May 26, 2024

True North Copper Limited (ASX: TNC) (TNC or the Company) is pleased to provide an update in relation to its fully underwritten $24.3 million equity raising announced on 23 May 2024 (Equity Raising).

Highlights

- Successful completion of the institutional component of Accelerated Non-Renounceable Entitlement Offer (Entitlement Offer) and Placement raising an aggregate of A$16.6 million.

- Retail component of Entitlement Offer (A$7.7 million) anticipated to open on Friday, 31 May 2024.

- The Equity Raising was strongly supported by key stakeholders, including Tembo Capital Management, the Company’s largest shareholder (32%) and Nebari Natural Resources, lender to the Company.

- The fully underwritten equity raising, together with existing cash, will fund TNC through to steady state production at the Cloncurry Copper Project (including contingency, working capital, and other corporate expenses), exploration growth strategy and strengthen the Company’s financial position.

The Equity Raising is being conducted pursuant to a transaction specific prospectus, released to the ASX on 24 May 2024 (Replacement Prospectus).

TNC has now successfully closed:

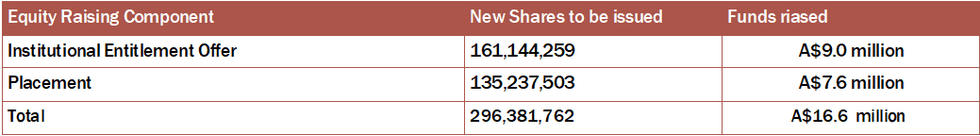

- the institutional component (Institutional Entitlement Offer) of the Entitlement Offer, raising a total of A$9.0 million (before costs) at an offer price of A$0.056 per New Share (Offer Price); and

- the placement to institutional investors (Placement), raising a further A$7.6 million (before costs).

The breakdown of funds raised (subject to settlement occurring) under these components of the Equity Raising, and the number of new fully paid ordinary shares (New Shares) to be issues, is set out below:

Settlement of the New Shares under the Institutional Entitlement Offer and the Placement is expected to occur on 30 May 2024, with the New Shares expected to be issued and commence trading on 31 May 2024.

TNC’s Executive Chairman, Ian McAleese, said: “The proceeds of the Placement and Institutional Entitlement Offer provides True North Copper with strong liquidity to begin mining at the Cloncurry Copper Project (CCP), starting at the high grade Wallace North deposit. TNC’s immediate focus is to be Australia’s next copper producer and we look forward to updating shareholders over the coming weeks.”

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00