(TheNewswire)

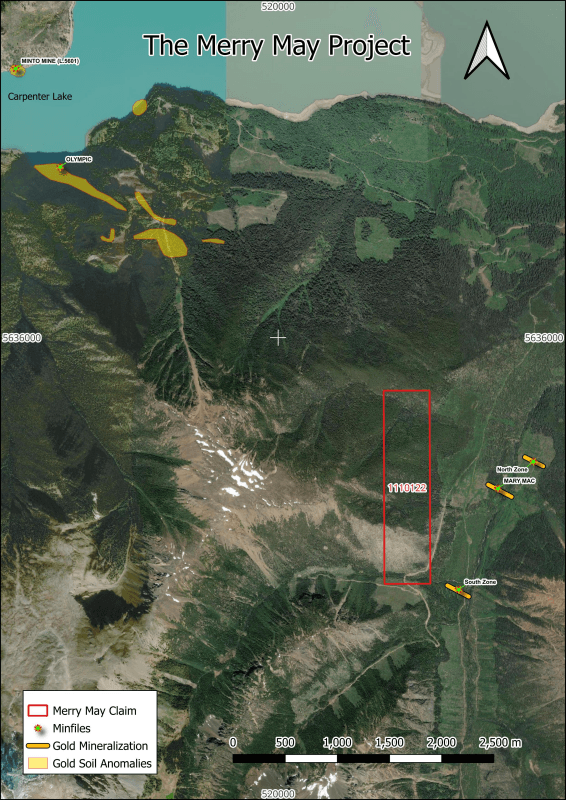

Vancouver, B.C. September 18, 2025 TheNewswire - Bathurst Metals Corp. ("Bathurst" or the "Company") is pleased to announce the completion of the acquisition of an undivided 100% interest in the "Merry May Project", as announced on September 5, 2025. The project is located on the west side of Truax Creek, south of Carpenter Lake, near Gold Bridge, B.C. It lies along the highly prospective Minto–Olympic–Mary Mac structural trend, which is well known for its gold and antimony mineralization.

The Merry May project consists of one mineral claim comprising 81.6 hectares near Gold Bridge, B.C.

Situated 500 metres southwest and directly on trend is the Mary Mac deposit. Approximately 3.2 kilometres northwest, Endurance Gold Corp. has recently outlined multiple gold-in-soil anomalies as part of its Reliance Gold Project. Further along the trend, 5.5 kilometres northwest, lies the historic Minto Mine, which operated from 1934 to 1940, producing 80,650 tonnes of ore averaging 6.8 g/t gold and 19.9 g/t silver. In total, Minto yielded 546 kg gold, 1,573 kg silver, with over 2,130 metres of underground workings developed, establishing it as a significant high-grade polymetallic producer in the Bridge River district. The Merry May Project is also directly across Carpenter Lake from the Company's Peerless property, providing the Company with a strong presence in this highly prospective region.

There is no assurance the Company's results of exploration of the Merry May Project will be similar to or mirror those of adjacent or proximal properties.

The Merry May Project was introduced to the Company by an arm's length vendor who had optioned the property four days before the Company agreed to acquire it for payment of $1,000, a minimum work commitment of $50,000 over 24 months and a 1% NSR royalty. The 1% NSR may be repurchased at any time after commencement of commercial production for the sum of US $1,000,000.

The Company assumed all these obligations and agreed to the issuance of 2,200,000 shares with a discounted market value of approx. $148,500 as consideration for the assignment of the option. The shares will be released to the vendor over a period of one year, with 20% released on closing and an additional 20% released at the end of each calendar quarter following the closing.

All common shares issued will be subject to a four (4) month hold period from the date of TSXV acceptance. No finders fee was paid in connection with the transaction.

The Company considers the share consideration to be fair and reasonable due to its location and proximity to the Company's Peerless property in the highly prospective Bridge River District.

Qualified Person

Lorne Warner, P Geo, is a qualified person as defined by National Instrument 43-101 and has reviewed

and approved the scientific and technical disclosure in this news release. Mr. Warner is not independent of the Company.

ON BEHALF OF THE BOARD OF DIRECTORS

"Harold Forzley"

CEO

For more information contact Harold Forzley

604-783-4273

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain of the statements made and information contained herein may contain forward- looking information within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, information concerning the Company's intentions with respect to the development of its mineral properties. Forward-looking information is based on the views, opinions, intentions and estimates of management at the date the information is made, and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated or projected in the forward-looking information (including the actions of other parties who have agreed to do certain things and the approval of certain regulatory bodies). Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of the Company, its financial or operating results or its securities. The reader is cautioned not to place undue reliance on forward-looking information.

.

Copyright (c) 2025 TheNewswire - All rights reserved.