Capitan intersects and expands high-grade silver mineralization at Cruz de Plata

Capitan Silver Corp. (TSXV: CAPT,OTC:CAPTF) ("Capitan" or "the Company") is pleased to report assay results from its recently expanded and fully funded Phase One reverse circulation ("RC") 15,000-metre drill program at its Cruz de Plata silver-gold project, located in Durango, Mexico. The Company is reporting assay results from six (6) drillholes.

Highlights:

- Further high-grade mineralization intersected by follow-up drilling near drillhole 25-ERRC-12 confirms the emergence of a new large, high-grade silver zone at Jesus Maria

- Drillhole 25-ERRC-26

- Upper zone: intersected 612.9 g/t AgEq over 1.5m, within a broader zone of 155.9 g/t AgEq over 6.1m

- Lower zone: intersected 1,767.4 g/t AgEq over 1.5m, within a broader zone of 1,222.1 g/t AgEq over 3m, which is part of a wider interval of 234.2 g/t AgEq over 25.9m

- Drillhole 25-ERRC-26 also returned a long continuous zone of mineralization with grades above 25 g/t AgEq for over 87m down-hole

- Drillhole 25-ERRC-21

- Upper zone: intersected 710.5 g/t AgEq over 1.5m and 353.2 g/t AgEq over 1.5m, within a wider interval of 292.4 g/t AgEq over 6.1m

- Lower zone: intersected 260 g/t AgEq over 1.5m, within a broader interval of 74.9 g/t AgEq over 35.1m

- Drillholes 25-ERRC-26 and 25-ERRC-21 add to previously reported high-grade silver mineralization intersected in drillhole 25-ERRC-12 (2,636 g/t Ag over 1.5m, within a wider interval of 370.2 g/t Ag over 19.8m, see Capitan news release dated September 2, 2025), suggesting an emerging high-grade zone of silver mineralization

- Drillhole 25-ERRC-26

- Broad new mineralized zone identified at the Peñoles Fault: Drillhole 25-ERRC-26 also intersected a wide zone of high-grade, Gully Fault-style, silver-gold mineralization, suggesting the presence of an additional structure cross-cutting the Jesus Maria vein

- Drilling confirms that mineralized intrusive dykes (cross-cutting mineralized structures) are becoming an important target across the property and could be important structures for transporting mineralization

- Peñoles Fault has been traced for approximately 500m on strike through mapping, with follow-up drilling planned to test the target

- Drillhole 25-ERRC-25 intersected 1.5m of 687.4 g/t AgEq, within a wider interval of 6.1m of 250.3 g/t AgEq at the Jesus Maria vein

- All drillholes reported in this news release extended silver mineralization in existing zones and identified new targets for follow-up drilling. Total drilled continuity on the western side of Jesus Maria trend is 1.7km

- Drilling update: Drilling is ongoing at Cruz de Plata, with the Company nearing completion of 10,000m of an upsized 15,000m drilling program. As of this news release, the Company will have released assay results for approximately 30% of the 2025 drilling campaign

- Catalyst-rich Q4 2025 and Q1 2026:

- Assay results pending for 25 drillholes

- Updated Mineral Resource estimate on Capitan Hill

- Property-wide geophysical survey initiated

Alberto Orozco, CEO of Capitan Silver, commented:

"Capitan's Phase One drill program at Cruz de Plata continues to find more mineralization at the Property — both in terms of high-grade intercepts but also through identifying new mineralized zones and structures.

Follow-up drilling on the eastern part of the Jesus Maria vein near drillhole 25-ERRC-12 was highly successful in confirming that drillhole 25-ERRC-12 (the highest-grade result to date for the 2025 drilling campaign) is not an anomaly and is part of a much larger high-grade target. Drillhole 25-ERRC-26, in addition to extending the Jesus Maria trend along strike, at depth, and down-dip, discovered a new broad zone of mineralization that shares many characteristics with Gully Fault-style silver and gold mineralization, compared to the Jesus Maria vein-style mineralization.

This discovery of another broad, mineralized cross-cutting structure is significant as we are seeing these structures as important conduits for carrying mineralized fluid across the property. We have identified several of these mineralized intrusive dykes as important targets for follow-up drilling. Additionally, this further reinforces the size and scale Cruz de Plata as a rich, robust mineralized system."

Discussion of drill results

Drilling continues to steadily progress at the Cruz de Plata silver-gold project, with a total of 57 drillholes completed to date across the Jesus Maria trend, Gully Fault, as well as new, early-stage targets throughout the Property.

