February 28, 2024

Carbonxt Group Ltd (ASX:CG1) (“Carbonxt” or “the Company”) has released its Half-year report for the half-year ending 31 December 2023 and provides the following update on the key areas of activity for the period -- all numbers are in A$.

OPERATIONS OVERVIEW

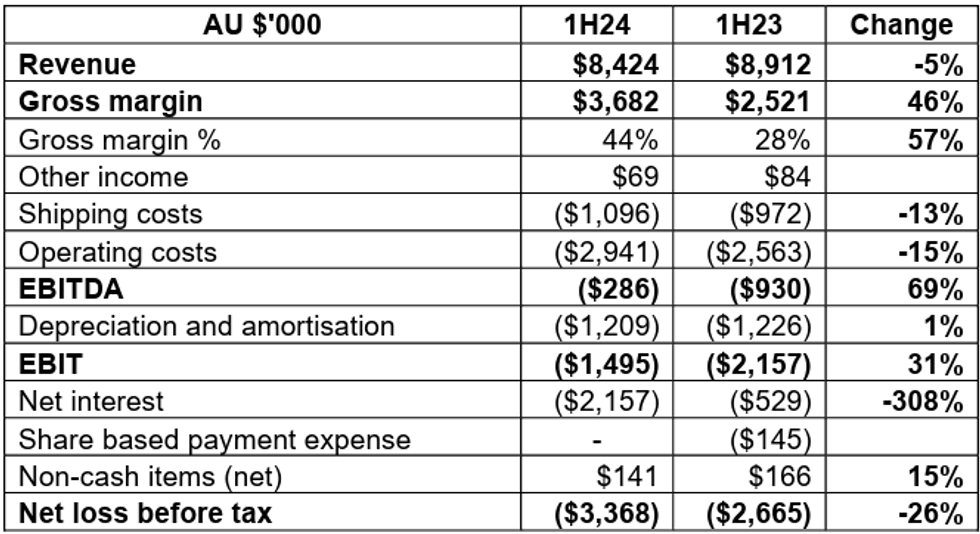

- Half year revenue of $8.4 million, down 5% on HY23, primarily due to a once-off impact on sales to the group’s largest pellet customer following outages at that customer’s facility.

- Operations during the half-year highlighted by great progress on the construction of the Company’s flagship Activated Carbon production facility in Kentucky, jointly owned with Kentucky Carbon Processing, LLC (“KCP”). Commissioning of the facility is now underway with a significant production ramp-up to occur next quarter.

- Pellet sales accounted for 54% of revenue and 37% of sales volume. Carbonxt continues to see strong demand for industrial pellets which is very encouraging given the near-term entry into production at the Kentucky facility.

- Powdered activated carbon (PAC) accounted for 46% of revenue and 63% of sales volume – PAC revenue increased by 31% from HY23.

- HY24 gross margin of 44%, up from 28% in HY23 principally due to positive flow-on effects from the successful rollout of operating cost reduction initiatives, as well as a reduction in manufacturing shifts at Arden Hills. The production performance of the Company’s other major ACP customer continues to decrease and is at a record low manufacturing cost.

- Underlying EBITDA for HY23 was a loss of $286K, compared to HY23 EBITDA loss of $930K, an improvement of 69%.

FINANCIAL OVERVIEW [All results in AUD]

REVENUE

- Total revenue was down 5% from HY23, driven primarily by downtime at our largest customer who had significant equipment issues at their facility in the December quarter.

- Pellet revenue was down 24% from HY23 reflecting the aforementioned reduction in demand from our largest pellet customer.

- PAC revenue was up 31% from HY23 reflecting the impact of material price increases across the customer portfolio and the increase in volume from one existing customer of approximately $1.5 million per annum.

MARGIN

- 1H23 gross margin was 44%, an increase from the 28% recorded in 1H23, reflecting the improvements made to operating costs over the past year.

- As noted earlier, continuous improvement is evident at Arden Hills based on lower fixed plant costs on a per unit basis.

- Several initiatives are also underway at Black Birch to further lower operating costs, including changes to the underlying lease structure. Negotiations on this matter will continue over the next quarter but are expected to lead to noticeable ongoing improvements in profitability.

OPERATING COSTS

- Shipping costs to customers increased in 1H24 to 13% of sales, compared to 1H23 at 11% of sales. The higher shipping costs reflect a customer mix change (lower sales to a major pellet customer who is located close to our Arden Hills plant).

- Operating costs of $2.9m were up 15% on 1H23 primarily reflecting additional one-off expenditure associated with entering into the Kentucky investment.

KENTUCKY PLANT

- During this period, construction has been underway for the new activated carbon plant in eastern Kentucky, USA. The plant will have an initial capacity of 10,000 tons per annum, with the ability to expand to 20,000 tons per annum for a small additional investment.

- Carbonxt has contributed USD $5.5 million to NewCarbon Processing, LLC (“NewCarbon”), alongside its US partner KCP. Carbonxt holds a 35.5% ownership interest in NewCarbon as of 31 December 2023, with options to invest a further USD $4.5m to move to 50% ownership interest.

- Construction progress has been pleasing with the plant now moving into the testing of front- end equipment and processes. The final electrical activities are expected to be undertaken in March with the delivery of the control systems, prior to the commencement of production.

- Near-term sales efforts are well underway with a very positive reception being received by our former industrial pellet customers. The next step for nearly all prospective customers is to provide pellet samples from the facility. This is expected to continue over the next few months.

- The JV project provides Carbonxt with a unique opportunity to benefit from major investments in pollution reduction technologies across the US market.

Click here for the full ASX Release

This article includes content from Carbonxt Group, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CG1:AU

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

24 July 2025

Carbonxt Group

Purpose-built advanced carbon for healthier communities

Purpose-built advanced carbon for healthier communities Keep Reading...

30 January

Q2 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q2 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

04 January

Placement to Fund Further Investment in New Carbon

Carbonxt Group (CG1:AU) has announced Placement to Fund Further Investment in New CarbonDownload the PDF here. Keep Reading...

28 October 2025

Q1 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q1 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

16 October 2025

Convertible Note and Placement

Carbonxt Group (CG1:AU) has announced Convertible Note and PlacementDownload the PDF here. Keep Reading...

15 September 2025

Completion of Non-Renounceable Pro-Rata Entitlement Offer

Carbonxt Group (CG1:AU) has announced Completion of Non-Renounceable Pro-Rata Entitlement OfferDownload the PDF here. Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

RZOLV Technologies Inc. (TSXV: RZL) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development ("ERD") to... Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development... Keep Reading...

22 January

CHARBONE Announces Hydrogen Sales in Ontario to Support Fuel Cell Generator Operations for the Film Industry

(TheNewswire) Brossard, Quebec, January 22, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

22 January

CHARBONE annonce des ventes d'hydrogene en Ontario afin d'alimenter des generatrices a pile a combustible pour l'industrie du cinema

(TheNewswire) Brossard, Quebec, le 22 janvier 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

15 January

S&P Global: Fragmented Climate and Energy Strategies to Define 2026

Global sustainability strategies are entering a more politically complex phase in 2026 as governments and companies balance immediate economic pressures against long-term climate risks. In a report published on Wednesday (January 14), S&P Global says that sustainability decision making in 2026... Keep Reading...

14 January

CHARBONE Secures its First Order for Clean UHP Hydrogen from a US Customer in NY State

(TheNewswire) Brossard, Quebec, January 14, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

Latest News

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00