January 27, 2025

Adavale Resources Limited (ASX:ADD) (“Adavale” or “the Company”) is pleased to announce the successful completion of a 72.5% interest acquisition in the Parkes Gold and Copper Project (the “Project”), located in the Lachlan Fold Belt of NSW, Australia.

KEY HIGHLIGHTS

- Completion of the acquisition of a 72.5% interest in the Parkes Gold-Copper Project (“Parkes Project”).

- A 354.15km2 tenement holding, encompassing a geological setting that is considered highly prospective for structurally controlled gold and gold rich porphyry copper-gold mineralisation.

- The Parkes Project is located at the intersection of the crustal-scale Lachlan Transverse Zone structural corridor with Early Ordovician-age Macquarie Arc Volcanics.

- The Project is adjacent to the giant Northparkes porphyry-hosted copper-gold mine (5.2Moz Au & 4.4Mt Cu) [ASX:EVN] and in a similar tectono-stratigraphic setting to the world-class Cadia-Ridgeway copper-gold porphyry deposits (35Moz Au & 7.9Mt Cu) [ASX:NEM].

- The key Project asset is the former London-Victoria gold mine located in EL 7242, which contains a remnant (unmined) Historical Estimate of 124koz Au**

- EL7242 was recently successfully renewed until 7 November 2030.

- The Adavale team and the Vendor have conducted a geological reconnaissance to the Project to inspect London Victoria drill core, meet with local landholders and geological consultants and also to carry out some initial rock chip sampling.

- Completion of the placement allows Adavale to progress exploration at a number of target prospects within the Project and focus on upgrading the London-Victoria Historical Resource to a JORC compliant Mineral Resource.

- Directors and Officers co-invest ~$100,000 (over 6%) of the Placement.

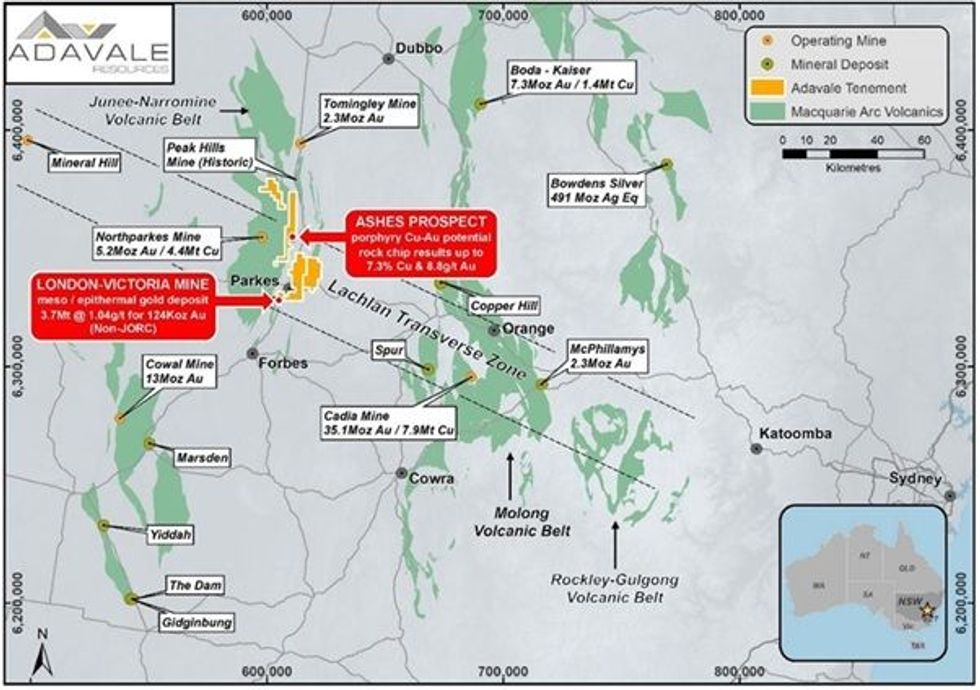

The Project comprises four exploration tenements for a total area of 354.15km2, that are prospective for orogenic, epithermal and gold-rich porphyry-style copper-gold deposits. The Project area is located within the prolific gold and copper producing Macquarie Arc portion of the Lachlan Fold Belt in central NSW. The Exploration Licences (‘EL’s’) are situated where Early Ordovician-aged Junee-Narromine Volcanic Belt rocks of the western part of the Arc are intersected by the crustal-scale structural corridor of the Lachlan Transverse Zone (‘LTZ’). Significantly, the LTZ is host to Tier 1 gold and copper mines, such as Northparkes (5.2Moz Au & 4.4Mt Cu) and Cadia Ridgeway (35.1Moz Au & 7.9Mt Cu) where it intersects Macquarie Arc rocks (Figure 1).

Commenting on the developments, Adavale Resources Executive Chairman and CEO, Mr Allan Ritchie, stated: “The successful completion of the acquisition and placement mark a pivotal step forward to advancing our activity with this world-class asset. The Vendor and the Adavale team along with our very experienced Lachlan Fold Belt geologists have just returned from an initial field trip and we are incredibly excited to start our exploration efforts at our highly prospective Parkes Project. We are very grateful to the shareholders for their continued support, Adavale’s Directors and Officers have also co-invested a further ~$100,000 (6%) in this placement and we look forward to providing regular updates from the Lachlan Fold Belt throughout the program ahead.”

The Parkes Project’s most advanced prospect is the former London-Victoria Gold Mine which saw estimated historical production by BHP Gold and Hargraves Resources of 200,000 to 250,000 ounces at a head grade of 1.5-2g/t Au. A non-JORC Historical Estimate of 3.7Mt at 1.04 g/t Au for 123.8koz Au is defined for London-Victoria (refer to Cautionary Statement1 below).

At London-Victoria, it is intended to utilise the existing drillhole database, augmented by a small number of new and well-targeted deeper holes, to estimate a Mineral Resource. This opportunity comes at relatively low cost and at a time of record gold prices. The London-Victoria Mine is located on EL7242 which has recently been successfully renewed until 7 November 2030.

The map of the Lachlan Fold Belt area in NSW (Figure 1) shows the location of Adavale’s newly acquired mineral tenure relative to significant copper and gold deposits, the Lachlan Transverse Zone and Ordovician volcanic belts of the Macquarie Arc Group. Note the Project’s proximity adjacent to the Northparkes mine at the intersection of the Lachlan Transverse Zone with the Junee-Narromine Volcanic Belt.

Click here for the full ASX Release

This article includes content from Adavale Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ADD:AU

The Conversation (0)

16 November 2025

Major Resource Growth Uncovered at London Vic

Adavale Resources (ADD:AU) has announced Major Resource Growth Uncovered at London VicDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities and Cashflow Report

Adavale Resources (ADD:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

26 October 2025

Transformational Appointment to Drive Gold & Copper Growth

Adavale Resources (ADD:AU) has announced Transformational Appointment to Drive Gold & Copper GrowthDownload the PDF here. Keep Reading...

21 October 2025

100% Native Title Consent for Marree Project Achieved

Adavale Resources (ADD:AU) has announced 100% Native Title Consent for Marree Project AchievedDownload the PDF here. Keep Reading...

24 September 2025

Wide Gold Intercepts Confirm Open Mineralisation

Adavale Resources (ADD:AU) has announced Wide Gold Intercepts Confirm Open MineralisationDownload the PDF here. Keep Reading...

14h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

16h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00