February 02, 2025

New Murchison Gold Limited (ASX: NMG) (“NMG” or the “Company”) is pleased to announce an Ore Reserve Estimate (ORE) for the Crown Prince Deposit (Crown Prince) at the Company’s flagship Garden Gully Gold Project near Meekatharra, Western Australia.

HIGHLIGHTS

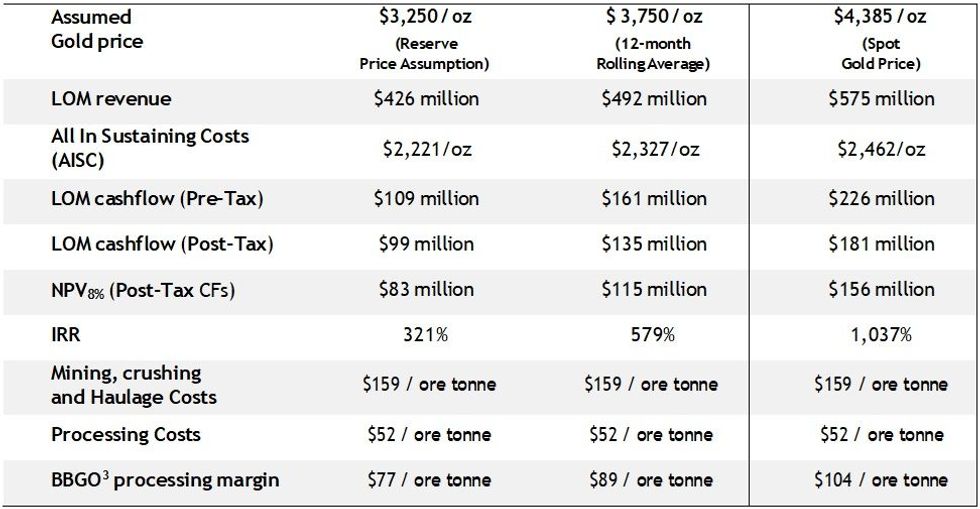

- New Murchison Gold Limited (ASX:NMG) is pleased to announce the results of a Feasibility Study into the Crown Prince Gold Deposit (Crown Prince Feasibility Study) in WA which outlines pre-tax cash flow of $226m (undiscounted) over a period of 30 months at current spot gold prices (A$4,385/oz).

- Capital expenditure required to commence production of $5.4m is very low relative to peer gold projects given the Company’s Ore Purchase Agreement (OPA) with Westgold Resources Limited (WGX or Westgold).

- NMG is also expecting to be able to utilise its substantial tax loss position (30-Sep-24: $84.4m in accumulated losses, $76.4m usable)1 to offset tax liabilities on initial pre-tax profits from Crown Prince.

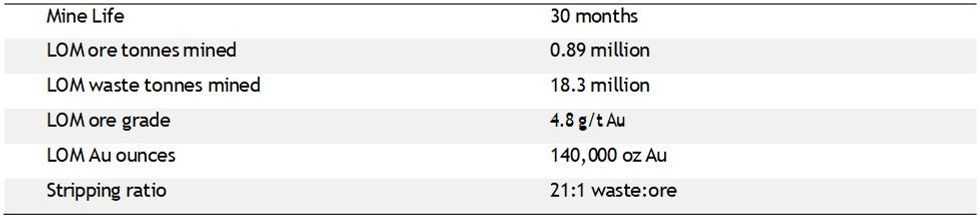

- 140koz contained ounces of gold are to be mined and trucked to WGX over 30-month open pit.

- Upside in potential underground mine below the pit, which will be studied in 2025.

- NMG’s production plan is based on Ore Reserves only. Contained ounce production profiles in the study comprise only that material delineated in Ore Reserves (estimated using a A$3,250 /oz gold price assumption) for the project.

- Commencement of mining is expected in June 2025 with first ore sales scheduled in August 2025. Mining and environmental approval documentation was submitted to relevant regulators and counterparties in late 2024.

- The Crown Prince Feasibility Study (FS) was completed in January 2025 and demonstrates sound financial returns based on:

- An updated Mineral Resource Estimate (MRE) of 2.205Mt @ 3.Gg/t for 27Gkoz2

- An Ore Reserve estimate for Crown Prince Project of 0.8G million tonnes @ 4.8g/t gold (Au) containing 140,000oz Au.

- Crown Prince ore sold at the mine gate under an Ore Purchase Agreement (OPA) for haulage to Westgold’s Bluebird Mill south of Meekatharra.

- Production from the Crown Prince Open Pit only, which is covered by the granted mining leases.

- Next steps to expand the resource base are to assess Crown Prince underground potential and other deposits including Lydia and New Murchison King. These were not considered in the FS.

- The FS Life of Mine (LOM) production schedule metrics are shown on Table 1. Financial results with sensitivity to gold price, are shown in Table 2. Summary of LOM Cash Flow is shown in Figure 1.

Click here for the full ASX Release

This article includes content from New Murchison Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NMG:AU

The Conversation (0)

02 April 2025

New Murchison Gold Limited

Advanced gold exploration company with a path to production

Advanced gold exploration company with a path to production Keep Reading...

20 June 2025

Trading Halt

New Murchison Gold Limited (NMG:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 June 2025

Further High-Grade Gold Intersections at Crown Prince

New Murchison Gold Limited (NMG:AU) has announced Further High-Grade Gold Intersections at Crown PrinceDownload the PDF here. Keep Reading...

27 May 2025

Grade Control Drilling Results

New Murchison Gold Limited (NMG:AU) has announced Grade Control Drilling ResultsDownload the PDF here. Keep Reading...

12 May 2025

High-Grade Gold Intercepts within Caprock Drilling

New Murchison Gold Limited (NMG:AU) has announced High-Grade Gold Intercepts within Caprock DrillingDownload the PDF here. Keep Reading...

30 April 2025

Second Quarter Activities and Cashflow Report

New Murchison Gold Limited (NMG:AU) has announced Second Quarter Activities and Cashflow ReportDownload the PDF here. Keep Reading...

3h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

4h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

4h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

13h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00