- WORLD EDITIONAustraliaNorth AmericaWorld

July 31, 2024

Description

Culpeo Minerals Limited (ASX:CPO) is pleased to report on its activities for the quarter ended 30 June 2024, and its Mining Exploration Entity or Oil and Gas Exploration Entity Quarterly Cash Flow Report.

Highlights from the Quarterly Activities Report

LANA CORINA PROJECT (50% CULPEO, EARNING 80%15)

• Diamond drilling at Lana Corina returned a long, high-grade intersection from near-surface of

298m of 0.98% CuEq in CMLCD0141, with drilling continuing to test the full extent of mineralisation

at depth.

• Subsequent assays, returned post quarter end from diamond hole CMLCD014 further increased the

mineralised interval to 454m @ 0.93% CuEq from 90m, with the following notable copper

equivalent results2:

• 78m @ 1.24% CuEq from 200m1

• 68m @ 1.14% CuEq from 320m1

• 40m @ 1.20% CuEq from 394m2

• Drilling is ongoing in CMLCD014, reaching a current depth of (870m), with assays outstanding for a

further 96m and results expected in the coming weeks.

• The mineralised zone encountered in CMLCD014 has expanded to a projected surface footprint of

600m x 400m and to a depth of 800m and remains open in all directions2.

• Results from reconnaissance rock-chip sampling at Vista Montana returned high-grade

mineralisation of up to 2.62% Cu, defining an area of anomalous copper 1km-long by 400m wide.3

FORTUNA PROJECT (80% CULPEO7)

• Remodeling of geophysical data identified additional targets at El Quillay West, further

enhancing the significant exploration opportunity within the 4,025-hectare Fortuna Project

area.4,5

• The El Quillay West target demonstrates potential to host additional zones of mineralisation

500m to the southwest of the main El Quillay Fault Zone.

• Reconnaissance drilling at the Vaca Muerta and El Quillay North targets intersected multiple zones

of shallow, high-grade copper mineralisation, with notable intersections that included6:

• 13.3m @ 0.59% CuEq from 20m (El Quillay North)

• 4m @ 0.65% CuEq from 45m (Vaca Muerta)

• 7m @ 0.67% CuEq from 55m, including, 1m @ 2.19% CuEq (Vaca Muerta)

• 2m @ 1.33% CuEq from 95m (Vaca Muerta)

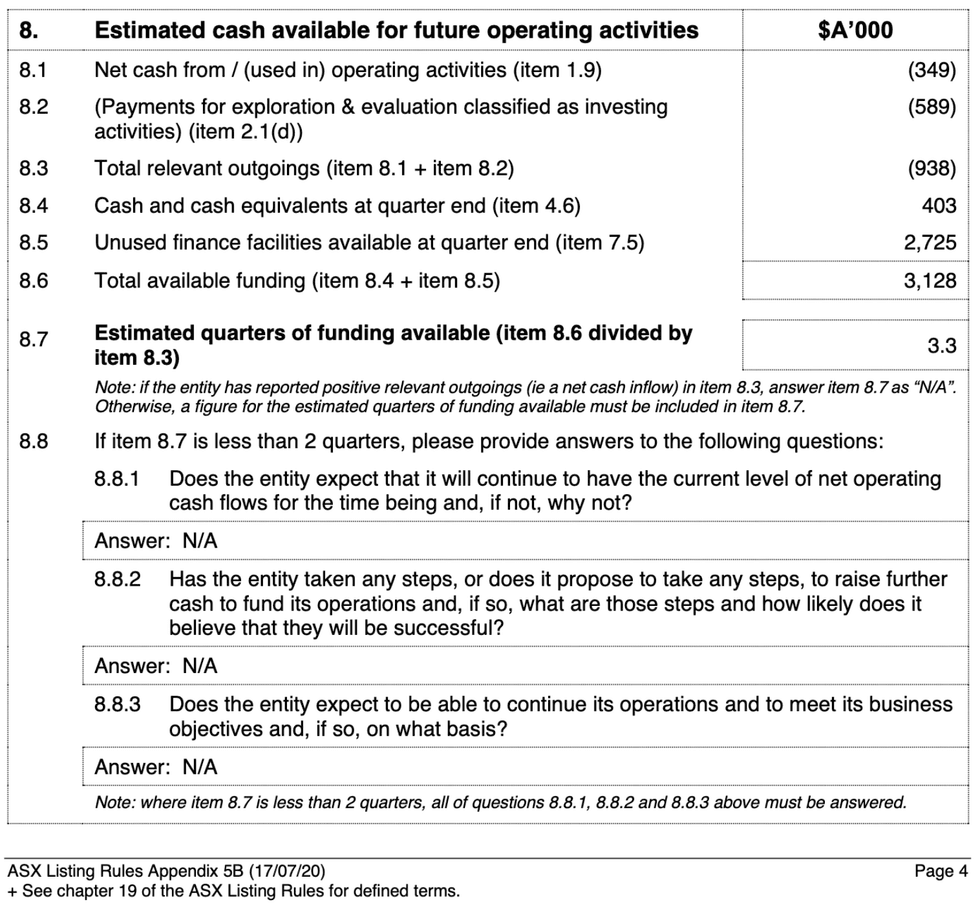

Highlights from the Quarterly Cashflow Report:

For Culpeo Minerals' new investor presentation, click here.

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

53m

Rio Tinto and Glencore Walk Away From Megamerger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination had been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00