Canadian Bioceutical Reports Q1 Fiscal 2018 Results

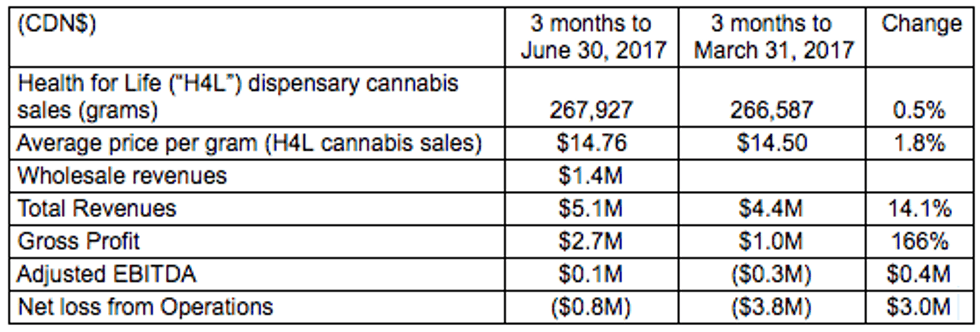

The Canadian Bioceutical Corp. (CSE:BCC) released its financial results for the first quarter of the 2018 fiscal year, which ended on June 30, 2017.

The Canadian Bioceutical Corp. (CSE:BCC) released its financial results for the first quarter of the 2018 fiscal year, which ended on June 30, 2017.

As quoted in the press release:

As the Company’s activities are nearly exclusively related to cannabis assets owned in the U.S., which were acquired in calendar 2017 only, comparison to the financial performance in calendar 2016 is relatively without meaning. Hence, the Company has chosen to present the prior quarter, Q4 F2017, as the most meaningful comparable.

Other highlights for the period are as follows:

Acquisitions

- Completed the acquisition of a 51% interest in a management company supporting a cultivation and production facility and up to three dispensaries in Massachusetts, which has voted in favour of legalizing the adult use of cannabis. In consideration of the acquisition, BCC paid US$5.1 million in cash and 2,000,000 stock options at an exercise price of CAD$0.39 per common share.

- Signed LOIs to complete the following acquisitions:

– GreenMart of Nevada, a Las Vegas-based cultivation and production wholesale operation

– A profitable fourth Arizona cultivation/production/dispensary operation

– Three licenses to develop and operate up to three dispensaries and one (of only 15 statewide) production licenses in MarylandPartnerships

- Signed a partnership with MJardin which will be providing cultivation services to certain of BCC’s operations, the first of which will be in Nevada, subsequent to completion of the acquisition.

- Signed a strategic partnership with Israeli pharmaceuticals company, Panaxia, for the formation of a Joint Venture whereby Panaxia will be providing proprietary, smokeless, pharma-grade cannabis-based products that have been proven to be in high demand, but have not been readily available in the U.S. These products will be sold through the Health for Life dispensaries, as well as wholesale to other dispensaries in the markets in which BCC is active. Revenues are to be shared on a 50/50 basis, with Panaxia taking on all CapEx and OpEx related to the building and operations of the assembly facilities within the footprint of BCC cultivation facilities. BCC will be providing the cannabis for extraction by the JV and assembly into the Panaxia products. The first production unit is scheduled to become operational in Arizona during the first quarter of 2018.

Financing

- Completed the second US$2.3M tranche of an US$11.2M private placement of common shares priced at CA$0.50 per share.

- Arranged a US$25M credit facility with Florida-based Hi-Med. To-date, no funds have been drawn down against the facility, with the maximum of US$25M remaining available to the Company to fund the execution of its growth strategy.

Scott Boyes, CEO of Canadian Bioceutical, commented:

We recorded a solid quarter with double digit sequential revenue growth, driven by strong sales of high-margin concentrates. At the same time, we continued to execute on our aggressive expansion strategy. We are developing a new dispensary in the Greater Phoenix Area, which we anticipate to be operational by late November of this year. Development of our assets in Massachusetts is progressing well, and we anticipate cultivation to commence in the second calendar quarter of 2018, with up to three dispensaries to open the following quarter. Additionally, we continue to make good progress on the other potential acquisitions, and anticipate completing several of these shortly. Once all initiatives have been developed, we aim to have a total of 10 dispensaries through four states, 9 million grams per annum in cultivation and 1.2 million grams per annum in concentrates production capacity. We believe this will generate significant additional firepower to fuel further expansion, especially in combination with our proven access to capital. Finally, our joint venture with Panaxia provides important product differentiation into the pharma-grade products segment, unlocking new avenues to pursue revenue and margin growth.

Click here to read the full Canadian Bioceutical Corp. (CSE:BCC) press release.