November 28, 2023

Belararox Ltd (ASX:BRX) (Belararox or the Company), an advanced mineral explorer focused on high-value clean energy metals is pleased to announce it has commenced a field program to infill lithium soil anomalies at the Company’s 100%-owned Bullabulling Lithium/Gold project.

KEY HIGHLIGHTS

- Infill soil sampling has commenced on Belararox 100% owned Bullabulling Lithium and Gold project located west of Coolgardie in Western Australia.

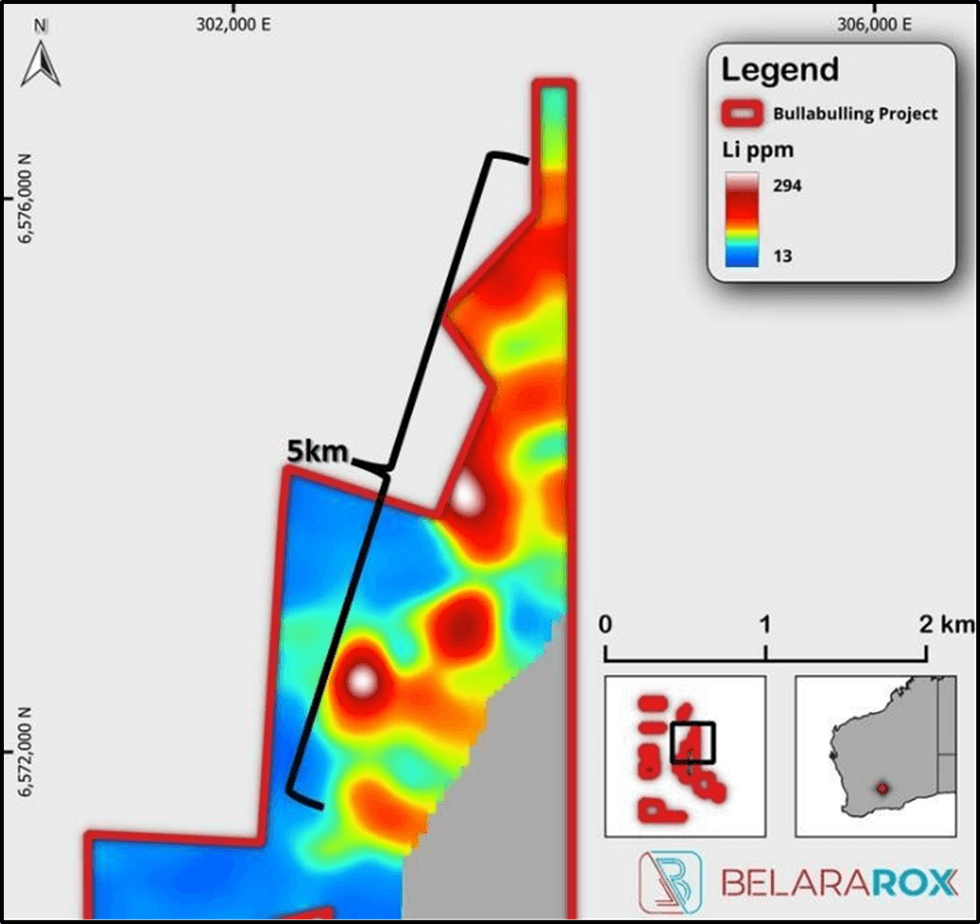

- Preliminary geological interpretation has identified a 5 km strike length of highly anomalous lithium including results up to 324 ppm lithium (697 ppm Li2O).

- Infill soil program has been planned across six lithium anomalies and several gold anomalies with field crews currently sampling.

Belararox’ Managing Director, Arvind Misra, commented: “I am thrilled to announce our infill soils field program will be completed by the end of this week. This initiative will offer critical insights that will inform our lithium drilling program, which our exploration team is diligently progressing. The promising initial results along a 5 km zone, coupled with the current strong interest in lithium projects in Western Australia, further bolster my optimism about our endeavours.”

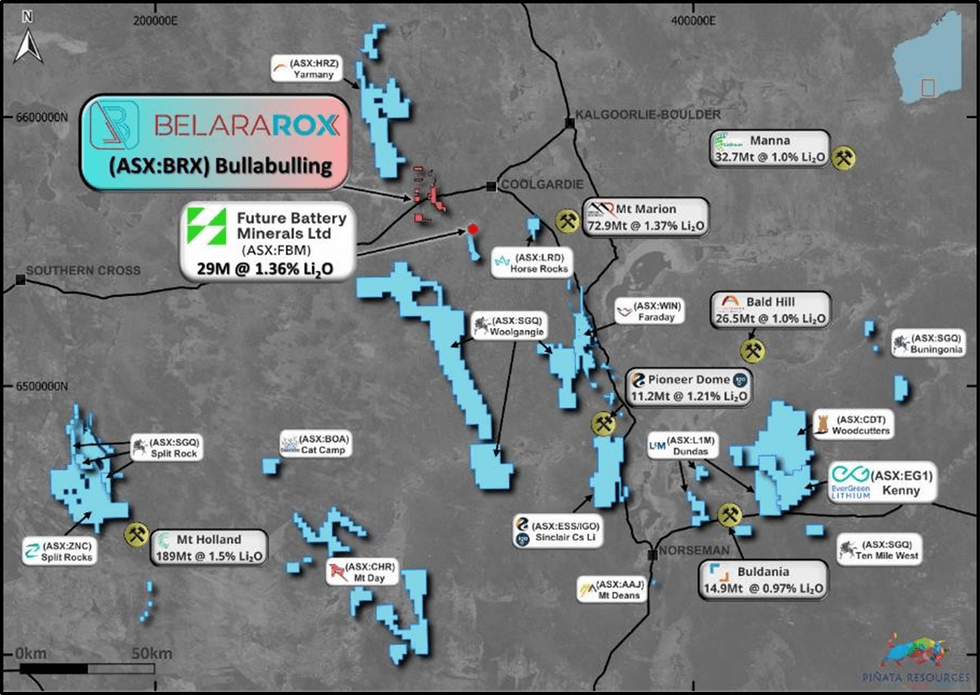

Belararox holds the Bullabulling Project which is comprised of 26 wholly owned tenements covering an area of approx. 50 km2 to the west of Coolgardie in the Eastern Goldfields of Western Australia. Significant lithium resources and projects in the surrounding area are displayed in Figure 2.

NEARBY EXPLORATION SUCCESS

11.5km to the east of Belararox’s eastern tenement boundary, Future Battery Minerals (ASX:FBM) announced it had intercepted 29m @ 1.36% Li₂O from 38m downhole in a 14-hole Phase 1 reverse circulation (RC) drilling program at its Kangaroo Hill Lithium Project (20 April 2023, FBM ASX announcement ‘Exploration Update Kangaroo Hills Lithium Project’).

These results, from fractionated pegmatites, are located in close proximity to the Belararox tenements and within a similar geological setting. They are considered analogous to the pegmatites identified across the Bullbulling Project, where elevated lithium values have been identified.

Click here for the full ASX Release

This article includes content from Belararox Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRX:AU

The Conversation (0)

14 September 2023

Belararox Limited

Developing Precious and Base Metal Assets to Meet Future Demand

Developing Precious and Base Metal Assets to Meet Future Demand Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00