July 06, 2023

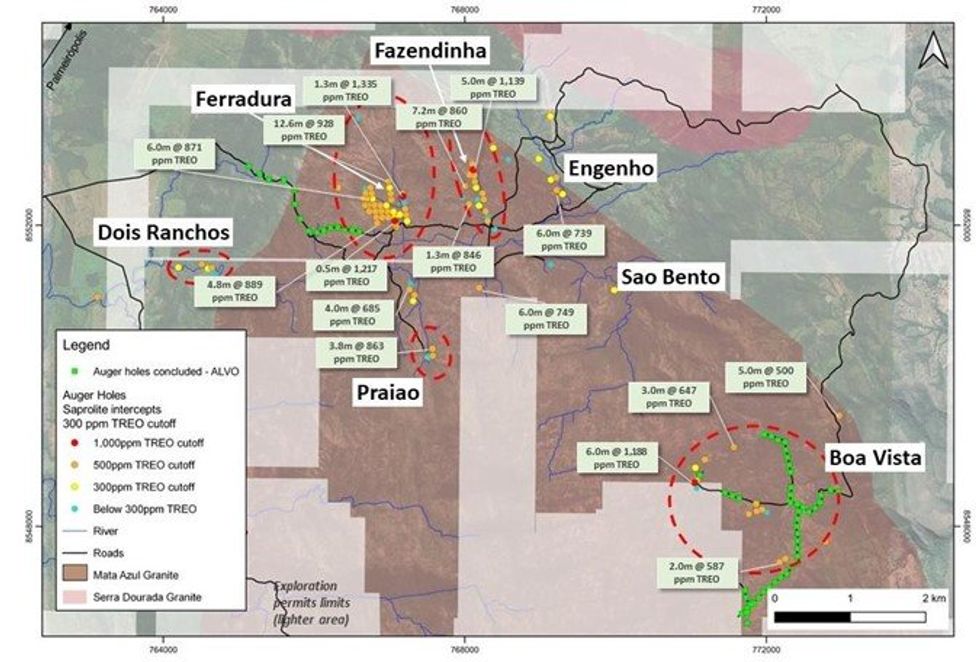

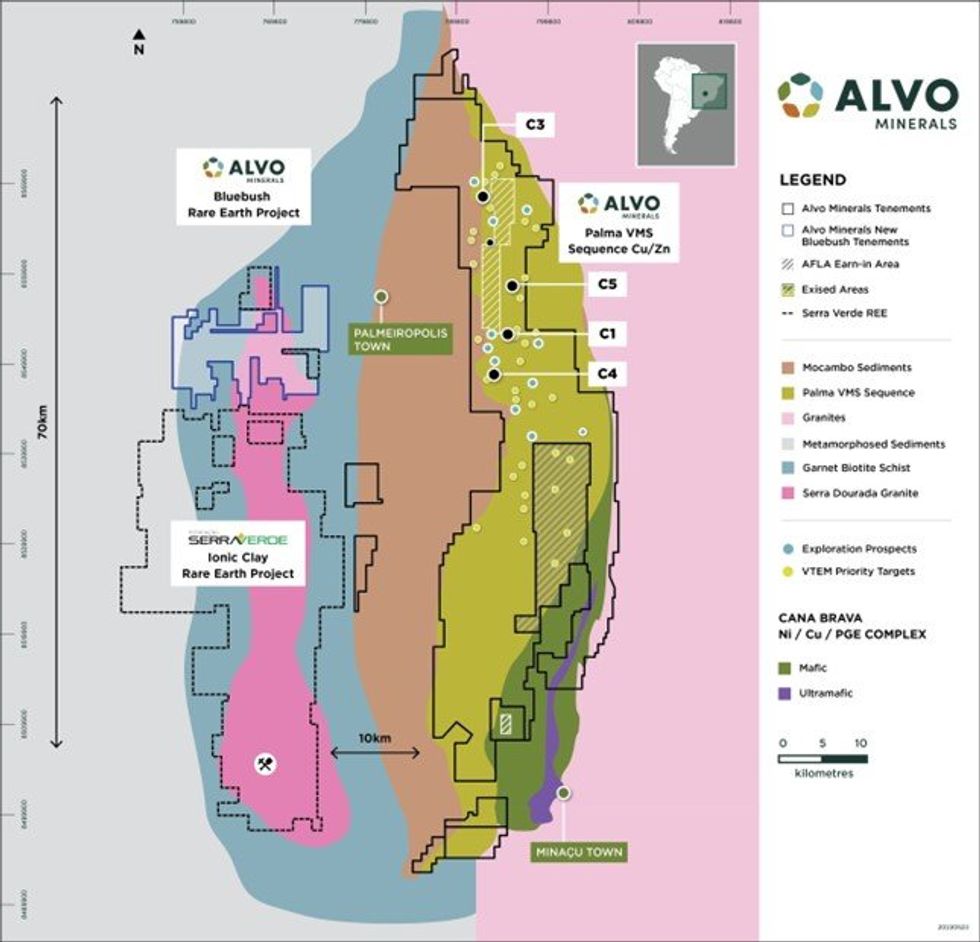

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to update shareholders on the ongoing exploration at the recently acquired Bluebush REE Project (“Bluebush” or the “Project”), located on the northern half of the Serra Dourada granite, host of the Serra Verde Ionic Clay REE deposit (“Serra Verde”) (see Figures 1 & 2).

HIGHLIGHTS

- Maiden auger drill program advancing at Bluebush with 58 holes completed for 472m (averaging 8.1m depth to date).

- Phase 1 drilling is targeting road network with clearing advancing ahead of the auger rig.

- Auger drilling was initiated across the Boa Vista prospect with the rig now operating at the Ferradura and Fazendinha prospects.

- Phase 1 Auger Drill Program is targeting an area of ~30km2 of the highly prospective Serra Dourada granite which hosts the Serra Verde Ionic Clay project 40km south.

- Serra Verde is the only Ionic Clay project in construction outside of China.

- First assays due within 2 weeks, with a second, larger batch currently at the lab with results expected in August.

- Once initial assays are received samples will be selected and submitted for ionic-clay testing with preliminary metallurgical results expected in Q3.

- Previous handheld auger drilling intercepted REE mineralisation in clays from surface to end of hole (EOH), including:

- 1m @ 1,355ppm TREO (29% MREO) auger ERRO031AGR from 1m to EOH (Ferradura)

- 5m @ 1,139ppm TREO (36% MREO) auger ERRO072AGR from 1m to EOH (Fazendinha)

- 13m @ 928ppm TREO (33% MREO) auger ERRO017AGR from 0m to EOH (Ferradura)

- 6m @ 1,188ppm TREO (37% MREO) auger ERRO273AGR from 1m (Boa Vista 01)

Rob Smakman, Alvo’s Managing Director commented on the Bluebush Project:

“With the commencement of activities at Bluebush immediately after the signing of the deal, we continue to demonstrate our commitment to the project and efficiency of operations in Brazil. Our focus during the due diligence period is covering the project with first pass auger drilling to investigate the depth and extensions of the mineralisation and its ionic clay potential. We are well on track to make a sound decision based on results- with first assays expected in the next few weeks.”