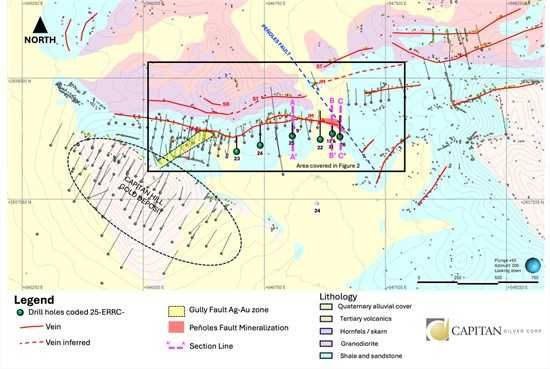

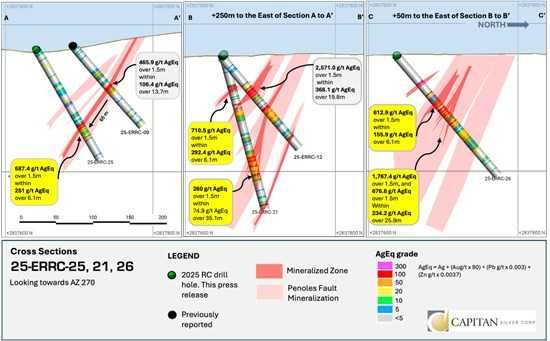

Drillhole 25-ERRC-21 and 25-ERRC-26 were drilled in proximity to previously announced drillhole 25-ERRC-12, with drillhole 25-ERRC-26 being a 50-metre step out to the east and 25-ERRC-21 testing the down-dip area to the south (See Figure 1). Both drillholes returned high-grade intercepts, with drillhole 25-ERRC-26 intersecting 1,767.4 g/t AgEq over 1.5m contained within 1,222.1 g/t AgEq over 3.0m, which is within a broader zone of 25.9m of 234.2 g/t AgEq. Drillhole 25-ERRC-26 also intersected a broad, 87m wide zone of continuous mineralization from 68.58m to 155.45m, containing intervals of 25 g/t AgEq and higher (See Figure 2 and Table 1). Drillhole 25-ERRC-26 also intersected an additional high-grade zone closer to surface containing 612.9 g/t AgEq over 1.5m, within a broader interval of 155.9 g/t AgEq over 7.6m. The mineralization in this hole was dominantly silver with gold and minor amounts of base metals. This, together with the broad mineralized zone, bears the same defining characteristics of mineralization at the Gully Fault Zone.

While more drilling will be required to define this new zone, broad intervals of mineralization in other surrounding holes from the current drill program also support the presence of a new zone with this same style of mineralization. Drillhole 25-ERRC-21 also intersected multiple zones of mineralization, with the highlight being a shallow zone of 710.5 g/t AgEq over 1.5m and 353.2 g/t AgEq, both within a broader intercept of 292.4 g/t AgEq over 6.1m, with values of only silver and gold with low base metal values. 25-ERRC-21 also hit 260 g/t AgEq over 1.5m and 242.8 g/t AgEq over 1.5m within a broader zone of 74.9 g/t AgEq over 35.1m, with this hit being more consistent with the Jesus Maria vein style of mineralization (See Figures 1 and 2).

Drillholes 25-ERRC-23, 25-ERRC-24, 25-ERRC-25, and 25-ERRC-22 were drilled as follow-ups of drillholes 25-ERRC-03, 25-ERRC-06, 25-ERRC-09 and 25-ERRC-01, respectively; testing on a 60m down-dip extension to those drillholes, with the exception of drillhole 25-ERRC-23, which was drilled at an 80m down-dip step out from drillhole 25-ERRC-03. All drillholes intersected the Jesus Maria vein as expected, with results shown in Table 1. From this set of drillholes, drillhole 25-ERRC-25 produced the best intercept with a high-grade interval of 687.4 g/t AgEq over 1.5m, within a wider interval of 250.3 g/t AgEq over 6.1m (See Figure 2 and Table 1).

All drill results in this news releases extended mineralization

- Drillhole 25-ERRC-26 extended mineralization approximately 50m to the east of drillhole 25-ERRC-12;

- Drillhole 25-ERRC-21 extended mineralization in the upper zone by 30m down-dip while the lower zone extended mineralization approximately 70m down-dip from drillhole 25-ERRC-12;

- Drillhole 25-ERRC-22 extended the mineralized zone approximately 60m down-dip from drillhole 25-ERRC-01;

- Drillhole 25-ERRC-23 extended the mineralized zone approximately 75m down-dip from drillhole 25-ERRC-03;

- Drillhole 25-ERRC-24 extended the mineralized zone approximately 55m down-dip from drillhole 25-ERRC-06; and

- Drillhole 25-ERRC-25 extended the mineralized zone approximately 65m down-dip from drillhole 25-ERRC-09

