January 16, 2023

Coarse visible gold and 199.1 g/t intercept among the latest results

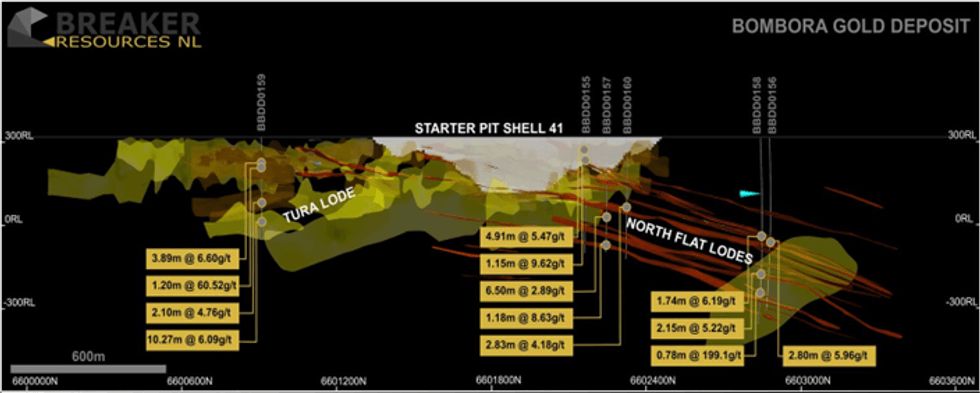

Breaker Resources NL (ASX: BRB; the Company or Breaker) is pleased to advise of the results from an additional 6 deeper diamond drill holes as part of the resource development program beneath the Bombora Discovery at its Lake Roe Gold Project.

Five holes targeted the Northern Flats lode structures with every hole delivering substantial (>10 grams x metre) results.

Best results from the Northern Flats include:

- 0.78m @ 199.1 g/t gold from 659.37m in BBDD158 (est. true width = 0.54m)

- 1.18m @ 8.63 g/t gold from 460.0m in BBDD158 (est. true width = 0.82m)

The one diamond hole targeting extensions of the Tura lode also returned significant results including:

- 10.27m @ 6.09g/t gold from 348.5m (est. true width = 5.2m)

- 1.20m @ 60.52 g/t gold from 129.8m (est. true width = 1.1m)

Breaker’s CEO, Sam Smith said:

“This is exciting stuff for Breaker!

These results continue to show how consistent the underground lodes are. Our previous mining studies* have confirmed the Tura lode has what it takes to sustain a meaningful underground production source beneath any future Bombora open pit. The lode continues to expand at depth with the results showing it has further potential to grow.

We now turn our focus to mine development studies on the Northern Flats. Our latest drilling continues to validate our structural model and in particular, their consistent predictable continuity and the structural controls of the high grade ore shoots within them.”

Northern Flats Lodes - Drilling

Drillholes BBDD0155, BBDD0156, BBDD0157, BBDD0158 and BBDD0160 were targeting the series of stacked, shallow north plunging flat lodes located below and north of the future open pit. The Northern Flat lodes have been drill tested over a strike of 2km and remain open at depth. The lodes fracture horizontally across the main brittle dolerite host with the intersection points of the steep west-dipping structures and steeper east-dipping structures creating dilation zones with thicker higher-grade shoots within them.

With reference to the bonanza hit result of 199.1 g/t gold, it sits within one of the Northern Flat lodes which previously returned 1.3m @ 42.7 g/t gold within 4.6m @ 12.5 g/t in BBDD0096W2, just 40m south and up-dip (ASX release 17 June 2020).

These latest results continue to confirm the Company’s belief that the Northern Flats lode structures can become a significant future underground mining source to complement and extend a mine-life at Lake Roe.

Click here for the full ASX Release

This article includes content from Breaker Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRB:AU

The Conversation (0)

29 June 2022

Breaker Resources

Transitioning From Explorer to Developer in Western Australia

Transitioning From Explorer to Developer in Western Australia Keep Reading...

4h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

5h

55 North Mining: The Economic Upside of US$5,000 Gold and High-grade Project Next to Alamos Gold

With gold prices maintaining their historic trajectory toward US$5,000 per ounce, gold exploration companies with high-grade assets offer immediate economic leverage. 55 North Mining (CSE:FFF,FWB:6YF) is emerging as a primary beneficiary of this. We sat down with CEO Bruce Reid as he discussed... Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00