April 27, 2021

Galena Mining Ltd. (“Galena” or the “Company”) (ASX:G1A) announces achievement of the key objectives from the 2020 Abra Drilling Program and has subsequently completed an updated JORC Code 2012 Mineral Resource estimate (“April 2021 Resource”) for the Abra Base Metals Project (“Abra” or the “Project”) located in the Gascoyne region of Western Australia. The April 2021 Resource has been independently prepared by Optiro Pty Ltd (“Optiro”).

Managing Director, Alex Molyneux commented, “The objectives associated with the 2020 Abra Drilling Program were successfully completed. The Project now has over 100 kilometres of drilling in its database, and the geological confidence and understanding of the deposit continues to improve. Almost all of the new holes were drilled within the previous Mineral Resource envelope and over 75% of those holes achieved expected or better results. This Mineral Resource update will now feed into an optimised mine plan, and mine development will allow for underground drilling to continue Resource development, particularly the conversion of significant Inferred Mineral Resources associated with the Core Zone

mineralisation, which remains open in several directions and also hosts the interpreted copper-gold zone.”

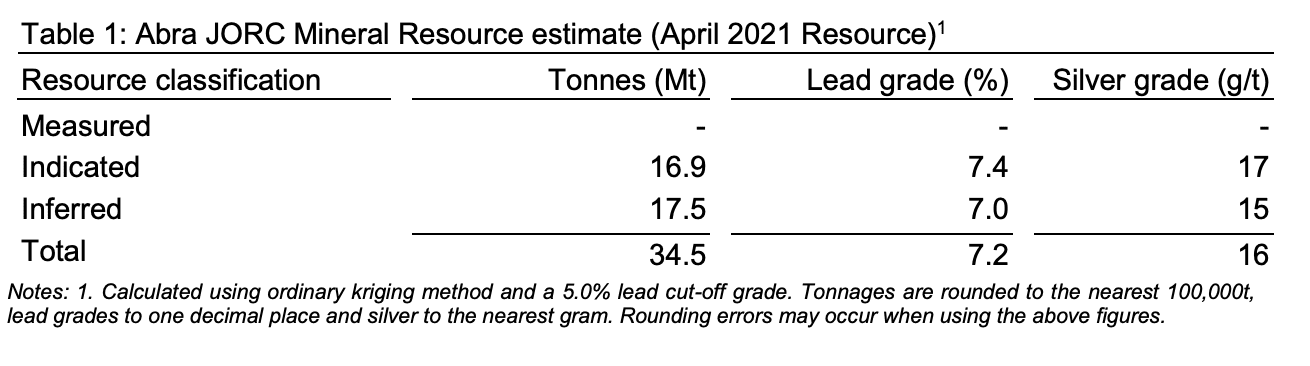

Table 1 (below) states the Abra April 2021 Resource at a 5.0% lead cut-off grade.

2020 ABRA DRILLING PROGRAM AND OBJECTIVES

The completed 2020 Abra Drilling program included 57 drill-holes totalling 24,834 cumulative linear meters and was designed to achieve three specific objectives. These objectives were mainly focussed on the original Mineral Resource estimate and potential grade and continuity risk

of certain areas within that estimate, and they were:

(i) Lead-silver orebody infill drilling – Some infill drilling that had previously been planned to take place from underground once the decline was in place was pulled forward into the 2020 Abra Drilling Program. This aimed to further tighten the drill-hole spacing over the first four years of proposed production to 20 by 20 metres and up to 30 by 30 metres or better, compared with a more variable drilling density of up to 40 by 40 metres and up to 60 by 60 metres in that area previously.

(ii) Drilling into selected lead-silver ‘metal rich’ zones – Some drill-holes successfully targeted selected areas within the Abra lead-silver mineralisation where higher concentrations of metal (in both grade and thickness) were projected from previous drilling campaigns, in particular drill-hole AB147, which became the best high-grade lead-silver drill-hole ever at Abra, and the follow-up drill-holes that were added to the program in its vicinity (see Galena ASX announcements of 19 October 2020, 18 November 2020, 22 January 2021 and 24 February 2021).