Figure 1. Drill Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7373/273964_3548711eb4b19927_002full.jpg

Figure 2. Cross sections of drillholes 25-ERRC-25, 21 and 26

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7373/273964_3548711eb4b19927_003full.jpg

Table 1. Drill results

| Hole ID | From (m) | To (m) | Interval (m) | Ag Eq Rec (g/t) | Ag (ppm) | Au (ppm) | Pb (%) | Zn (%) |

| 25-ERRC-21 | ||||||||

| Interval | 39.6 | 45.7 | 6.1 | 292.4 | 276.4 | 0.772 | 0.010 | 0.018 |

| Including | 41.1 | 42.7 | 1.5 | 353.2 | 299.0 | 1.037 | 0.014 | 0.017 |

| Including | 44.2 | 45.7 | 1.5 | 710.5 | 644.0 | 1.508 | 0.023 | 0.021 |

| Interval | 56.4 | 57.9 | 1.5 | 29.6 | 27.8 | 0.041 | 0.002 | 0.019 |

| Interval | 65.5 | 68.6 | 3.0 | 74.7 | 60.4 | 0.251 | 0.003 | 0.018 |

| Interval | 74.7 | 82.3 | 7.6 | 45.0 | 30.4 | 0.217 | 0.004 | 0.042 |

| Interval | 111.3 | 115.8 | 4.6 | 30.2 | 25.3 | 0.082 | 0.006 | 0.019 |

| Interval | 135.6 | 170.7 | 35.1 | 74.9 | 57.2 | 0.049 | 0.188 | 0.367 |

| including | 144.8 | 146.3 | 1.5 | 260.0 | 249.0 | 0.129 | 0.159 | 0.369 |

| Interval | 205.7 | 207.3 | 1.5 | 242.8 | 244.0 | 0.109 | 0.073 | 0.115 |

| 25-ERRC-22 | ||||||||

| Interval | 36.6 | 38.1 | 1.5 | 54.4 | 44.7 | 0.171 | 0.009 | 0.010 |

| Interval | 54.9 | 56.4 | 1.5 | 63.5 | 57.7 | 0.124 | 0.014 | 0.010 |

| Interval | 96.0 | 97.5 | 1.5 | 351.1 | 251.0 | 0.035 | 1.180 | 2.340 |

| Interval | 131.1 | 143.3 | 12.2 | 53.1 | 44.5 | 0.105 | 0.056 | 0.072 |

| Interval | 193.5 | 195.1 | 1.5 | 27.7 | 18.8 | 0.016 | 0.075 | 0.201 |

| Interval | 202.7 | 204.2 | 1.5 | 31.7 | 25.9 | 0.075 | 0.039 | 0.032 |

| Interval | 262.1 | 263.7 | 1.5 | 25.7 | 21.2 | 0.036 | 0.016 | 0.084 |

| 25-ERRC-23 | ||||||||

| Interval | 9.1 | 10.7 | 1.5 | 56.4 | 47.3 | 0.160 | 0.012 | 0.016 |

| Interval | 62.5 | 64.0 | 1.5 | 87.0 | 50.1 | 0.564 | 0.015 | 0.019 |

| Interval | 68.6 | 70.1 | 1.5 | 59.0 | 52.9 | 0.111 | 0.022 | 0.029 |

| Interval | 121.9 | 125.0 | 3.0 | 49.5 | 35.0 | 0.033 | 0.117 | 0.325 |

| Interval | 132.6 | 134.1 | 1.5 | 250.5 | 252.0 | 0.041 | 0.109 | 0.226 |

| Interval | 146.3 | 150.9 | 4.6 | 117.7 | 72.2 | 0.087 | 0.409 | 0.950 |

| 25-ERRC-24 | ||||||||

| Interval | 21.3 | 22.9 | 1.5 | 56.7 | 28.9 | 0.406 | 0.002 | 0.045 |

| Interval | 64.0 | 65.5 | 1.5 | 27.4 | 10.9 | 0.237 | 0.003 | 0.021 |

| Interval | 71.6 | 73.2 | 1.5 | 28.0 | 24.8 | 0.030 | 0.013 | 0.068 |

| Interval | 140.2 | 141.7 | 1.5 | 30.2 | 13.9 | 0.051 | 0.122 | 0.300 |

| 25-ERRC-25 | ||||||||

| Interval | 10.7 | 12.2 | 1.5 | 25.5 | 20.7 | 0.083 | 0.002 | 0.009 |

| Interval | 24.4 | 25.9 | 1.5 | 45.9 | 22.9 | 0.344 | 0.004 | 0.016 |

| Interval | 57.9 | 59.4 | 1.5 | 27.3 | 25.9 | 0.034 | 0.008 | 0.012 |

| Interval | 79.2 | 80.8 | 1.5 | 31.9 | 30.9 | 0.037 | 0.000 | 0.009 |

| Interval | 115.8 | 121.9 | 6.1 | 250.3 | 202.1 | 0.144 | 0.454 | 1.134 |

| including | 117.3 | 118.9 | 1.5 | 687.4 | 596.0 | 0.155 | 1.120 | 2.500 |

| Interval | 137.2 | 138.7 | 1.5 | 36.9 | 8.3 | 0.070 | 0.106 | 0.628 |

| 25-ERRC-26 | ||||||||

| Interval | 48.8 | 50.3 | 1.5 | 324.0 | 316.0 | 0.366 | 0.011 | 0.043 |

| Interval | 68.6 | 76.2 | 7.6 | 155.9 | 150.7 | 0.198 | 0.003 | 0.017 |

| including | 74.7 | 76.2 | 1.5 | 612.9 | 616.0 | 0.482 | 0.005 | 0.016 |

