May 07, 2024

Honeymoon is exceeding key feasibility study estimates; First uranium sales set for July

Boss Energy Limited (ASX: BOE; OTCQX: BQSSF) is pleased to advise that the commissioning process at its Honeymoon uranium project is proceeding to plan, with key metrics exceeding feasibility study forecasts.

Highlights

- Commissioning process advancing well, with key metrics ahead of feasibility study (FS) estimates, including:

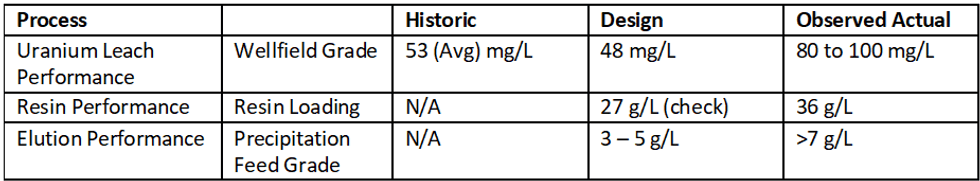

- Wellfields averaging 80 - 100mg/L vs FS estimate of 47mg/L (~100% uplift)

- Ion Exchange loaded resin recoverability is virtually 100%

- Resin loading averaging 36g/L vs FS estimate of 27 g/L (~33% uplift)

- Elution performance > 7g/L vs a targeted range of 3 – 5 g/L

- First uranium sale is expected to occur in July with cash to be received in Q3 2024

- Boss remains highly leveraged to rising uranium price, with sales contracts covering just 1.8Mlbs over eight years

This outperformance is reflected in results of the uranium-rich Pregnant Leach Solution (PLS) from the wellfields, IX column resin loading and high grade IX column eluate.

The focus is now on optimisation of the ion exchange, elution and precipitation processes to achieve continuous operations.

Production update

Tenors from the individual wellfields into the PLS are averaging 80 - 100 mg/L. Honeymoon’s feasibility study assumed PLS grade of 47 mg/L based on results from the project’s previous operation.

The lixiviant chemistry, as proved during the field leach trial, is now demonstrating superior performance at commercial throughput rates. The increased leach efficiency leads to a more efficient loading on the ion exchange resin, effectively lowering operating costs as less reagents and power are required per drum of uranium.

A critical factor in resin performance is the actual loading of uranium from the PLS onto the ion exchange resin. Demonstrated loading rates of up to 36g/L are 33% higher than feasibility estimates. This means Honeymoon’s ion exchange circuit is currently making more uranium per cycle than designed. The cost of processing a cycle of ion exchange resin is fixed, which means that higher resin loading will drive a more efficient use of reagents.

Stripping of uranium from the loaded resin is virtually 100%, also demonstrating that the ion exchange process is working as designed, resulting in a high grade concentrated eluate greater than 7g/L.

First Sale of Product

Boss has sought from the outset to align its production strategy and timetable with the global uranium market, maximising its ability to capitalise on favourable supply and demand fundamentals.

As at 31 March 2024, Boss had ~$300m in liquid assets, no debt and diversity of supply with no jurisdictional risk. This strong balance sheet has provided Boss with flexibility to choose when it enters into contracts and to select pricing mechanisms which maximise our exposure to market upside while limiting risk in softer market conditions.

To date, Boss has entered into two binding sales agreement to sell 1.8Mlbs U308 to major European / US power utilities over eight years from 2024 to 2032. The Company intends to enter into further as the uranium price rises.

Boss’s contracting strategy is to monitor the markets and layer in contracts, predominantly market related, to optimise future pricing and, in the near term, to ensure profitability and cash flow as production ramps up. First delivery into these contracts is planned to occur in July 2024 with payment expected in that quarter.

Boss Managing Director Duncan Craib said: “We are very pleased with the commissioning progress to date. We are meeting or exceeding key feasibility study forecasts and the processing technology is performing as our extensive testwork showed it would.

“These early production results provide confidence that we are on-track to meet our ramp up targets. Ramp-up timing has been designed to align with a rising uranium market. We believe we will be hitting our straps as the uranium price rises in the near term”.

Click here for the full ASX Release

This article includes content from Boss Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

11h

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00