Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the " Company " or " Brixton ") is pleased to announce additional drill results from the Trapper Gold Target this season. Drilling at the Trapper Target has been completed for the season. A total of 6272m was drilled at the Trapper Target from 30 holes. Assays are pending for the remaining 18 holes with visible gold having been identified in several of these remaining holes. The zone remains open for expansion.

Highlights

- Drilling was successful extending mineralization by 36m to the south-southwest from previous drilling where it remains open

- Hole THN25-337 returned 6.40m of 4.61 g/t gold from 27.10m depth

- Including 1.50m of 14.30 g/t gold

- Including 1.50m of 14.30 g/t gold

- Hole THN25-339 returned 15.00m of 2.26 g/t gold from 16.00m depth

- Including 3.00m of 4.68 g/t gold from 22.00m depth

- Including 3.00m of 4.68 g/t gold from 22.00m depth

Chairman, CEO, Gary R. Thompson stated, " Mineralization at Trapper is structurally controlled and was subjected to post mineral displacement. Further drilling is required to expand on these faulted and dislocated blocks. Gold mineralization remains open to the northeast, southeast and north of the main area. Further structural interpretation is planned prior to the next drill campaign. "

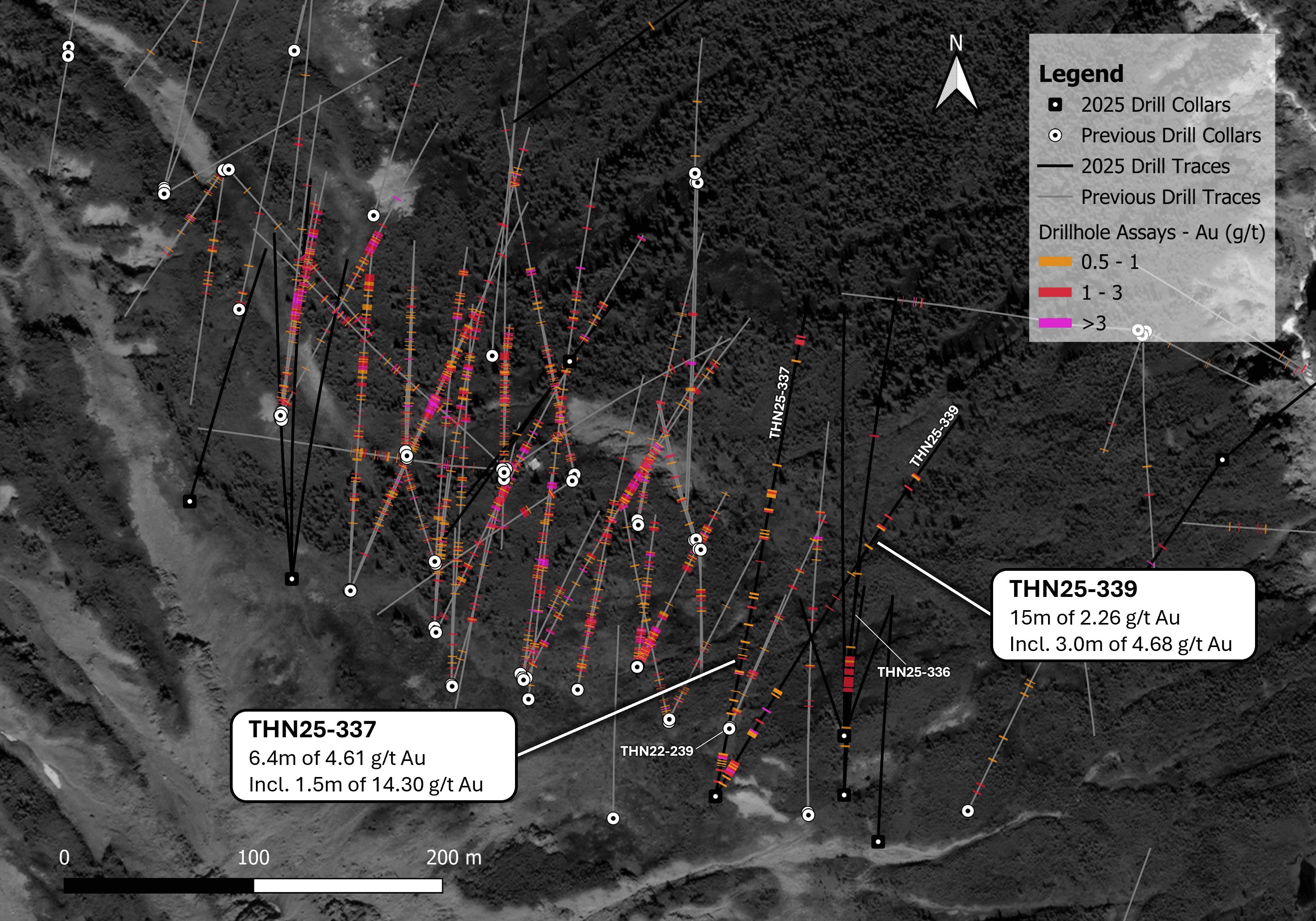

Figure 1. Trapper Gold Target Plan Map for Holes THN25-336/337/339.

