October 21, 2021

A 100% -owned subsidiary of Lithium Australia NL (ASX: LIT, 'the Company'), VSPC is a developer of advanced battery materials, including lithium ferro phosphate ('LFP') and lithium manganese ferro phosphate ('LMFP') cathode powders. Its proprietary nanotechnology is the subject of international patents

HIGHLIGHTS

- VSPC Ltd ('VSPC'), a developer and manufacturer of advanced cathode materials for lithium-ion batteries ('LIBs'), is now also producing commercial-quality lithium titanium oxide ('LTO') anode powder.

- The performance of VSPC's LTO exceeds industry benchmarks.

- Furtherresearchanddevelopment, including niobium-based anode powders, is also underway at VSPC.

VSPC's LTO

In addition to producing advanced LFP and LFMP cathode powders, VSPC's pilot plant has now manufactured high-quality LTO, an anode material required for high- performance LIB cells.

Conventionally, LTO is prepared via a solid-state reaction, with titanium dioxide (rutile or anatase) and lithium carbonate or lithium hydroxide as the raw materials. The materials are calcined at temperatures above 800° Celsius for a prolonged period (from 12 to 24 hours) to ensure high-phase purity.

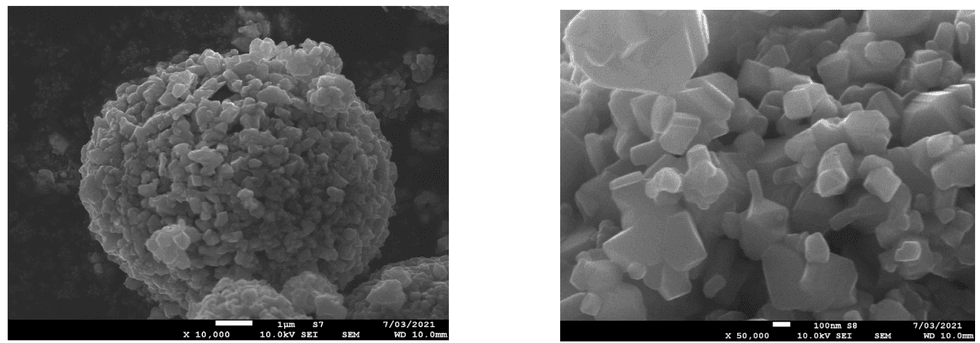

Because VSPC's patented, slurry-based process reduces calcination time and ensures consistent phase- and end-product quality, it is ideal for producing LTO. Figures 1(a) & 1(b) below show VSPC's LTO powder at two different magnifications.

Read the full article here.

LIT:AU

The Conversation (0)

17 September 2025

Livium Expands Clean Energy Waste Recycling Capabilities

Livium (LIT:AU) has announced Livium Expands Clean Energy Waste Recycling CapabilitiesDownload the PDF here. Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00