Group said at the recent World Copper Conference in Chile. “This is negatively affecting copper semi fabricators and hence reducing cathode demand.”

CRU is assuming that COVID-19 disruptions will only be temporary. The firm is relatively optimistic about the Asian country in 2022, although there are still virus and property market risks ahead. “We are keeping just over a 2 percent year-on-year growth forecast for Chinese refined copper demand for now at least,” Edwards said.

But ING's Yao pointed out that monetary and fiscal policies in China are moving towards more easing and stimulus — the opposite of what is happening in the US. "Hence, despite some of the high-frequency indicators showing a mixed picture of a healthier economic and demand optics in the short term, it is still expected that copper demand will pick up later after the COVID cases peak," she said.

Looking over to supply during the first three months of the year, restriction measures related to COVID-19 limited mine production in a number of countries. However, global mine output benefited from additional production at new or expanded mines, according to the International Copper Study Group (ICSG).

CRU data shows 2022 and 2023 should be years of exceptional mine supply growth, reaching around 8 percent.

“That’s due to the start of several large-scale projects … even though this year we expect a high level of disruptions of mines at around 5 percent, primarily due to the effects of COVID-19,” Edwards said.

Copper output is expected to increase by 3.9 percent in 2022, as per the ICSG, as it continues to recover to pre-pandemic levels in a number of countries — notably Peru, the world’s second overall top-producing country.

“It will also be supported by the ramp-up of recently commissioned mines and expansions as well as the planned start-up of some large projects,” the group said in a statement.

Key projects to keep an eye on in 2022 include Grasberg, Kamoa-Kakula and Quebrada Blanca Phase 2.

But a major catalyst of uncertainty for financial markets in the first quarter of the year came from the Russia/Ukraine war.

For copper, the conflict's impact is more immediate in terms of metals flows, CRU’s Edwards explained. Russia exports around 700 to 750 MT of cathodes, and it is also a significant net exporter of copper wire rod.

“Around one-third of the cathodes are sent to Europe and actually stay there, with almost half going to China ultimately,” he said.

Copper supply from Russia is dominated by three producers, namely Norilsk Nickel (MCX:GMKN), Ural Mining and Metallurgical Company and Russian Copper Company.

“The most likely outcome is Russia and Ukraine reach an uneasy truce in the months ahead,” Smith said. “Russia's economy is likely to head into a deep recession though as sanctions are likely to be in place for a long time.”

Another aspect of the supply-side narrative is what is happening with copper inventories around the world.

“There has been a seasonal build in Chinese Shanghai Futures Exchange non-bonded stocks this year, but we are already seeing holdings moving lower again, and at just above 100,000 MT, absolute levels are historically low,” Edwards commented. “The limited metal available to the market is at a level where even small changes can lead to significant movements in the copper price.”

CRU expects a copper market deficit of around 100,000 MT in 2022 before a similar-sized surplus in 2023.

Copper price update: What’s ahead?

For investors interested in copper, there are two key factors to pay attention to as the new quarter begins: lockdowns in China and the ongoing war in Ukraine.

“Both these factors are weighing heavily on copper demand and helping to keep prices in check,” Smith said.

Looking ahead, Smith said that for now he sees copper prices trending sideways at a high level. “There is potential for prices to spike higher if mine supply growth starts to falter, but treatment charges are currently trending up from a low level, which suggests that raw material supplies are more than adequate,” he said.

FocusEconomics panelists have diverging views on the price outlook for this year. The minimum forecast for Q4 2022 is US$6,513, while the maximum forecast is US$12,250.

Meanwhile, Fitch Solutions has revised its copper price forecast for 2022 from US$8,500 up to US$9,500, with prices expected to average US$7,000 long term.

“Copper is the only commodity where we increased our long-term assumptions due its use in electrification,” the firm's analysts said. “The revised short-term prices reflect very low global stocks, a balanced market and current and potential supply disruptions, particularly due to due water stress in Chile and socio-political protests in Peru.”

As a base case, ING currently expects the price to average around US$10,000 in the next quarter. "A more bullish scenario is for the price to re-test the highs seen back in early March before moderating later this year," Yao said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Commodities Outlook: Blackrock Expects Prices to Remain High for ... ›

- Copper Supply to Catch Breath in 2022 Before Heading for ... ›

- Copper Outlook 2022: Prices Likely to Remain High, Modest Surplus ... ›

- Top 5 Copper Stocks on the TSX in 2022 | INN ›

- When Will Copper Go Up? | INN ›

- Top 5 Copper Stocks on the TSX in 2022 (Updated June 2022) ›