December 01, 2023

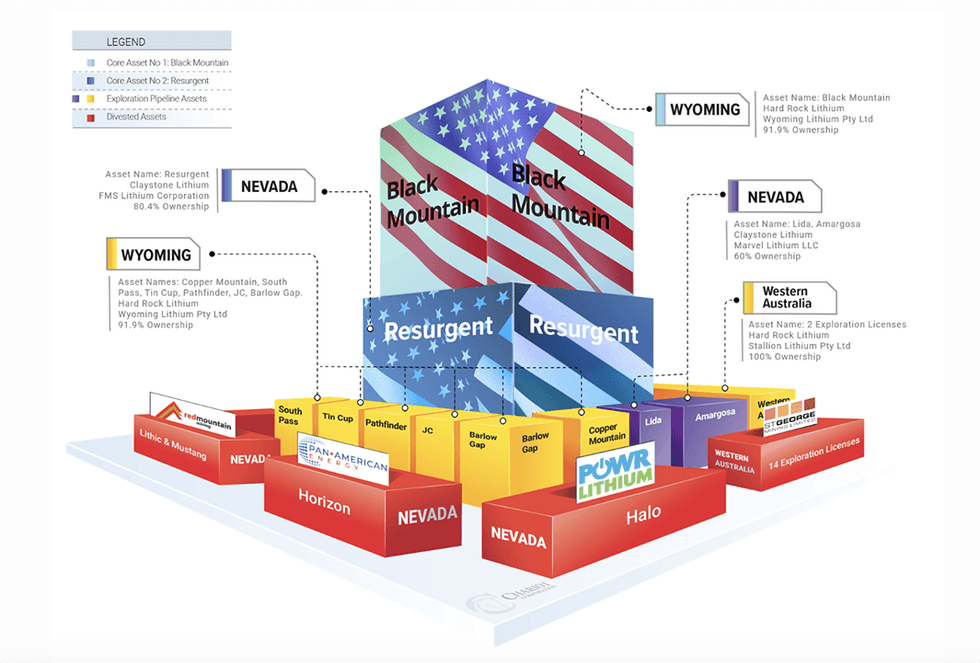

Chariot Corporation (ASX:CC9) targets both hard rock lithium in Wyoming and claystone lithium in Nevada and Oregon. Its Black Mountain Project in Wyoming has shown significant mineralization with grades of up to 6.68 percent Li2O from rock chip samples. The company holds six other hard rock projects in Wyoming with 443 claims covering 3,585 hectares.

Chariot’s Resurgent project holds the second largest land position in the McDermitt Caldera, which hosts the two largest lithium resources discovered to date (Thacker Pass 19.1 million tons (Mt) lithium carbonate equivalent (LCE) and McDermitt 21.5 Mt LCE). The recent $650-million investment in Thacker Pass by General Motors indicates interest from automakers looking to secure a supply of battery raw materials. The McDermitt Caldera’s size and scale potential present an opportunity for Automotive OEMs, battery manufacturers and others to obtain large-scale supply to meet their growth plans.

Chariot has been actively focusing on creating value through the divestment of selected lithium assets. Four assets have been divested through sale and/or option agreements with publicly listed companies. These transactions, assuming the existing options are exercised, may generate up to an estimated US$5.1 million in cash and stock-based consideration, in addition to future royalty payments for Chariot. The company currently has four additional projects that may be potential divestment opportunities, including Lida and Amargosa (Nevada), Mardabilla (Western Australia) and Nyamukono (Zimbabwe).

The company believes its two core projects, Black Mountain and Resurgent, represent early, prospective lithium opportunities in the United States.

Company Highlights

- Chariot Corporation Limited is a mineral exploration company focused on discovering and developing high-grade and near-surface lithium opportunities in the U.S.

- Chariot holds the largest land position for lithium exploration in the U.S. with hard rock lithium and claystone hosted lithium exploration assets.

- The company commenced trading on the ASX in October 2023 after closing a highly sought-after and oversubscribed A$9 million initial public offering (which is in addition to A$14.8 million being raised privately to assemble the portfolio).

- It is currently focused on its two core projects in the US: (1) the Black Mountain Project, a hard rock lithium project located in Wyoming; and (2) the Resurgent Project, a claystone lithium project located in Oregon and Nevada.

- The Black Mountain Project has had two-rounds of rock chip sampling which resulted in 22 rock chip samples collected with 10 of these samples returning assay results greater than 2.00% lithium oxide (Li2O) with the highest value being 6.68% Li2O. The Resurgent Project has had multiple rounds of rock-chip sampling with 289 samples being collected and returning values as high as 3,865 ppm lithium. The initial surface rock-chip sampling programs demonstrate the presence of lithium mineralization at surface.

- In addition to the core projects, Chariot holds an exploration pipeline of six projects in Wyoming including Copper Mountain, South Pass, Tin Cup, Barlow Gap, Pathfinder and JC projects. These projects are prospective for hard rock lithium.

- The company’s portfolio includes several additional projects prospective for hard rock (Western Australia and Zimbabwe) and claystone lithium (Nevada, U.S.A.).

- Chariot also holds interests in several projects that have been either sold or conditionally divested through option agreements to publicly listed companies. These include assets such as Halo, Horizon, Lithic & Mustang, and the Western Australia Lithium portfolio. Each of the divested projects are operated by a publicly listed counterparty and depending upon the particular transaction, the projects generate additional revenue for Chariot in the form of future payments and royalties.

- Chariot offers investors exposure to the nascent and rapidly growing U.S. lithium market.

This Chariot Corporation profile is part of a paid investor education campaign.*

Click here to connect with Chariot Corporation (ASX:CC9) to receive an Investor Presentation

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00