| Interval | 83.8 | 109.7 | 25.9 | 234.2 | 231.9 | 0.214 | 0.012 | 0.035 |

| including | 83.8 | 86.9 | 3.0 | 1222.1 | 1205 | 1.25 | 0.04 | 0.07 |

| including | 83.8 | 85.3 | 1.5 | 676.8 | 650.0 | 0.926 | 0.023 | 0.042 |

| including | 85.3 | 86.9 | 1.5 | 1,767.4 | 1,760.0 | 1.569 | 0.066 | 0.093 |

| including | 96.0 | 97.5 | 1.5 | 355.2 | 369.0 | 0.075 | 0.024 | 0.073 |

| Interval | 115.8 | 126.5 | 10.7 | 50.9 | 43.0 | 0.129 | 0.010 | 0.036 |

| Interval | 137.2 | 146.3 | 9.1 | 39.4 | 35.5 | 0.067 | 0.015 | 0.031 |

| Interval | 150.9 | 152.4 | 1.5 | 53.8 | 55.1 | 0.016 | 0.014 | 0.015 |

| Interval | 166.1 | 167.6 | 1.5 | 33.0 | 23.6 | 0.136 | 0.012 | 0.035 |

| Interval | 172.2 | 173.7 | 1.5 | 44.4 | 36.2 | 0.023 | 0.040 | 0.226 |

| Interval | 184.4 | 185.9 | 1.5 | 63.9 | 63.4 | 0.042 | 0.019 | 0.027 |

Metal Recovery: Ag 94%, Au 86%, Pb 93.5%, Zn 92%

AgEq considers Ag, Au, Pb and Zn and calculated as follows: AgEq = Ag g/t + (80x Au g/t) + (0.003 x Pb g/t) + (0.0037 x Zn g/t). High grades have not been capped. Capitan Silver field samples are sent to the Bureau Veritas Lab in Durango, Mexico for prep. RC Drill samples have been analysed using the following codes: MA300, 4-acid digestion, multi-element analysis (Vancouver Lab). Au is analyzed using Fire Assay (FA430, Durango Lab). Overlimit (>200 ppm Ag) assays utilize method MA370, with gravimetric utilized for any overlimit thereafter. QAQC: Capitan Silver maintains a rigorous QAQC program and inserts multiple standards, blanks and duplicates into the sample stream at regular intervals. Check Assays are performed at SGS laboratories in Durango, Mexico.

Qualified Person

The scientific and technical data contained in this news release pertaining to the Cruz de Plata project was reviewed and approved by Marc Idziszek, P.Geo, a non-independent qualified person to Capitan Silver, who is responsible for ensuring that the technical information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Capitan Silver Corp.

Capitan Silver is defining a new high-grade silver system at its Cruz de Plata project, located in the heart of Mexico's primary silver belt. The Company is led by a proven and accomplished management team that has previously advanced three projects into production, on time and on budget. The Company has been diligent in maintaining a tight share structure and has one of the tightest share structures among its peer group, with the top three shareholders owning over 38% of the Company's share capital. Capitan Silver is fully funded and actively drilling at its Cruz de Plata silver project.

ON BEHALF OF Capitan Silver Corp.

"Alberto Orozco"

Alberto Orozco, CEO

For Additional Information Contact:

| Alberto Orozco, CEO Capitan Silver Corp. info@capitansilver.com | Greg DiTomaso, Investor Relations Capitan Silver Corp. info@capitansilver.com Phone: (416) 433-2801 www.capitansilver.com |

DISCLAIMER FOR FORWARD-LOOKING INFORMATION

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., "expect", "estimates", "intends", "anticipates", "believes", "plans"). Such information involves known and unknown risks -- including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Capitan in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273964