Table 1. Select Assay Intervals in Holes THN25-337 and THN25-339.

| Hole ID | From | To | Interval | Gold |

| meter | meter | meter | g/t | |

| THN25-337 | 27.10 | 33.50 | 6.40 | 4.61 |

| including | 29.00 | 30.50 | 1.50 | 14.30 |

| THN25-337 | 95.00 | 99.00 | 4.00 | 1.44 |

| including | 95.50 | 96.00 | 0.50 | 5.48 |

| THN25-337 | 146.50 | 148.00 | 1.50 | 3.03 |

| THN25-339 | 16.00 | 31.00 | 15.00 | 2.26 |

| including | 22.00 | 25.00 | 3.00 | 4.68 |

| THN25-339 | 53.50 | 58.50 | 5.00 | 2.60 |

| including | 57.00 | 58.50 | 1.50 | 6.70 |

| THN25-339 | 66.00 | 67.50 | 1.50 | 3.50 |

| THN25-339 | 76.00 | 77.50 | 1.50 | 7.06 |

| THN25-339 | 242.50 | 244.00 | 1.50 | 2.61 |

| THN25-339 | 278.50 | 280.00 | 1.50 | 2.62 |

| THN25-339 | 288.05 | 291.00 | 2.95 | 1.83 |

Assay values are weighted averages. Reported intervals are drilling length and the true width of the mineralized intervals has not yet been determined.

Discussion

The objective of holes THN25-337 and THN25-339 was to expand and infill the southern limit of mineralization from previous drilling. Both holes were drilled from the same drill pad with an azimuth of 10 degrees and 30 degrees with dips of -45 and -40 degrees to depths of 389m and 346m, respectively. Collars for THN25-337 and THN25-339 were located 36m south-southwest from the collar for hole THN22-239 (Figure 1).