(iii) Gold-copper exploration – Some of the drilling, in particular drill-hole AB195 (see Galena ASX announcement of 22 February 2021) successfully targeted the newly interpreted gold and copper drilling targets to the south and south east of the leadsilver mineralisation and at depth (see Galena ASX announcement of 29 June 2020).

The first two of these objectives enable the Company to optimise mine planning, which is now underway.

MINERAL RESOURCES

Geological model

Abra is located in the Gascoyne region of Western Australia within clastic and carbonate sediments of the Proterozoic Edmund Group. Abra is a base metals replacement-style deposit, where the primary economic metal is lead. Silver, copper, zinc and gold are also present within

the established lead mineralised zones but are of lower tenor.

Abra can be divided into two main parts, the upper “Apron Zone” and lower “Core Zone”.

The Apron Zone comprises stratiform massive and disseminated lead sulphide (galena), with minor copper sulphide (chalcopyrite) and zinc sulphide (sphalerite) mineralisation within the lower conglomerate unit (KCLC) of the Edmund Basin Kiangi Creek Formation and the Upper

Carbonate Unit (UID) of the Irregully Formation. The Apron Zone is characterised by flat-lying alteration zones containing jaspilite (Red Zone), barite (Barite Zone), silica-sericite (Micrite Zone), siderite and dolomite (Carbonate Zone), and haematite and magnetite (Black Zone). Distinct stratiform alteration domains can be defined within the Apron Zone and have assisted in the definition of the distribution of the lead mineralisation and construction of the lead mineralisation lodes. The Apron Zone extends for over 1,200 metres along strike and 750 metres down dip, dipping gently south.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

14 January

Lead Price Forecast: Top Trends for Lead in 2026

Lead prices were volatile in 2025 amid investor uncertainty and factors like tariff threats. The base metal is primarily consumed by lead-acid batteries, but is also used to produce radiation shielding, weights and, in the defense sector, ammunition. More recently it's seen increased demand from... Keep Reading...

09 January 2025

Lead Price Forecast: Top Trends for Lead in 2025

The lead price was volatile in 2024 as global economic uncertainty continued to affect metals markets.As an industrial metal, lead has traditionally been used in lead-acid batteries, and to a lesser extent in pigments, weights, cable sheathing and ammunition. More recently, the electric vehicle... Keep Reading...

07 June 2023

Top 7 Lead-producing Countries

The lead price surged past the US$2,500 per metric ton (MT) level in early 2022, and the rest of last year saw periods of volatility. Rising energy costs for smelting and China's COVID-19 recovery are key factors to watch in 2023.Most lead is used to make lead-acid batteries, primarily to power... Keep Reading...

28 January 2019

Vendetta Releases PEA for Pegmont Lead-Zinc Project

Vendetta Mining (TSXV:VTT) has released a preliminary economic assessment (PEA) for its Pegmont lead-zinc project in Queensland, setting its lifespan at 10 years. The PEA also lays out the project’s financials, including an after-tax net present value of $124 million and an internal rate of... Keep Reading...

31 December 2018

Lead Outlook 2019: Mines Back Online as Prices Dither

In 2018, lead took on much of the same calamity that its fellow base metals endured in the face of dismal investor sentiment caused by the US-China trade war. From a starting value of US$2,543 a tonne on January 1 to prices below US$2,000 towards the end of the year, lead lost 22.3 percent of... Keep Reading...

26 September 2018

Benz Announces Proposed Acquisition of Fox Automotive Switzerland AG

Benz Mining Corp. (TSXV:BZ) (FSE:1VU) (OTCQB:BENZF) (the “Company” or “Benz”) is pleased to announce that it has entered into an arms-length binding letter of intent (the “Letter of Intent”) dated September 26, 2018, with Fox Automotive Switzerland AG (“Fox”), a privately held company existing... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00