April 28, 2024

Key activities for Brightstar Resources Limited (Brightstar or the Company) (ASX: BTR) during the March Quarter are outlined below.

Highlights:

- Brightstar makes recommended takeover offer for Linden Gold Alliance Limited

- Successful completion of A$12 million share placement

- A highly positive Scoping Study was released for the Jasper Hills Gold Project (owned by Linden Gold) with compelling operational and financial outputs1,4:

- An initial mine production target of 142koz @ 1.84g/t Au over a four-year life of mine

- Pre-Tax NPV8 of approximately A$99 million and IRR of 736% (@ A$3,000/oz gold price)

- Payback of 9 months on all pre-production capital costs of $12 million

- Selkirk mining joint venture and gold pours successfully completed, with finalised net cashflow generated to Brightstar of $6,500,000 to be received this quarter

- Cork Tree Well diamond drilling results returns spectacular intercepts including:

- 27.6m @ 17.8 g/t Au (CTWMET003)

- 34.4m @ 7.94g/t Au (CTWMET004)

- High grade RC drilling intercepts were received from Menzies Gold Project at the Aspacia & Link Zone deposits

Brightstar to acquire Linden Gold Alliance Limited, $12 million share placement and Board Change1,2,3

- Brightstar Resources Limited to acquire Linden Gold Alliance Limited (Linden) via unanimously recommended off-market scrip takeover offer (Offer)

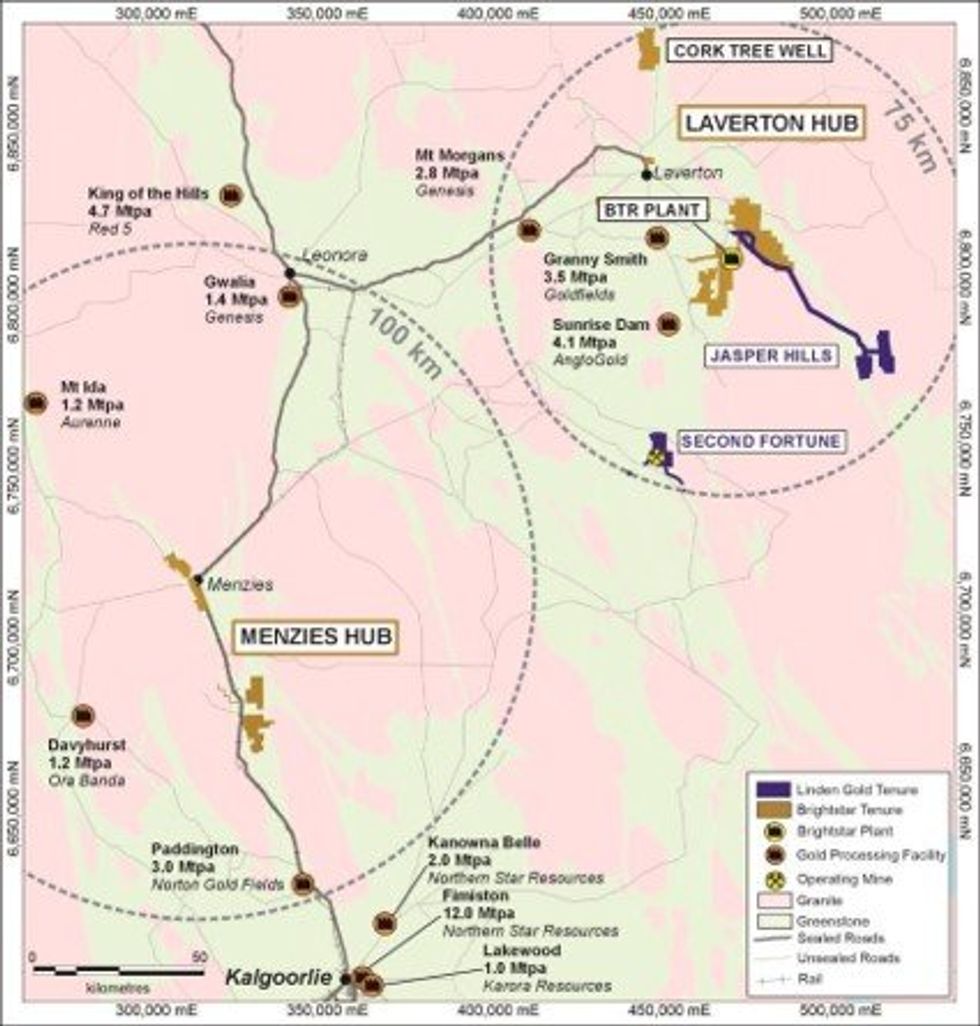

- Linden is a gold producer, developer and explorer with existing mineral resources of 350koz @ 2.1g/t Au near Brightstar’s existing processing infrastructure (on care & maintenance) in the Laverton district (Figure 1)

- Under the Offer, Linden securityholders are to receive 6.9 Brightstar shares for every 1 Linden share held and 6.9 Brightstar options for every 1 Linden option held, equating to an implied Offer price of 11.04 cents per share

- The Offer implies an undiluted equity value for Linden of approximately $23.7 million

- Linden’s Directors unanimously recommend Linden shareholders accept the Offer, in the absence of a superior proposal

- Linden Directors representing 13.2% and Linden’s major shareholders, including St Barbara Limited (St Barbara), representing approximately 67.3% of shareholders, have signed pre-bid agreements with Brightstar or have signed intention statements to accept the Offer in respect of all current Linden shares and Linden options they own and control, in each case in the absence of a superior proposal

- The Offer is subject to conditions including a minimum 90% acceptance condition by the Linden shareholders and Linden optionholders

- As part of the Offer, Brightstar announced the successful receipt of firm commitments for a capital raising of A$12.0 million at A$0.014 per share via a two-tranche placement (Placement)

- The Placement received strong cornerstone support from Brightstar and Linden’s major shareholders Collins Street Asset Management and St Barbara for a total $4.3 million

- Mining investment house Lion Selection Group (ASX:LSX) committed to $2 million in the Placement to become a Brightstar shareholder

- Linden Directors Andrew Rich and Ashley Fraser to be appointed as Executive Director and Non- Executive Director respectively of Brightstar at successful completion of the Offer

- Highly regarded natural resources industry professional Richard Crookes will join the Board of Directors as Independent Non-Executive Chairman subject to the successful completion of the Offer.

- The combination of Linden and Brightstar will create a gold producer and developer with a material resource base that supports the Company’s strategy of becoming a mid-tier gold producer

Compelling Scoping Study for Jasper Hills Gold Project4

The Jasper Hills Gold Project (Jasper Hills) is wholly owned by Linden, which is the subject of a Board- recommended off-market takeover offer by Brightstar. Jasper Hills is located 50km SE of Brightstar’s processing infrastructure, and will, subject to final feasibility studies, permitting and approvals and final investment decision, support Brightstar’s ambition of becoming a meaningful WA gold producer.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

23h

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

28 January

Trading Halt

Brightstar Resources (BTR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

6h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

23h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00