September 12, 2022

Canadian Copper Inc. ("Canadian Copper" or the "Company") (CSE: CCI) is pleased to announce positive exploration results from its next thirteen holes at Chester Copper Project ("Chester") located in the Bathurst Mining Camp, New Brunswick, Canada.

"We are pleased with the results of Phase Two drilling at the Chester Central and East Zones. These two areas previously did not contribute to the historical Mineral Resource Estimate ("MRE") at Chester. The Phase Two program has established Central and East zone grade and spatial continuity, and as a result, these resources will be incorporated into the updated MRE. The Chester historic geologic model continues to deliver within expectations." Simon Quick, CEO of Canadian Copper.

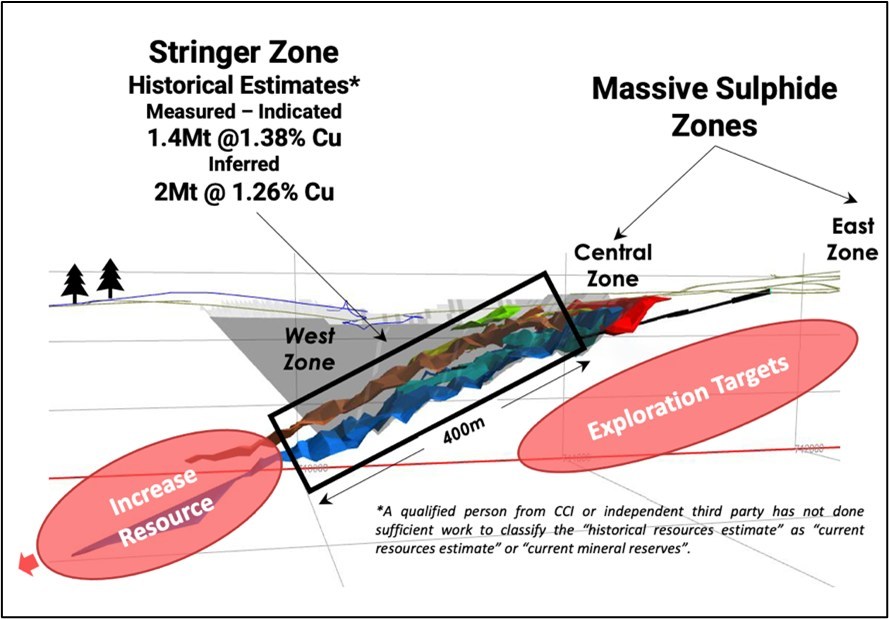

Figure 3: Chester Deposit Cross Section (CNW Group/Canadian Copper Inc.)

Highlights of Phase Two Program:

- Hole C21-14: 1.44 % copper over 11.25 meters in a continuous mineralized envelope grading 0.69% copper over 25.7 meters.

- Hole C21-15: 2.48% over 2 meters in a continuous mineralized envelope grading 0.92% copper from 13 meters.

- Precious metals: All holes within the massive sulphide zones intersected anomalous gold and silver mineralization. (See Table 1 for drilling results).

Similar to the first phase of drilling at Chester (https://canadiancopper.com/¬¬canadian-copper-begins-active-trading-and-provides-company-update/), the program successfully met the designed objectives of:

- Validate historical resource and geologic model for the three primary zones, Central, East, and West Zone (Copper Stringer), which are all located near surface.

- Outline additional resources in existing gaps between the Central and East Zone.

- Further explore for the presence of gold and silver mineralization near surface within the gossanous Central and East zones.

Each of the above stated objectives were met by the Phase Two program. All thirteen drill holes intersected the near-surface target massive sulphide mineralization validating the historical geologic model. Also, portions of the Chester historical resource estimate consisting of dated drilling (pre-1960's) may now be included into the upcoming MRE because of new data collected. Additionally, the continuous presence of silver and gold across the resource is a positive development, bringing potential additional value to the ore body.

About the Chester Copper Project

The Chester copper deposit ("Chester") is a volcanogenic massive sulphide ("VMS") resource containing three (3) zones; the Central Zone (massive Sulphide), the East Zone (massive sulphide), and the West Zone (Copper Stringer), which are all located near surface as shown in Figure 3. Previous mining development in 1974 included a 470-meter decline targeting the West Zone and produced 30,000 tonnes of bulk samples grading +2.0% copper (Geoscience Canada, McCutcheon, 2020). No other development has occurred on the property.

Table A: Chester Historical Mineral Estimate (Sim, 2014)*

* NI 43-101 Technical Report entitled "Technical Report - Chester Copper Property New Brunswick Canada" (effective March 07, 2014) prepared by Robert C. Sim, P. Geo., for Explor Resources and filed on www.sedar.com (Sim, 2014).

Canadian Copper is not treating the "historical resources estimate" as a "current resources estimate" or "mineral reserves", as it has not taken steps to identify what work needs to be done to verify, upgrade or re-classify the "historical resources estimate" using a qualified person from Puma or independent third party.

About the Bathurst Mining Camp

The Company is focused on the prolific Bathurst Mining Camp of New Brunswick, Canada. This region is a world class mining district with thirteen former mining operations and hosts more than forty-five known volcanogenic massive sulphide ("VMS") deposits. Our flagship Chester Project is 75 km south of the renowned Brunswick #12 mine that operated for 5 decades. New Brunswick has the modern infrastructure needed for mineral exploration and mine development coupled with a clear and well-established regulatory environment.

Qualified Persons

Dominique Gagné, PGeo, is a qualified person as defined by Canadian National Instrument 43-101 standards who is working for Geominex Inc., an independent contractor of the Company. Mr. Gagne has reviewed and approved the geological information reported in this news release.

Quality Assurance/Quality Control (QA/QC)

Phase 1 drilling samples were bagged, sealed by Geominex and sent to the facility of ALS CHEMEX in Moncton, New Brunswick where each sample is dried, crushed, and pulped. The samples were crushed to 70% less than 2mm, riffle split off 1kg, pulverise split to better than 85% passing 75 microns (Prep-31B). A 30-gram subsplit from the resulting pulp was then subjected to a fire assay (Au-ICP21). Rock sample ICP results with gold >1g/t were subjected to a metallic screening (Au-SCR24) 1kg pulp screened to 100 microns.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada.

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This news release includes certain forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future exploration programs, anticipated content, and commencement in respect of the Company's projects and mineral properties, anticipated exploration program results from exploration activities, resources and/or reserves on the Company's projects and mineral properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "will", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, including the Company's option to acquire properties under the Puma Option Agreement, the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the CSE), permits or financing, changes in laws, regulations and policies affecting mining operations, the Company's limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading "Risk Factors" in the Company's prospectus dated May 24th, 2022 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com. Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this presentation or incorporated by reference herein, except as otherwise required by law.

Table 1: Phase 2 Chester Project Drilling Results

Table 2. Phase 2 Chester Project Drill Locations

The Conversation (0)

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00