February 09, 2023

Lithium Energy Limited (ASX:LEL) (Lithium Energy or the Company) is pleased to confirm that further assay results received from Reverse Circulation (RC) holes drilled in the recently completed drilling programme1 continue to confirm the 100% owned Burke Graphite Project located in Queensland, Australia (Burke Project) as one of the highest grade graphite deposits globally.

KEY HIGHLIGHTS

1. Assays from 6 further RC drill holes continue to show significant intercepts of exceptionally high grade graphite content over 20% TGC and over thick widths in multiple drill holes at Burke Graphite Project.

- Multiple new high-grade intercepts of graphite include:

- BGRC022: 102m @ 13.3% TGC from 22m, including 20m @ 23.1% TGC from 103m

- BGRC024: 88m @ 18.0% TGC from 15m, including 68m @ 20.1% TGC from 32m

- BGRC023: 68m @ 18.4% TGC from 20m, including 47m @ 20.6 % TGC from 36m

- BGRC026: 61m @16.2% TGC from 3m, including 36m @ 20.0% TGC from 28m

- BGRC025: 61m @ 14.3% TGC from 10m, including 11m @ 20.3% TGC from 57m

- BGRC027: 36m @ 13.3% TGC from 1m and 7m @ 21.6% TGC from 41m

2. Assay results from the balance of (16) RC holes and the 7 diamond core holes are pending.

3. Drilling results to be used to upgrade current JORC Inferred Mineral Resource of 6.3Mt @ 16% TGC.

Further to the excellent assay results previously reported for the first 7 RC holes2 , assay results from a further 6 RC holes continues to show multiple outstanding (composite) intercepts of graphite in excess of 20% Total Graphitic Carbon (TGC) (refer Tables 1 and 3).

The grades from the Burke Deposit are exceptionally high when compared with most other known graphite deposits globally. Assays remain pending for the remaining 16 RC holes and the 7 diamond core holes.

The recently completed drilling programme at the Burke Tenement comprised:

- 2,589 metres drilled across 29 RC holes (Hole ID’s BGRC010 to BGRC038); and

- 715 metres drilled across 7 diamond core holes (Hole ID’s BGDD02 to BGDD08).

Initial assay results from 7 RC drill holes (BGRC015 to BGRC021) were announced on 3 February 2023.2

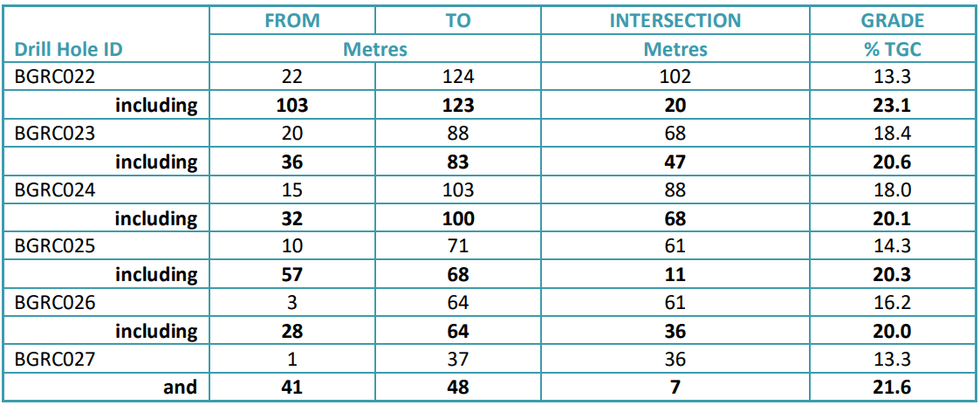

Assay results from a further 6 RC drill holes (BGRC022 to BGRC027) continues to confirm the high-grade nature of the Burke Deposit, with composited graphite intersections encountered reported in Table 1:

Table 1 - Significant Intersections Encountered – RC Drilling – Holes BGRC022 to BGRC027

Notes:

- Intersections reported only if greater than 2 metres width and at a cut-off of 6% or higher TGC

- Intersections with greater than 20% TGC are considered to be highly significant and are highlighted in bold in the table.

The complete assay results (for %TC and %TGC) for RC Holes BGRC022 to BGRC027 are reported in Table 3. Details of the collar location, inclination, azimuth and depth for RC Holes BGRC022 to BGRC027 are reported in Table 2.

The balance of the assay results for both RC and diamond holes are pending and will be released when received (expected through the course of February and March 2023).

Figure 1 shows the location of RC Holes BGRC010 to BGRC038 and the location of the cross-section line (78311020mN) (shown in Figure 2) on the south-east corner of the Burke Tenement (with the results of the previous Electro Magnetic (EM) surveys3 also shown). The location of the RC holes (BGRC015 to BGRC021) where assay results have been announced, together with their cross-section lines (7831170mN and 7831125mN lines) are also shown in Figure 1.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00