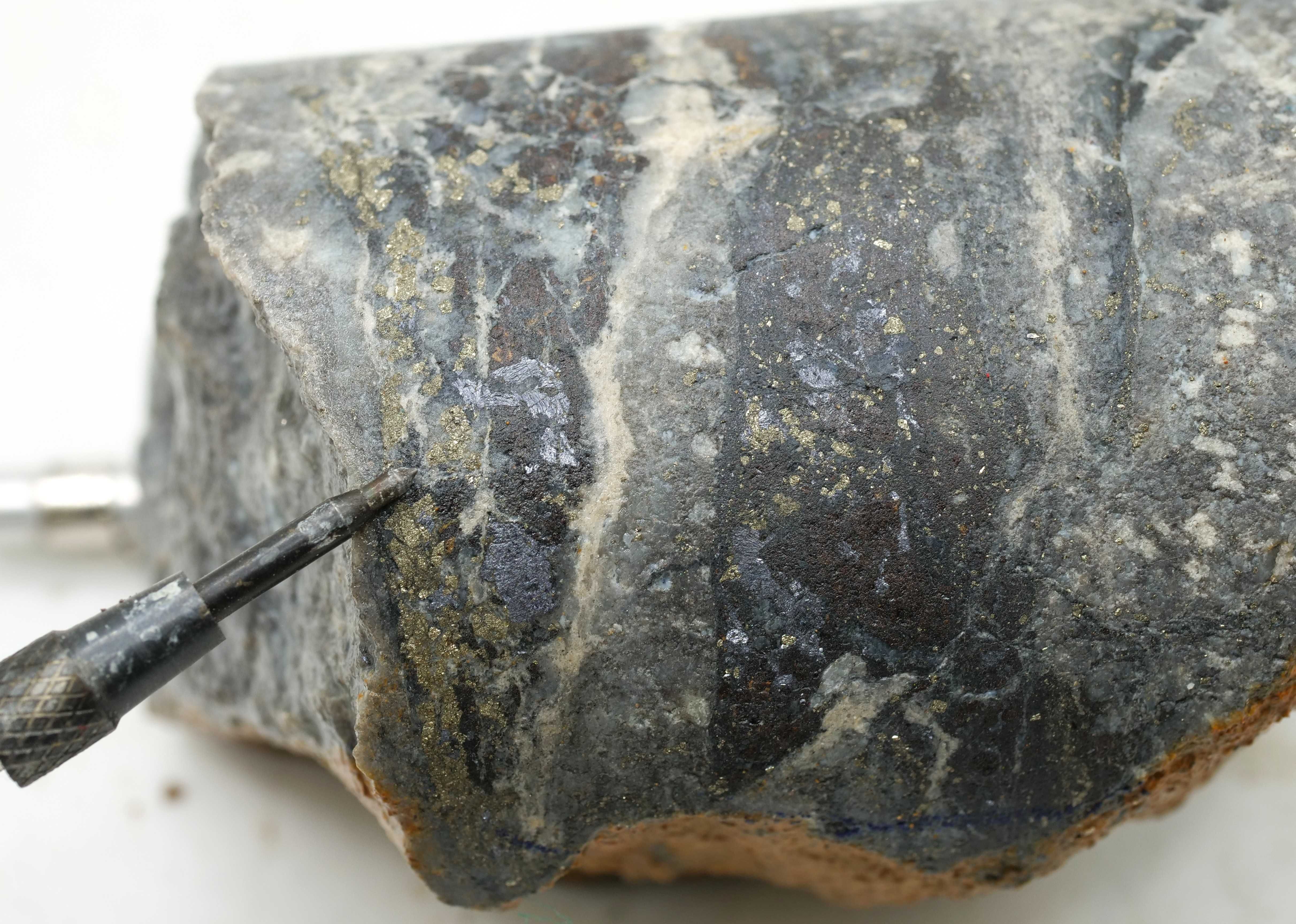

The gold mineralization in THN25-337 and THN25-339 is hosted within Triassic lapilli tuff volcanic, intruded by a Cretaceous quartz diorite and a feldspar porphyry dike of unknown age. Gold is associated with vein assemblages of pyrite-sphalerite-galena as seen in Figure 2. While mineralization is hosted within all three rock types, higher grade favours the contacts between these units. Low grade gold mineralization occurs between these reported intervals.

Hole THN25-336 was collared 78m east of pad for 337/339 and was drilled at azimuth of 2 degrees with a dip of -60 to a depth of 220m to test for extension; however, hole THN25-336 returned no significant results.

Figure 2. Closeup Photograph of HQ Size Core of Mineralization in Hole THN25-337 at 30.80m.

Figure 3. Photograph of HQ Size Core in hole THN25-337 from 25.00m to 33.95m.

Table 2. Collar Information for Holes THN25-336, THN25-337 and THN25-339.

| Hole ID | Easting (m) | Northing (m) | Elevation (m) | Azimuth | Dip | Depth (m) |

| THN25-336 | 630519 | 6485369 | 1226 | 2 | -60 | 220 |

| THN25-337 | 630451 | 6485368 | 1265 | 10 | -45 | 389 |

| THN25-339 | 630451 | 6485368 | 1265 | 30 | -40 | 346 |

Quality Assurance & Quality Control

Quality assurance and quality control protocols for drill core sampling was developed by Brixton. Core samples were mostly taken at 1.5m intervals. High-grade intervals were taken at 0.5 to 1m intervals. Blank, duplicate (lab pulp) and certified reference materials were inserted at a combined rate of 15%. Core samples were cut in half, bagged, zip-tied and sent directly to ALS Minerals preparation facility in Whitehorse, Yukon or Langley, British Columbia depending on available lab capacity. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Samples were analyzed at ALS Laboratory Facilities in North Vancouver, British Columbia for gold by fire assay with an atomic absorption finish, whereas Ag, Pb, Cu and Zn and 48 additional elements were analyzed using four acid digestion with an ICP-MS finish. Over limits for gold were analyzed using fire assay and gravimetric finish. The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd., of Langley, British Columbia and the standards inserted varied depending on the type and abundance of mineralization visually observed in the primary sample. Blank material used consisted of non-mineralized siliceous landscaping rock. A copy of the QAQC protocols can be viewed at the Company's website.

Qualified Person (QP)

Ms. Madeline Berry, P.Geo., is a Project Geologist for the Company who is a Qualified Person as defined by National Instrument 43-101. Ms. Berry has verified the referenced data and analytical results disclosed in this press release and has approved the technical information presented herein.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton's flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB , and on the OTCQB under the ticker symbol BBBXF . For more information about Brixton, please visit our website at www.brixtonmetals.com .

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

info@brixtonmetals.com

For Investor Relations inquiries, please contact: Mr. Michael Rapsch, Vice President Investor Relations. email: michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Follow us on:

LinkedIn | Twitter/X | Facebook | Instagram

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Links:

https://brixtonmetals.com/wp-content/uploads/2025/09/Figure-1_1Oct2025_3-scaled.png

https://brixtonmetals.com/wp-content/uploads/2025/09/Figure-2_1Oct2025-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2025/09/Figure-3_1Oct2025-scaled.jpg