The maiden auger drill program1 has focused initially on the Boa Vista prospect where access on multiple roads facilitated faster entry for the auger rig (see Figure 1). Road improvement to allow for ongoing drilling across the wider Project area is ongoing with over 30km2 of the Serra Dourada granite to be assessed.

First laboratory assays from the SGS lab in Brazil are expected within the next 2 weeks, with a second and larger sample lot expected in early-mid August 2023. Ongoing sampling will be submitted to the lab on a batch basis with results released to the market in a timely manner.

Once initial assays are received and interpreted, samples will be selected and submitted for ionic-clay testing with preliminary results expected in September.

Auger drilling is targeting multiple prospects across Bluebush, designed to test and expand on positive results reported by the Project vendor2. These results (which are from handheld auger drilling from the clay horizon only as outlined in the ASX announcement dated 7 June 2023) were from drilling which targeted the alluvials. Significant results2 included:

- 1m @ 1,355ppm TREO (29% MREO) auger ERRO031AGR from 1m to EOH (Ferradura)

- 5m @ 1,139ppm TREO (36% MREO) auger ERRO072AGR from 1m to EOH (Fazendinha)

- 13m @ 928ppm TREO (33% MREO) auger ERRO017AGR from 0m to EOH (Ferradura)

- 6m @ 871ppm TREO (31% MREO) auger ERRO142AGR from 0m to EOH (Ferradura)

- 6m @ 1,188ppm TREO (37% MREO) auger ERRO273AGR from 1m (Boa Vista 01)

- 6m @ 796ppm TREO (34% MREO) auger ERRO279AGR from 0m (Boa Vista 1)

The previous owners of Bluebush drilled a total of 258 auger holes for approximately 930m (average 3.6m depth). The auger drilling would often stop once the saprolite clay horizon was intercepted as the primary target were the alluvials (and partly due to restrictions of the handheld equipment) and as such, the routine sampling of these horizons often ended in mineralisation.

Other work underway at Bluebush includes a review of the official Mata Azul company documents and tenements at the relevant governmental agencies. The Brazilian Mines Department staff are currently on strike, however Alvo should be able to review the relevant documents which are largely online.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

10 February

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00